The steady performance of the EUR/USD on the daily chart foreshadows a stronger move ahead. At the beginning of this week’s trading, the pair dropped to the 1.1161 support level before returning to test 1.1230, and this was the performance since Tuesday’s trading. The pair remains under pressure amongst pessimistic outlook to the Eurozone economic performance and the widening political dispute in Italy again. Today, ZEW sentiment index, the highly monitored economic indicator in Germany will be announced, and expectations are still suggesting weak sentiment in light of continues world trade wars which led to slowing manufacturing sector in Germany. Fears have pushed the ECB to think about easing its policy, to a point where they might adopt negative interest rates among other motivation plans to revive the zone’s economy.

The pair didn’t benefit much from multiple reports and expectations from international banks and institutions suggesting that the US economy was to enter a recession phase in the coming months, especially if the trade dispute with China continues. These expectations, along with expectations that the Federal Reserve might cut interest rates, to a point where others expect it to reach 0%, in case the global economic slowdown continued. It seems that the variance of the economic performance and monetary policy between the Eurozone and the U.S still favors the USD. Investors will be on the lookout for the US economic data to anticipate the Fed Reserve’s plans in their meeting next month.

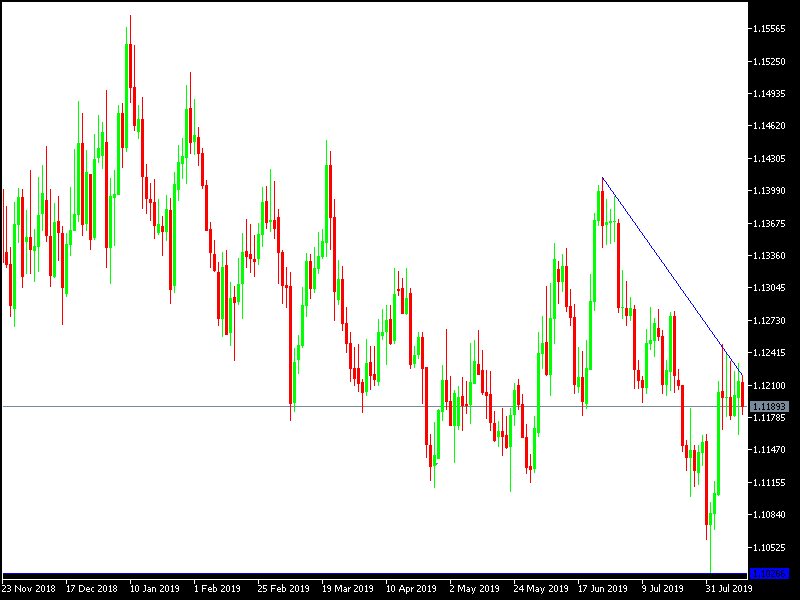

Technically: The EUR/USD performance remains under bearish pressure that would push it below the 1.1200 psychological support. Therefore, the pair might move to test stronger support areas at 1.1140, 1.1080 and the psychologically important 1.1000. In case of a bullish correction, the nearest resistance levels might at 1.1285, 1.1335 and 1.1420 respectively. The EUR is moving strongly within a bearish channel on the daily chart.

On the economic data front: Today’s economic agenda will focus on the German Economic Sentiment data from ZEW. From the US, there will be an announcement of the CPI data, the most important inflation index for the country.