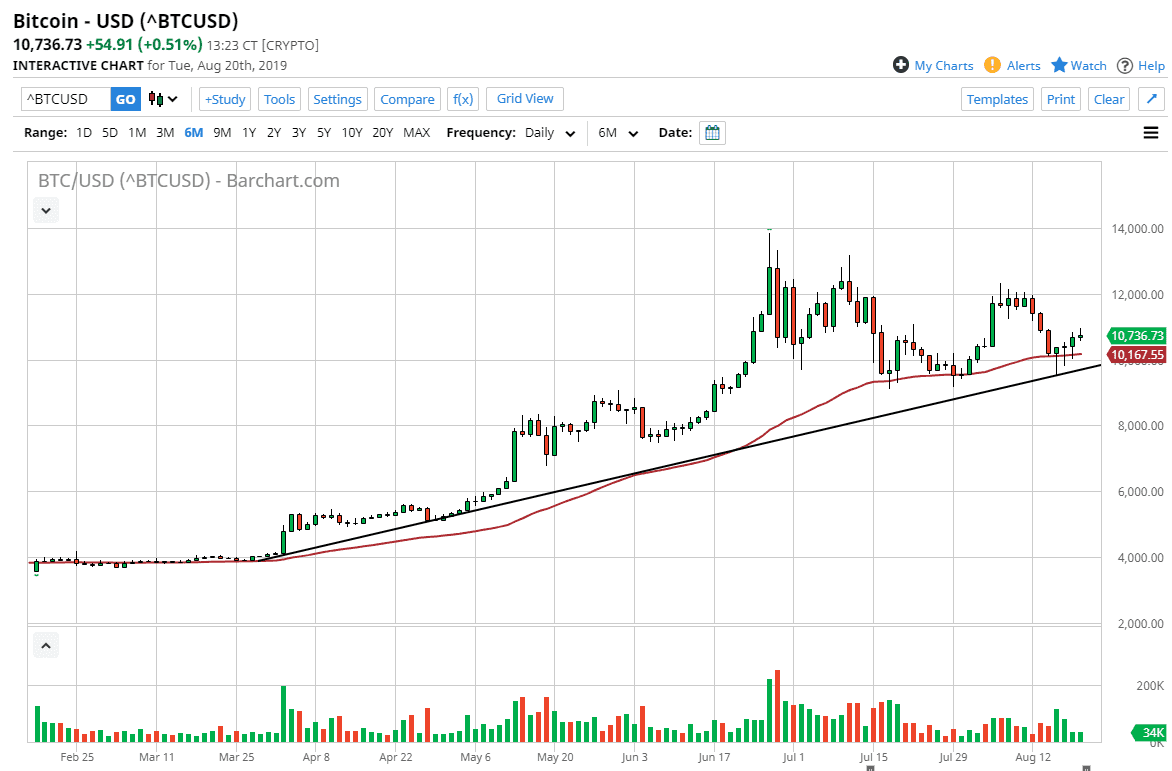

Bitcoin markets rallied slightly during the New York trading session on Tuesday as we continued to find more of a grind to the upside than anything else when it comes to Bitcoin. As you can see on the chart, the 50 day EMA is just below, as we have found plenty of support underneath. You can clearly see that we have formed three hammers in a row, and that of course is very bullish and very strong for the buyers.

Beyond that, the 50 day EMA is sitting just above the uptrend line and of course the $10,000 level. That is a ton of support just waiting to happen from both a psychological and structural standpoint, so I do think that it’s only a matter time before buyers return on any type of dip. We have seen this happen over the last three days, and I would anticipate that will continue to be the case going forward. That being said, we have shown a little bit of weakness during the trading session on Tuesday which was rather quiet.

One thing that I would point out is that the market seems to be attracted to the $2000 level each time it approaches it. What I mean by this is that the $12,000 level was resistance, the $10,000 level has been supported, and the $8000 level has been both supported and resisted. In other words, this market is evenly distributed at these $2000 handles. With that in mind, I like the idea of testing the $10,000 level in finding buyers yet again.

Bitcoin continues to look very bullish in general, and there are plenty of reasons to think that we should continue to see Bitcoin rally. Quite frankly, central banks around the world are continuing to “race to the bottom”, driving down the value of fiat currencies. This of course does help Bitcoin as people try to protect their wealth. Beyond that, we also have money leaving places like Venezuela, China, Iran, and many other hotspots around the world. Ultimately, I think that the Bitcoin markets will continue to attract more money and therefore I remain bullish from that reason as well. That being said, if we did break down below the uptrend line underneath, that could show signs of trouble. In the meantime though, I believe it’s only a matter of time before buyers return and therefore selling is the last thing on my mind.