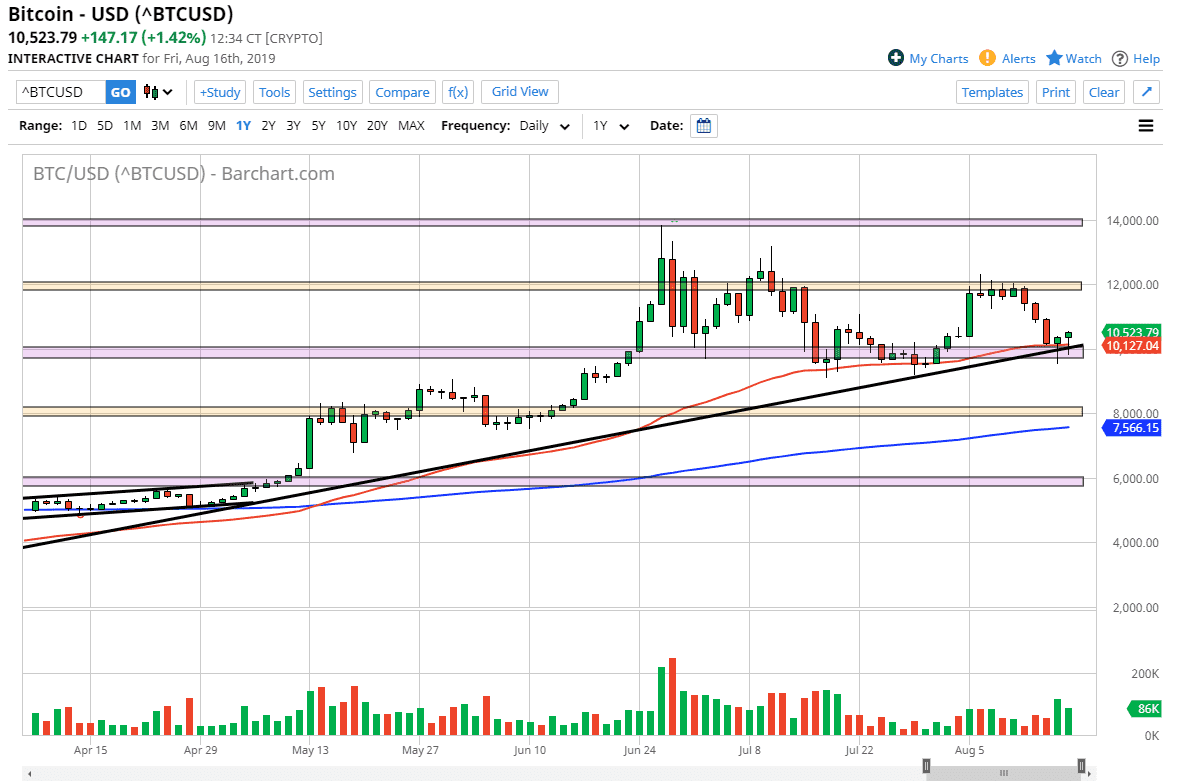

Bitcoin initially fell during the trading session on Friday, but then turned around of form a bit of a hammer. At this point, the hammer is a strong sign, but at this point another thing that you should pay attention to is the fact that we ended up forming a hammer during the previous session as well. With all that being said it’s likely that we will continue to go higher because of these dual bullish candlesticks. Beyond that, there are a lot of reasons to think that buyers will step in here as well.

Not only do we have those hammers, but we also have the 50 day EMA slicing through the those hammers, so this is an extraordinarily strong sign. The $10,000 level is in that area as well, so there are at least four reasons to think that we are going to go higher. Again, we have the 50-day EMA, the trend line, the $10,000 level, and of course the hammers. All of this together is an excellent signal because to be realistic, a break down through would require a sudden change of attitude and a complete capitulation of buying pressure.

To the upside I believe that we are going to go looking towards the $12,000 level, as it is an area that has attracted a lot of resistance in the past. When you look at the chart you can see that the markets continue to react to every $2000, so that’s something to pay attention to. At this point, I believe that a move to the $12,000 level makes quite a bit of sense, as we will more than likely make another attempt at that high. If we can break above the $12,000 level, then the market is likely to go to the $13,000 level, followed by the $14,000 level.

If we were to break down below the hammer from the Thursday session, this would be a breakdown of major support, as we will have not only broken through the hammer from the lows, but also has broken through the hammer from the Friday session as well. Any time you see a couple of hammers broken to the downside it’s catastrophic. That seems very unlikely though, so I am a buyer of Bitcoin as money continues to run away from fiat currencies around the world with central banks easing everywhere.