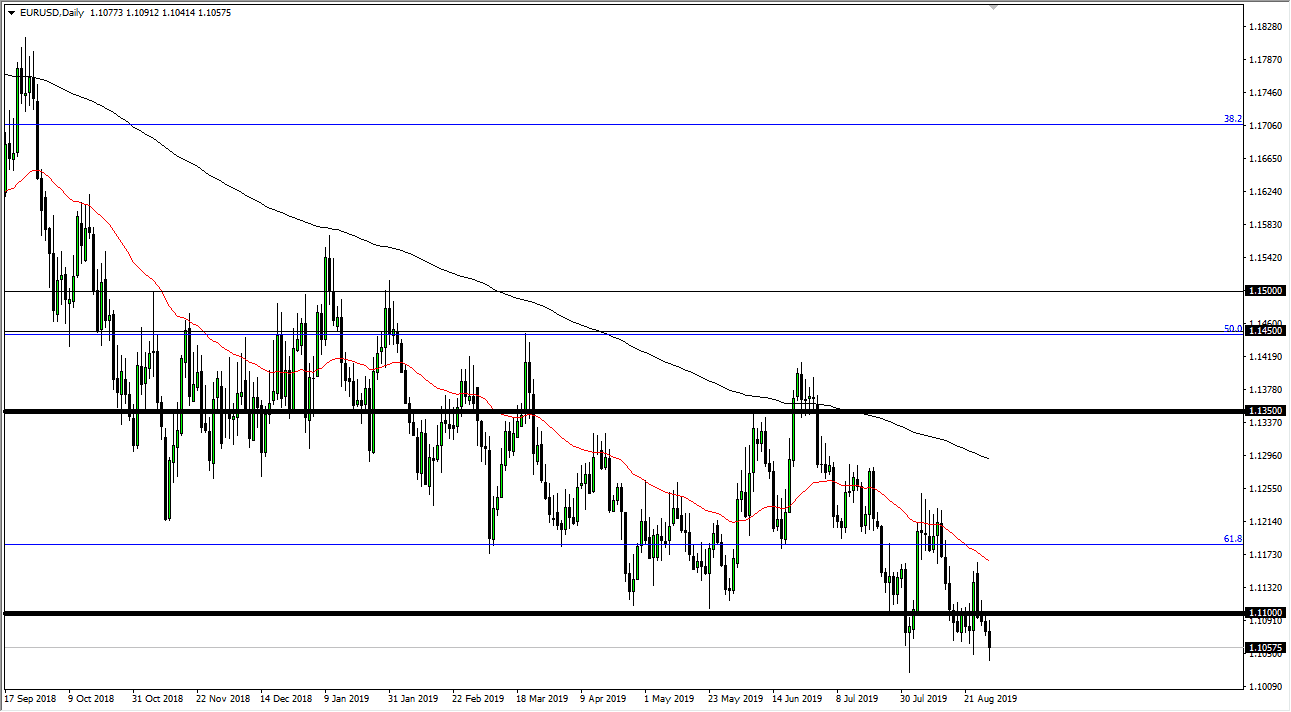

The Euro initially tried to rally during the trading session on Thursday, but then broke down yet again as we continue to grind lower. As we had broken down below the 1.11 EUR level, it looks as if we continue to drift down towards the 1.10 EUR level. At this point, the market should continue to have plenty of choppiness between here and there, so it’s going to be difficult to break down completely but I do think that’s what happens given enough time. When you look at the fundamentals, certainly it would favor a lower valued Euro.

If we were to break down below the 1.10 level underneath, it’s very likely that the market would continue to drift towards the 1.05 EUR level which is the 100% Fibonacci retracement level from the bigger move. I think that given enough time we are probably going to see quite a bit of negativity out there due to the fact that the European Central Bank is going to have even easier monetary policy, and beyond that we also have the German economy heading into recession, so it doesn’t make any sense for the Euro to rally overall.

Beyond that, we also have the interest rate differential between the two countries that we have to pay attention to. The bond markets in the United States are still offering positive yield, while the European bonds are almost all negative. Think of it this way: if you’re going to put money into bonds, and that’s where large amounts of capital flows into, are you going to take something with the yield or something without? That is a big reason why this market has been grinding lower and should probably continue to go lower for quite some time. Rallies at this point in time should be selling opportunities and I do believe that the 50 day EMA which is painted in red should continue to be a massive selling signal.

Overall, I think that the downtrend should continue, but I also think that the markets will put up quite a bit of fight. In other words, you should be looking for signs of exhaustion that you can take advantage of in order to start shorting again. All things being equal I fully anticipate that this market breaks down but it might be a few weeks before we can actually make that larger move as volume is a bit tentative right now.