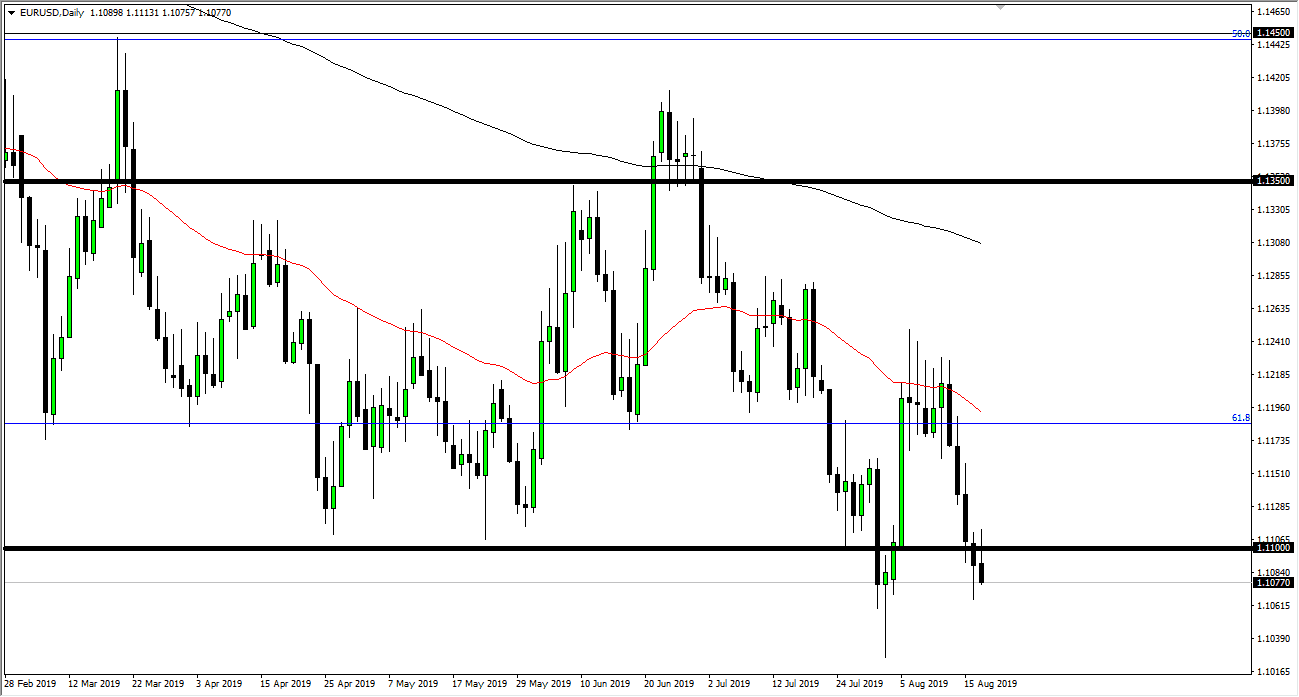

The Euro initially rallied during the trading session on Monday, breaking above the 1.11 EUR level. That’s an area that has previously been supportive, but then was broken through a couple of weeks ago. We have bounced back above there until the last couple of days, and now it looks likely to continue to go lower based upon this massive selloff. The last couple of days have been very interesting, because we have formed a hammer, and now we’ve has formed an inverted hammer. I think it shows a lot of confusion, but the fact that we are closing at the bottom of the candle stick looks very poor.

If we did break above the top of the candle stick for the trading session on Monday, that probably has this market looking towards the 50-day EMA on the chart which is painted in red and sloping lower. That’s an area where I would expect to see sellers as well. However, as we have struggled quite a bit, I believe that the market is likely to continue to go lower. The hammer that had formed a couple of weeks ago and began the bounce should offer plenty of support and if we can break below that level, and then reached down below the 1.10 EUR level, then I think that will basically open up the “trapdoor” to lower levels.

When we broke down over the last several months, we also sliced through the 61.8% Fibonacci retracement level. We have gone back to test that area and found resistance there, it typically this means that we will see the market reached down towards the 100% Fibonacci retracement level. If that does in fact turn out to be true, the market is likely to go down towards the 1.05 level underneath.

The European Central Bank is going to continue to be soft with its monetary policy, so expect that we will continue to go lower. Beyond that we also have the US bond market attracting a lot of monetary flow, this should push things much lower, perhaps fulfilling that 100% Fibonacci retracement level. Rallies at this point will be looked at with skepticism, and therefore I’m looking for opportunities to short this market. I don’t have any interest in trying to buy this market because I think there are far too many issues with the Germany showing signs of recession.