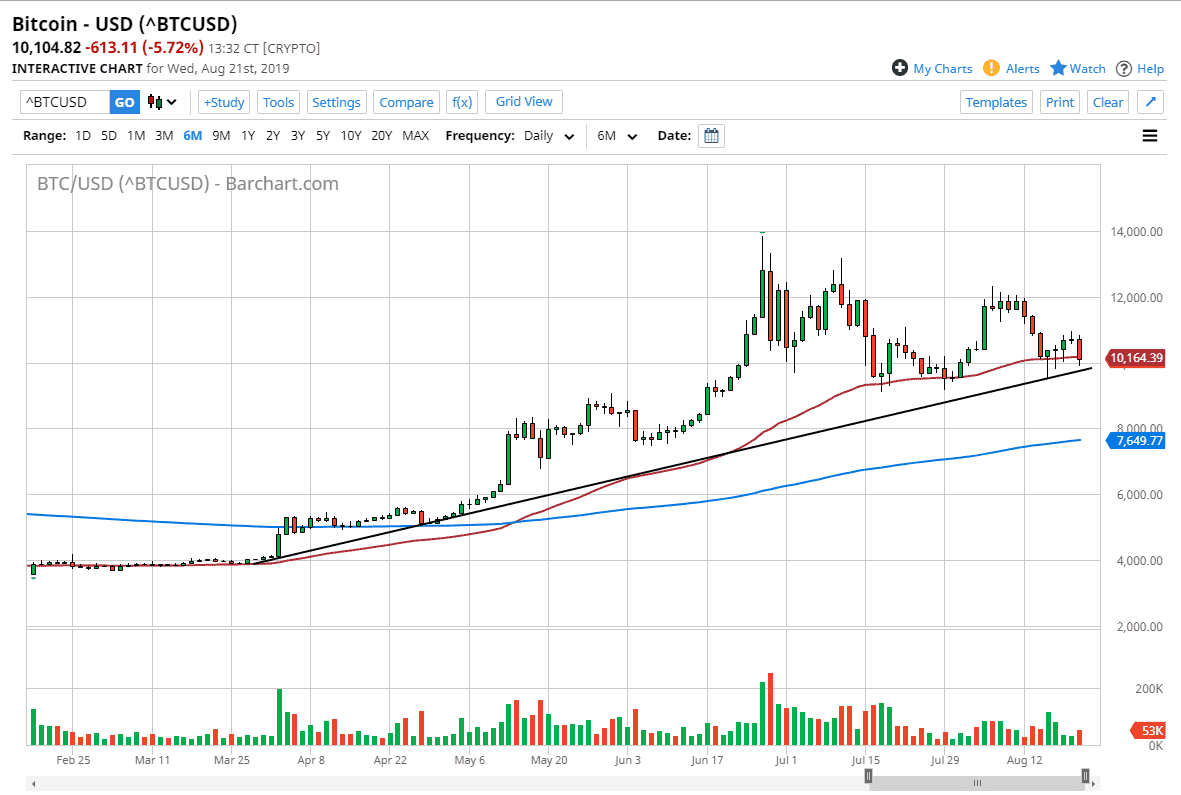

The Bitcoin market fell rather hard during trading on Wednesday, reaching down below the 50 day EMA during that day. However, there is a trend line underneath that continues offer support, and of that uptrend line should continue to show a lot of interest in the market. Now that we are testing the support area, it’ll be interesting to see whether or not Bitcoin can hold up. One thing that’s for sure though, we are definitely testing an area that has attracted a lot of attention in the past.

When you look at the last several candlesticks, there have been several hammers, so the fact that these hammers are being tested is rather interesting. If we were to break down below the bottom hammer that touches the trend line, that’s a very negative sign and send this much market lower, perhaps reaching towards the $8000 level which would be the 200 day EMA. However, if we do bounce from this uptrend line that would be yet another confirmation of strength. That being said, the highs are lower as we go along since the end of June, so I believe we are right on the precipice of making a longer-term decision. Initially, we started to see a lot of support but now that we have broken down the way we have, I think the next 24 or even 48 hours will be crucial, so at this point it’s likely that we need to see what the market does before putting a lot of money to work if we are not already involved.

To the upside, the $11,000 level and then the $12,000 level will eventually find quite a bit of resistance. If we can break above the $12,000 level, then it’s likely that we could go to the $13,000 level as Bitcoin tends to move in $1000 increments. I do like the idea of buying Bitcoin at this point as so many of the world’s central banks are easing monetary policy, but we need to hold this area. If this trendline breaks down and we go much lower, it’s very likely that we are going to see a complete capitulation of the trend, and that could really spell trouble for crypto in general. It’ll be interesting to see if it can hold up, right now I still think again but this candlestick is not very conducive of offering a lot of confidence.