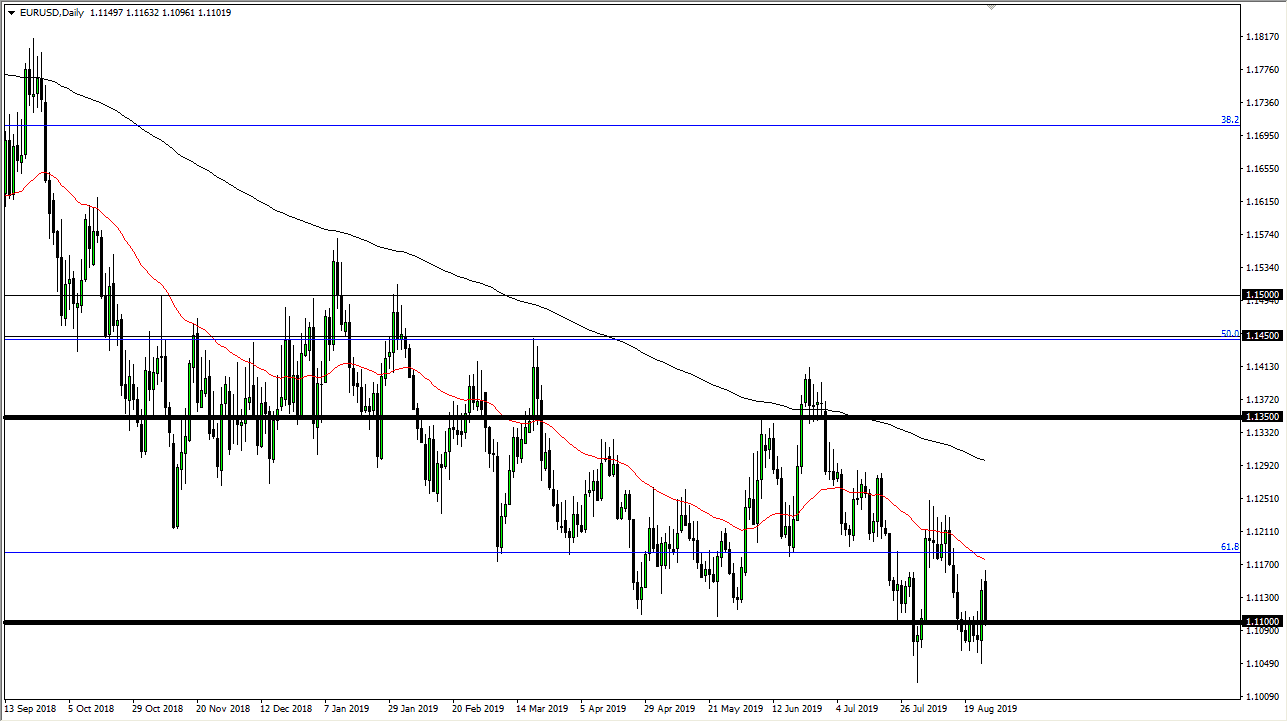

The Euro tried to rally initially during trading on Monday and what would have been the first opportunity traders had to react to the increased tariffs coming out of the United States on the Chinese. That being the case, it makes sense that we did struggle. Overall though I think what we are about to see is an attempt to find support right around the 1.11 EUR level. This is an area that begins significant support all the way down to the 1.10 EUR level. That being said, it’s likely that we are at least going to try to get down there but it’s going to be more of a grind than anything else.

Rallies at this point will probably cause selling opportunities yet again, as the German economy looks ready to be entering a recession. The 50 day EMA above is just above the candle stick for the trading session on Monday, so I think at this point it’s likely that we will continue to see a lot of noise, but I think you can continue to fade the rallies. The US dollar will continue to attract monetary flow because bond markets are doing so well. Beyond that, the ECB is going to continue to loosened its monetary policy because it has to at this point. If we can break down below the 1.10 EUR level, then it’s likely that we will go down to the 100% Fibonacci retracement level which is just below the 1.05 EUR level.