The Euro has gone back and forth over the last week, and Thursday was just more of the same. With central bankers meeting in Jackson Hole, Wyoming currently, it makes sense that there is a lot of volatility and choppiness in the Euro. Because of this, I think it’s difficult to trade this market under the current circumstances. However, once we get through the Jerome Powell speech on Friday, there is the possibility we might get a little bit more in the way of determined positioning.

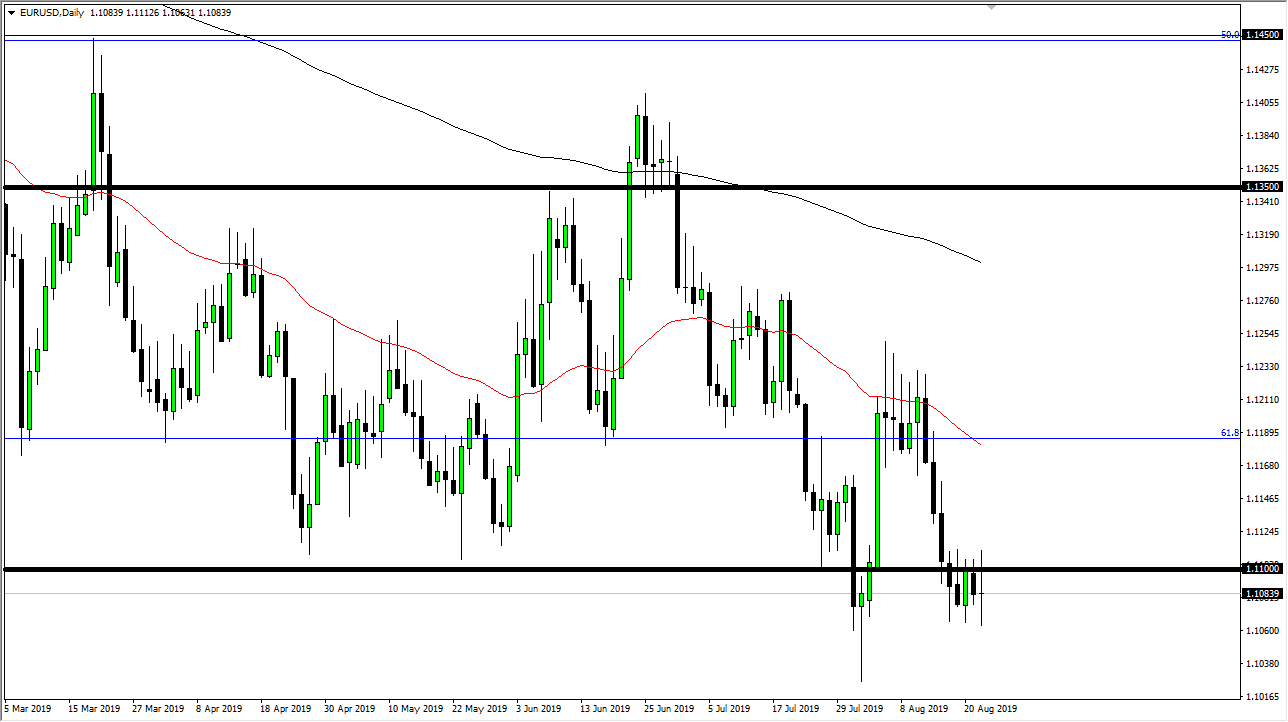

As you can see, the candle stick for the Thursday session highlights that there is a lot of resistance above the 1.11 handle, just as there is significant support near the 1.1050 level underneath. I think that the next trade is relatively simple in the sense that it will simply be a break of this tight range. Because of this, if we were to break to the upside, I think the next target would be the 50 day EMA which is pictured in red on the chart. That could send the market closer to the 1.10 handle at that point in time.

If we were to break down from here, it’s very likely that we could go down to the 1.10 level, which has been massive support more than once. That’s a large, round, psychologically significant figure as well, so it would make sense that we could get a bit of a bounce in that general vicinity. However, once we break down below the 1.10 level that would probably throw more money to the downside here, reaching down towards the 100% Fibonacci retracement level which is closer to the 1.05 handle. Ultimately, I think rallies at this point are to be sold just as breakdowns are. In the meantime though, we are simply going back and forth in a bit of a floundering state.

I suspect that you are probably going to need to see a daily close outside of the range in order to have any type of confidence whatsoever in trying to trade this market, as we have so much in the way of problems. I think ultimately this pair will head lower based upon the massive amount of problems we have in the European Union; the sad truth is that the problems are so pervasive that even Germany, the strength of the EU, has been affected.