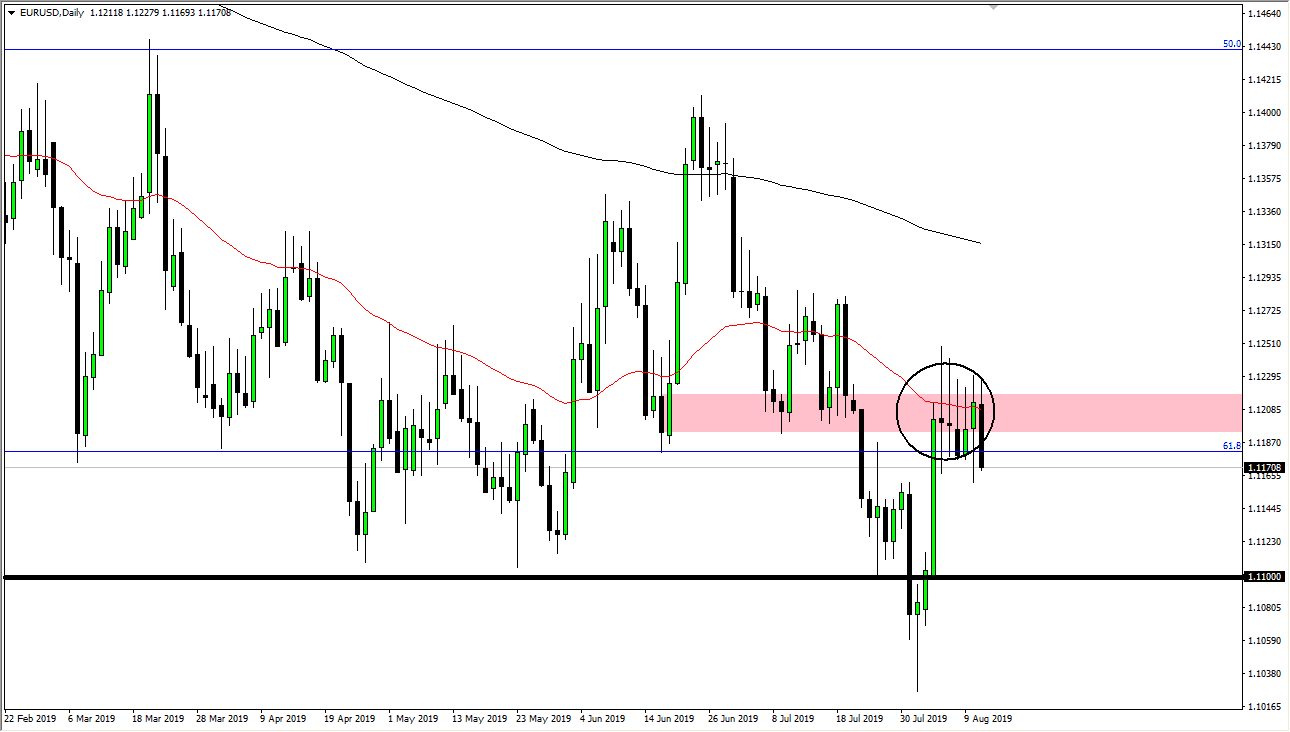

The Euro has had a very interesting trading session on Tuesday, initially trying to rally but then broke down rather significantly towards the bottom of the range that we had been in. Because of this, it shows just how difficult it’s going to be for the Euro to continue to find buyers, as I have been talking about resistance extending from the 1.12 level all the way to the 1.13 level. We have broken down quite a bit until recently, and now it looks like we just won’t be able to hang onto these gains.

At this point, the US dollar got a bit of a boost due to the fact that the Americans have noted that they are more than likely going to extend the trade tariff deadline from September 1 to allow the Chinese and American negotiators to have a telephone meeting in the next week or so. If that’s going to be the case, then it gives people hope, which of course has people buying the US dollar as it should be good for the US stock market. The stock market rallied quite nicely; at the exact same time this market fell.

At this point, I believe that what we are looking at is a market that is trying to break down again and reach towards the 1.11 handle, which is major support underneath. If we can break down through there it’s likely that the market could break down towards the 1.10 level. To the upside, it’s not until we can break above the 1.13 level that I would buy into the idea of the Euro rallying, and with both central banks looking to cut interest rates it makes sense that both of these currencies will be somewhat soft, but most of the central banks around the world continue to cut monetary policy and ease the overall interest rate situation. With that in mind I think it’s very obvious that the US dollar is probably the “cleanest shirt in the dirty laundry”, so therefore that’s why the US dollar continues. Ultimately, the candle stick is rather negative so I think that also helps the downward argument, as well as the 50 day EMA slicing through the wicks of these candles that we have just formed. While I do believe that the market is going to break down, I don’t think it’s going to be a huge move, just simply more of a grind lower.