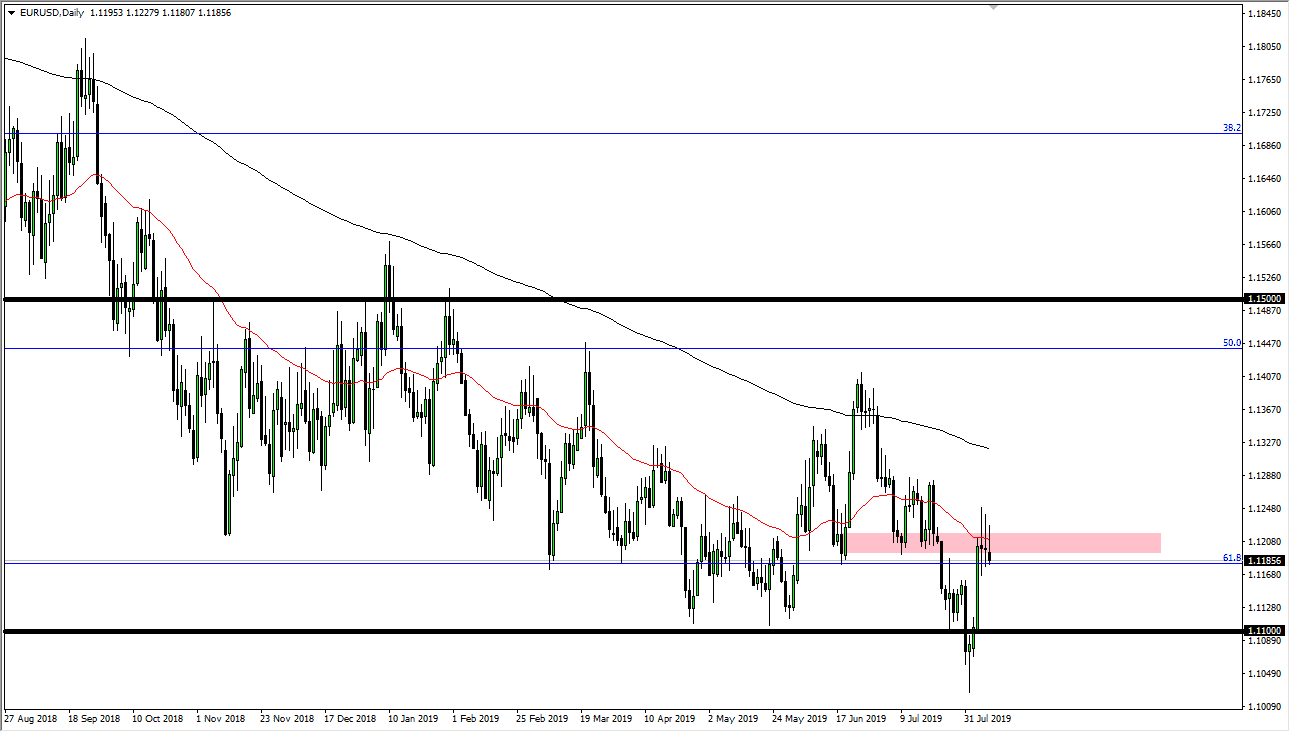

The Euro tried to rally during the trading session on Thursday but continues to find selling pressure above the 1.12 handle. That’s an area that looks very likely to continue to show signs of resistance, and I think it extends to the 1.13 handle. That is a major resistance barrier, and I do have it marked on the chart. I believe that the 50 day EMA slicing through that level also offers plenty of reason to think that were going lower, and then of course the fact that we have formed a triple shooting star is a rather negative sign.

The great thing about this chart is not necessarily that it offers a potential selling opportunity, but what it does is tell us what the Euro itself is doing. Remember, currencies are measured against the greenback for a reason. This means that even if you don’t sell here, you could be looking to sell the Euro against other currencies around the world that are considered to be “safer.” Example, you could sell the EUR/JPY pair. Or maybe even you could start shorting the EUR/CHF pair. Maybe you don’t like the risk to reward ratio here, because the 1.11 level should be supportive. This market continues to see that as an area that should be paid attention to, but I do think that we continue to go even lower at this point.

The only way that I see this market turning around is if we can break above the top of these three shooting stars that we have just formed on the daily chart. We clearly are not doing that now, but if Friday ended up seeing a very bullish candle stick and we broke above those levels, then I think it would be an extraordinarily bullish sign. All things being equal though, it certainly looks as if we have more downside than anything else.

US dollar strength continues to be the case from what I see, and I do think that won’t be any different here. That doesn’t mean that we are going to go straight down, but I do think it’s going to be more of what we seen recently, and other words a significant grind to the downside. With that being the case, I think that we continue to see traders come in and short this pair on small rallies on short-term charts. Again though, if you’re looking for a little bit more momentum, you may have to sell the Euro against other currencies.