Bitcoin rallied a bit during the trading session on Friday as we continued to see a bit of a runaway from a fiat currencies in general. Jerome Powell gave a speech that was just dovish enough to have money flowing into the precious metals market, and as you have seen as of late we have been seeing Bitcoin run right along with gold quite a bit of the time.

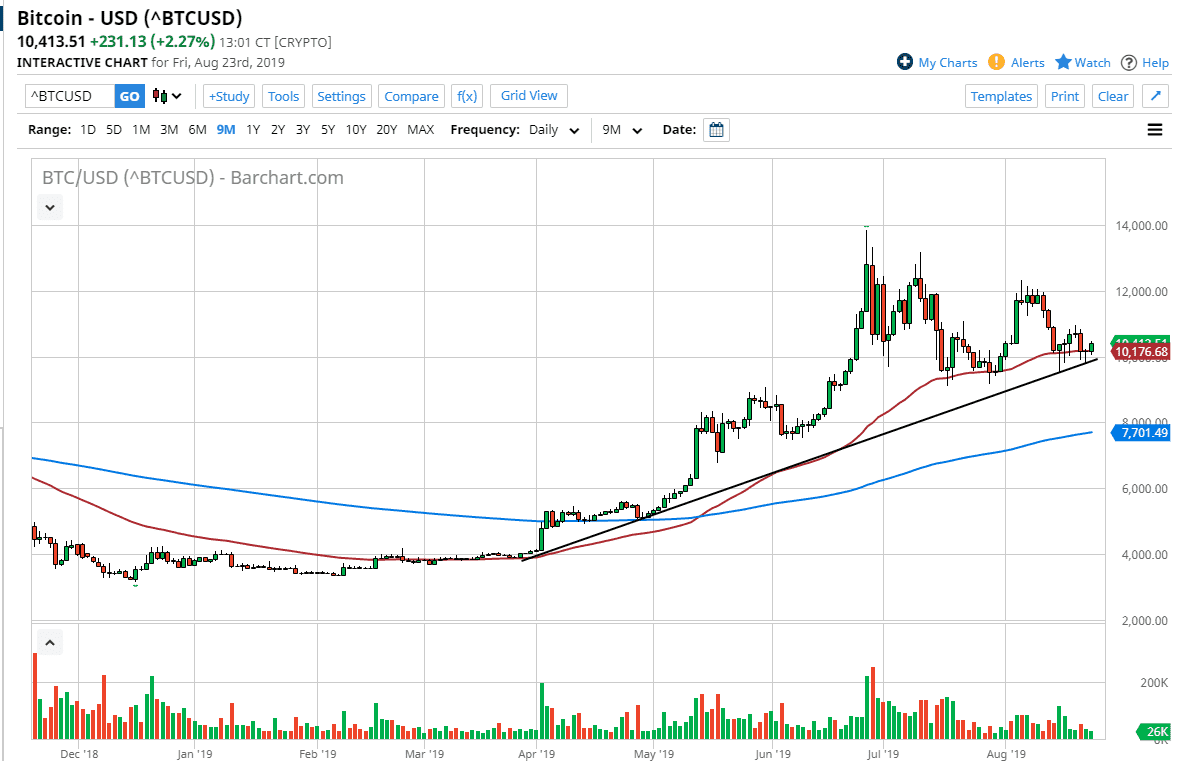

Looking at this chart, you can see that the 50 day EMA continues offer support, and we have bounced from there during the trading day. Ultimately, the market also has a significant amount of support in the uptrend line that is showing, and of course the $10,000 level as this market is very sensitive to the $2000 areas. I think that the pullbacks at this level should continue to attract a lot of attention, and quite frankly this is a market that continues to benefit from the fact that the central banks around the world continue to ease monetary policy.

Beyond that we also have a lot of capital controls in various countries right now, as the currency wars are kicking into high gear. China, Iran, and of course Venezuela all are areas where we are seeing quite a bit of money flow into Bitcoin, and that should continue to help propel this market. That being the case, it’s very likely that there are plenty of reasons to see Bitcoin go higher. While the US dollar has not gotten exactly crushed, the reality is most other currencies around the world are. Far too many people worry about Bitcoin against the greenback, but you should also think about Bitcoin against other currencies such as the Euro, Pound, and many more. It’s a fiat versus crypto equation.

At this point I suspect that we will go looking towards the $11,000 level next, followed by the $12,000 level. To the downside, if we were to break down below the $9500 level, then the market could unwind down to the $8000 level. In that area we could also see the 200 day EMA offer support but it certainly would make a nice opportunity for sellers to try to target a major figure. All things been equal though, it does look like we are trying to form a little bit of a double bottom on top of the trend line at the 50 day EMA, which is plenty of technical reasons to think that we go higher.