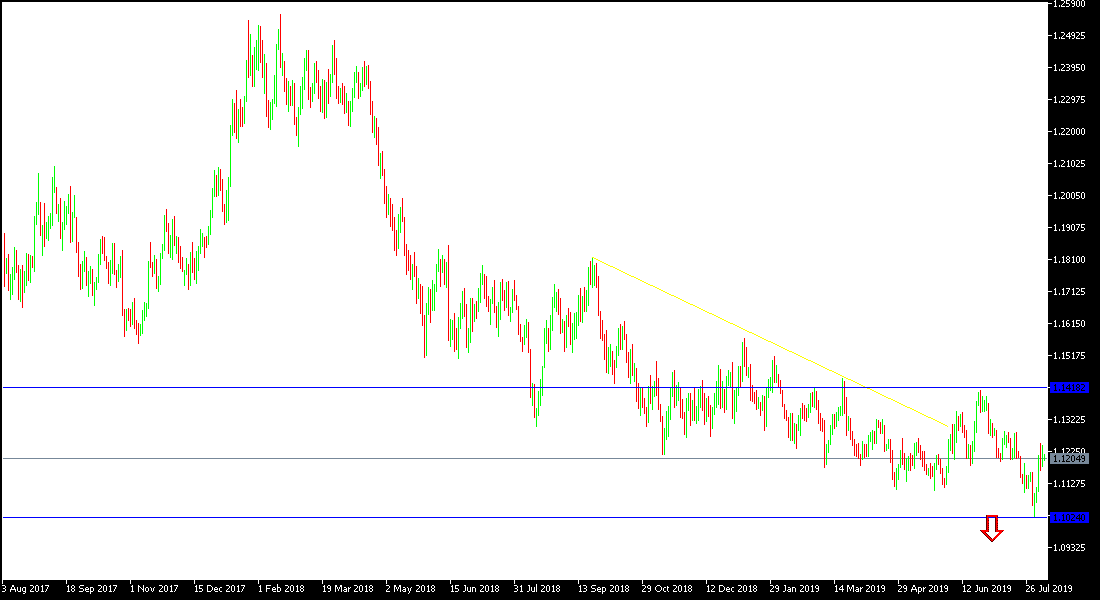

For three consecutive trading sessions, the EUR/USD has been holding steady between the 1.1167 support and 1.1249 resistance in a narrow, limited and stable range, and around 1.1200 at the time of writing awaiting any developments. As noted on the economic calendar, there are no important economic data affecting the performance of this pair today. Overall, the main feature of the trend is still bearish. A move below 1.1200 support could push the bearish momentum to test stronger support levels. Technical indicators are still in oversold areas, but so far no signs of bullish correction have been given.

From a basic perspective, weak results in European economic data have given the euro only more pressure, as the negative effects of the global trade war increase the pressure on the Eurozone, prompting the European Central Bank to consider stimulating the economy even if that means cutting interest rates to the negative zone for the first time in the bank's history. The US dollar remains strong as the US economy is still performing better than that of the Eurozone. But his strength weakens America's stance if it tries to enter into a currency war with China, which has weakened the value of the Chinese Yuan to an 11-year low below the $ 7 level to hit US exports and weaken its competitiveness in world markets.

Financial markets are watching carefully the developments of the trade war, which will naturally slow down global economic growth. It seems that US President Donald Trump does not want to calm things down, and only wants to impose America's First policy on the rest of the world economies.

Technically: EUR / USD move below the 1.1200 psychological support level will increase downward pressure on the pair and may support a move towards stronger support levels at 1.1145, 1.1080 and then the 1.1000 psychological support, as a downside target. If the correction is made upward, then the resistance levels will be 1.1285, 1.1335 and 1.1420 will be the closest when this happens. On the daily chart, the pair is still floating within a bearish channel.

On the economic data front: Today's economic calendar highlights the announcement of the monthly report from the European Central Bank and then the weekly unemployed claims.