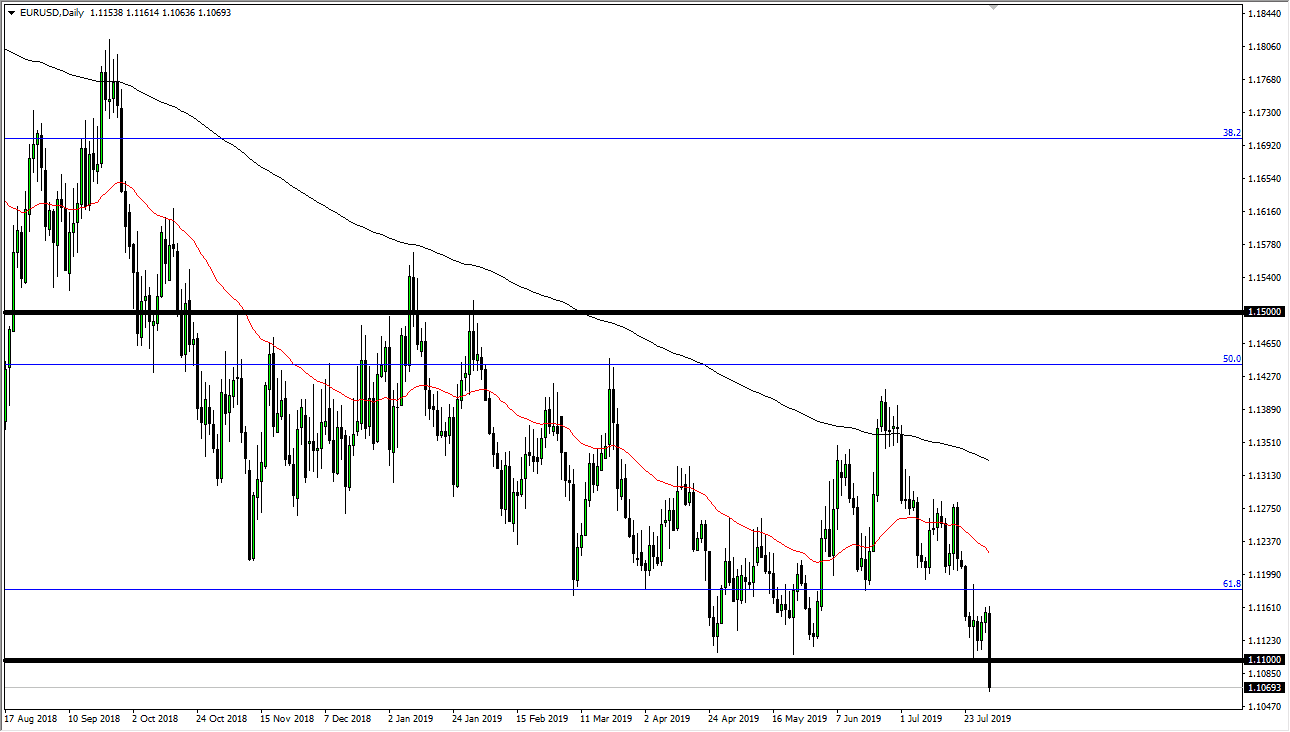

The Euro broke down below the 1.11 level during the trading session on Wednesday, after the Federal Reserve had cut interest rates by 25 basis points but did not sound like they were ready to continue cutting in a long sequence of moves. It is because of that traders started to buy the US dollar, as the dovish statement wasn’t quite dovish enough. Ultimately, this is a market that has formed an extraordinarily bearish candle stick and we are closing at the bottom of it, which of course is a very negative sign.

I think that if we can break down below the bottom of the candle stick for the trading session on Wednesday, we are likely to extend down towards the 1.10 level underneath which has a certain amount of psychological importance to it as well. I did believe that this market would hold the 1.11 handle, but that’s what trading is about: recognizing when you are wrong in readjusting your expectations. We do now have a signal that we are going to go lower, and I think at this point short-term rallies will continue to attract a lot of selling pressure, as long as we can stay below the top of the candle stick for the Wednesday session.

That being said, if we did turn around and break above the top of the Wednesday candle stick, then we probably go towards the 1.13 handle. Ultimately though, I think this is a market that is very likely to continue to the downside so I am most certainly looking for selling opportunities on short-term charts with the idea of the 1.11 level being massive resistance now that it had proven itself to be such significant support. Beyond that, we are starting to see a lot of US dollar strength around the world, as the Federal Reserve just hasn’t been dovish enough to turn things around for this currency pair, as well as many others.

If we can break down below the 1.10 level, the Euro could really be on its back foot. I don’t know about that yet, but for what it’s worth, the 100% Fibonacci retracement level is closer to the 1.05 level underneath, which is still quite a way from current trading levels. Again, short-term rallies that show signs of exhaustion are fading opportunities as far as I can see in what seems to be an accelerating downtrend.