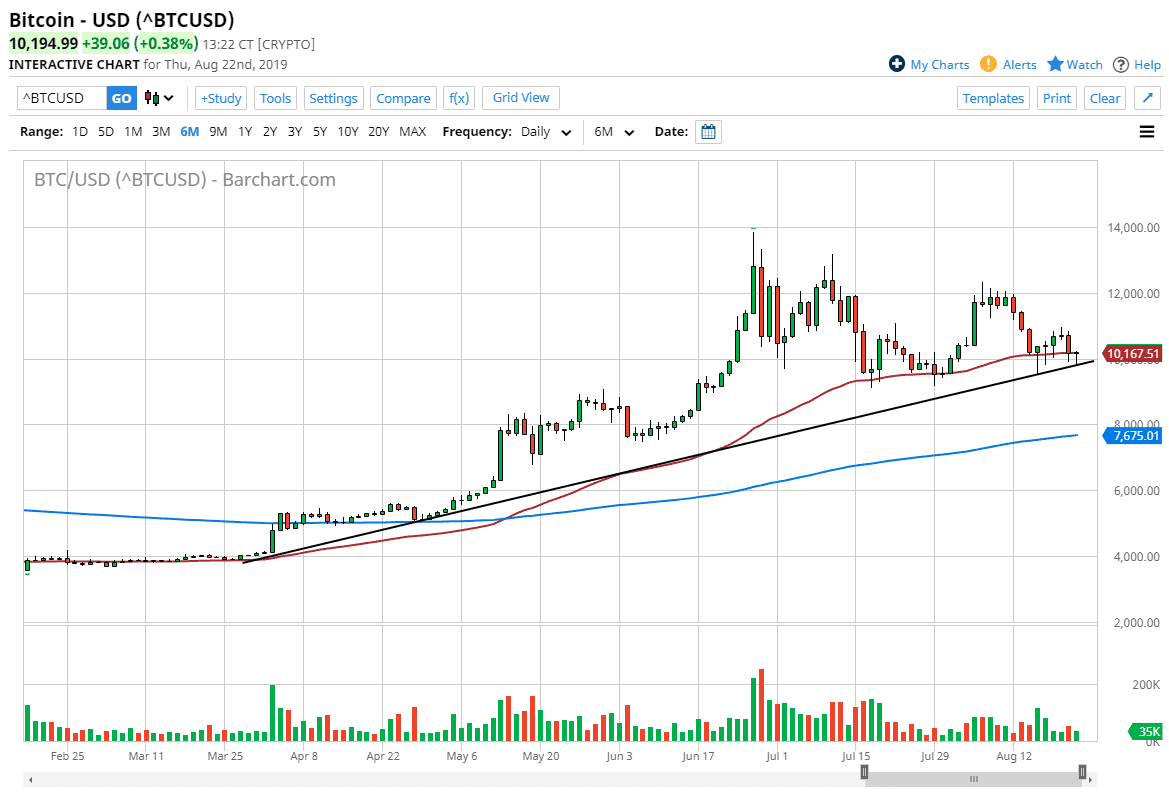

Bitcoin markets initially fell during the New York trading session on Thursday but then found enough support at the uptrend line to turn around and form a significant hammer as the market continued to show signs of resiliency. At this point, the 50 day EMA is also in this area, so this is a market that needs to make some type of decision. This is a scenario that I think will continue to play out over the next couple of days, and it makes some type of major move very likely to be the case. With that in mind let’s take a look at some of what’s going on.

We have seen several hammers form over the last week or so. That’s something to pay attention to by itself, just simply because it shows that every time we fall, the buyers are willing to turn things back around. At this point, showing signs of resiliency is something to hang your hat on, because there is a simple failure to break down. That being said, that trend line is being held to significantly, so I think at this point it’s likely that the buyers will continue to show up in the near term. If we can continue to see that be the case, one would have to think it’s only a matter of time before we break out to the upside.

If we were to break down below the low from about a week ago, then we could break down towards the $8000 level which of course would be where the 200 day EMA shows up. At this point, the market would probably recognize that as potential support not only due to the fact that it is a large, round, psychologically significant number, but it’s also a major moving average that longer-term traders will pay attention to. That being said, it’s the alternate scenario to what I think will happen.

In my professional opinion, it looks as if we could break to the upside yet again, as we would go towards the $12,000 level. The market does tend to move in $2000 increments, so keep that in mind. All things been equal though, we have central bank members meeting in Jackson Hole, so we’re likely to get some type of noise in the market when it comes the fiat currencies which of course could have a knock-on effect over here. From where I’m standing, it looks like Bitcoin is going to hang on and continue to rally.