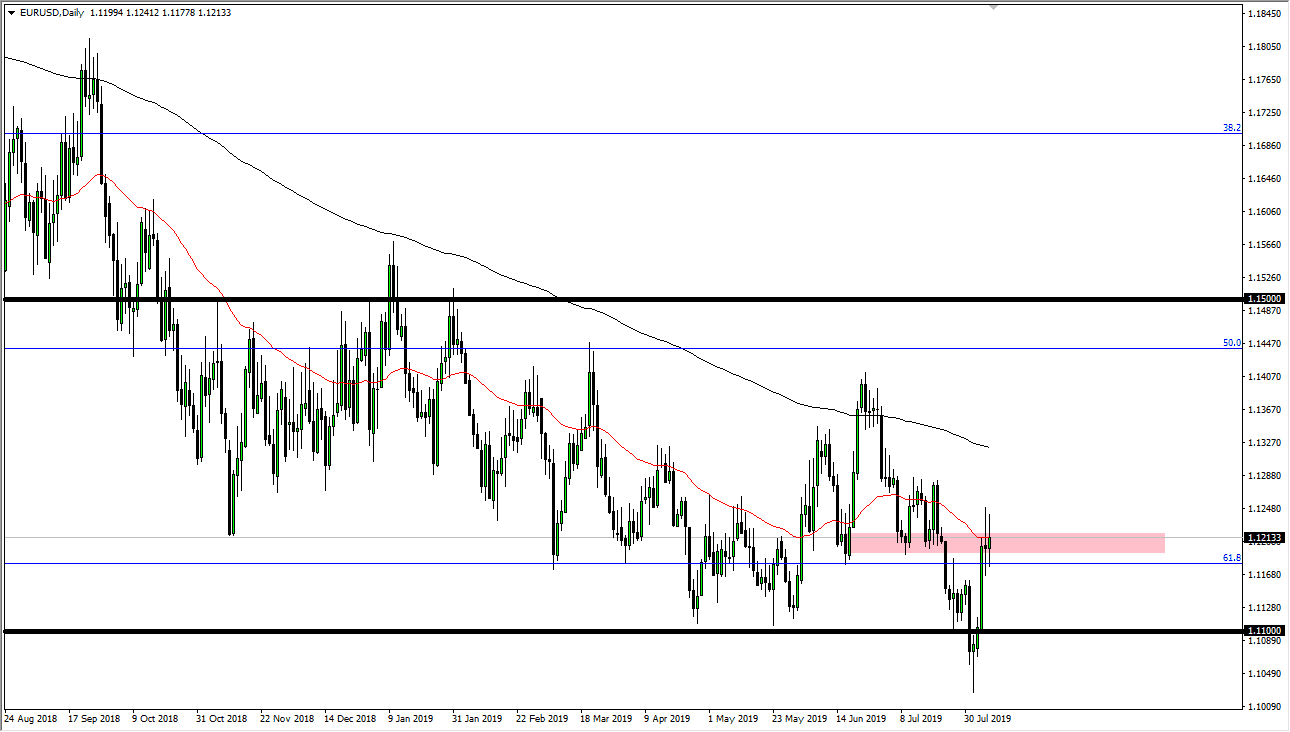

The Euro went back and forth during the trading session on Wednesday, as we can’t have any clarity apparently. This is a market that has rallied quite significantly, but then sat still over the last couple of days, chopping in a very short trading range. Because of this, we are likely to need to make some type of decision, but if you been watching any of my analysis here at Daily Forex you know that I see the area between the 1.12 and the 1.13 levels as massive resistance. After the action on Wednesday, there’s nothing on this chart that changes my opinion.

I suspect that we will roll over, and a break down below the last couple of days could open up the door down to the 1.11 handle. I don’t have any interest in buying this pair, because not only do I see resistance all the way to the 1.13 level, but the 200 day EMA is starting to grind down towards that level. In other words, there’s plenty of reasons to think that this market breaks down. Beyond that, the European Union is a disaster and bonds alone should continue to drive money away from the continent.

The Brexit of course isn’t helping anything either, as we don’t know how that’s going to turn out but the one thing that we do know is that there is going to be a lot of noise and uncertainty around that. On the other side of the Atlantic Ocean, we have the United States. Yes, we may see another rate cut or two, but the reality is that with global growth slowing down, a lot of money will flow into the United States as it is the “best bad market” out there. The economy continues to rally a bit in the United States, although it is slowing. Perhaps this means that we don’t get some type of major meltdown, but we should see a bit of a grind lower. If we did break above the 200 day EMA, which is pictured in black on the chart, then I could rethink the entire situation. Until then I believe that the sellers continue to run the show, and that this short-term rally is probably going to fail in the next 24 hours or so. That doesn’t mean that we jump all in, but I still am bearish in the intermediate term.