Weak confidence in the performance of the German economy to the lowest level in 8 years increased the bearish momentum of the EUR / USD pair, which remained stable below psychological support with losses reaching the 1.1170 level. The European Central Bank (ECB) is expected to adopt more stimulus plans, including lower interest rates, which are currently at zero. Previously, the Euro was negatively affected by the widening Italian political row, paving the way for early elections and a return to concern about the budget of the region's third largest economy.

As for the US economy, the US inflation rate has risen as expected but is still far from the Fed's target. Surprisingly, the country decided to postpone further tariffs on Chinese imports, which were scheduled for Sept. 1. Expectations have recently been raised by international banks and financial institutions that the US economy will enter a recession in the coming months. Those expectations included the possibility of the US Federal Reserve to cut interest rates, some of whom went so far that the US interest rate may reach zero if the global economic growth continues to slow in response to the continuing trade dispute with China. Overall, the divergence of economic performance and monetary policy between the Eurozone and the United States is still in favor of a stronger US dollar.

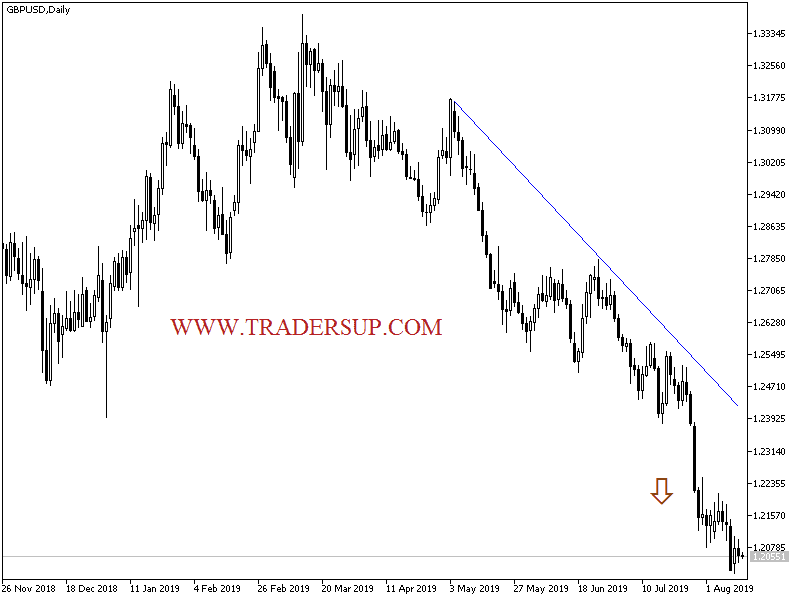

Technically: Stabilizing the price of the EUR / USD pair below the 1.1200 psychological support, as we expected before, will increase the bearish momentum and test the support areas at 1.1140 and 1.1080 and the 1.1000 psychological support respectively, which confirm the strength of the current downtrend. On the upside, the resistance levels will be 1.1285, 1.1335 and 1.1420 respectively, the closest for the pair's performance. Overall, the EUR / USD keeps moving within a violent bearish channel and so far there has been no sign of a change in direction.

On the economic data front: The economic calendar today will focus first on the release of the German CPI, GDP, industrial production and employment costs for the Eurozone. From the US, there are the weekly import price index and U.S oil inventories data.