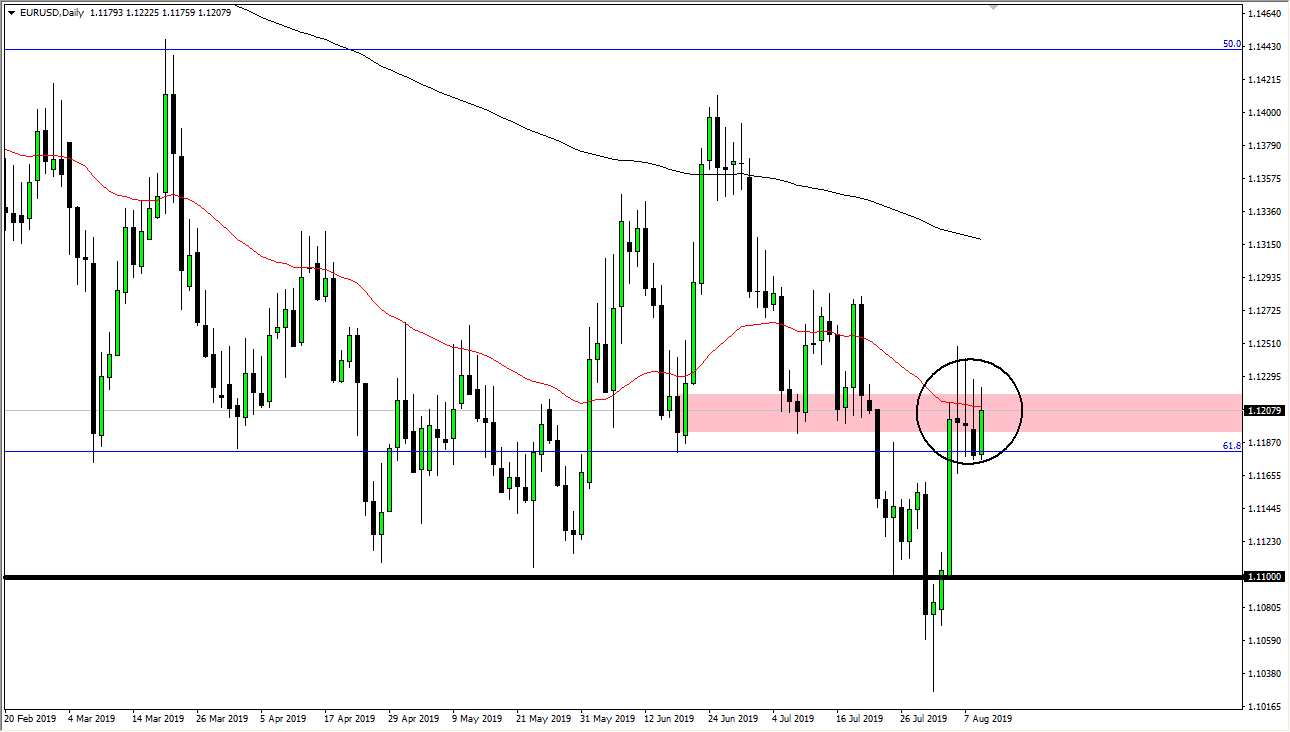

The Euro has tried to rally again during the trading session on Friday, but as you can see, the 50 day EMA continues to attract a lot of selling pressure. Because of this, I find it very interesting that we have seen four days in a row offer selling pressure at this level, and it tells me just how important the 50 day EMA suddenly is. Granted, we did close higher during the day on Friday and with a little bit more of a bullish candle stick, but I think there is a lot of work to do before we can continue to go to the upside.

Furthermore, I see the area between 1.12 and 1.13 as massive resistance. There is a lot of noise in that region, so I think it’s going to take something rather special to break through it. In the short term, I believe it’s easier to simply fade these rallies at the first signs of trouble.

Even with the Federal Reserve cutting rates, the European Central Bank continues to ease its monetary policy in multiple ways, and of course the EU is struggling with the idea of Germany going into recession. Because of this, and the fact that the bond markets in the European Union offer negative rates more often than not, it’s hard to believe that a lot of money will go flowing from the United States into the European Union. That being said, there have been occasional pop higher based upon the stock market. Money flows out of the US stock market, but have to come home, so we have seen the Euro pick up a bit of strength early in US trading as money flows back across the pond. However, this is a short-term phenomenon, and I do think that the longer-term attitude of this market will continue to exert itself, selling off any signs of strength.

To the downside I would expect the market to go looking towards 1.11 level where we have seen a bit of support here and there. If we break down below there it’s likely that we could go to the 1.10 level underneath. A breakdown below that level would of course be rather catastrophic. I continue to sell rallies in this pair, especially considering how much resistance we have seen above the 1.12 handle. Longer-term, I do think that we are getting closer to the bottom than ever, but we have some time to go before we get there.