For the fifth consecutive trading sessions, the EUR / USD stabilized around the psychological 1.1200 support level, waiting for any developments amid stronger bearish momentum, which pushed during last week's trading to the 1.1180 support leve. The Eurozone economy continues to slow down due to the escalation of the global trade war between the world two largest economies, supporting the ECB's assertion of its readiness to ease its monetary policy, which could lead the bank to cut interest rates to negative as well as other stimulus plans. Despite the mixed results of recent US economic data, it will not be an incentive for the Federal Reserve to accelerate its monetary easing even after China's latest move to devalue the Yuan against the US dollar to its lowest level in 11 years in response to the imposition of more US tariffs on Imports from China.

The independence of the US central bank may prevent interference in the currency market, as happened with China, which was aimed at striking the competitiveness of US products in world markets, where US exports become more expensive than Chinese products. This step followed a decision to ban the import of all kinds of US agricultural products and urged importers to search for other sources and countries. The continued aggravation of the US-China trade dispute could increase pressure on global economic growth and consequently global central banks are moving towards further easing of their monetary policy.

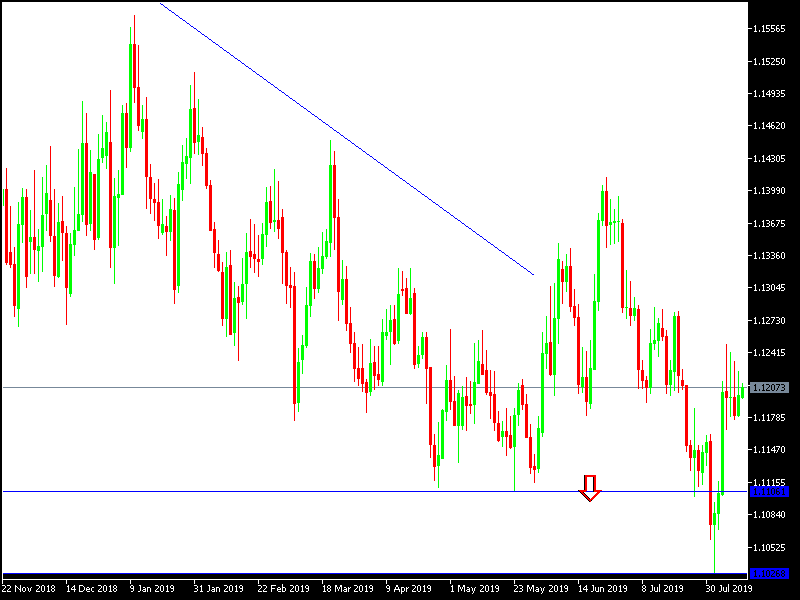

Technically: according to the latest technical analysis and what we now confirm, the performance of the EUR / USD below the 1.1200 psychological support level will support the downward strength and move the pair to test stronger support areas that may reach the support levels at 1.1140 and 1.1080 and the psychologically important 1.1000. On the upside in case of a correction, the closest resistance levels for the pair will be 1.1285, 1.1335 and 1.1420 respectively. The pair's performance on the daily chart still confirms that it sticks to its movement within a bearish channel.

On the economic data front: the economic calendar at the beginning of this week's trading has no significant data from either the Eurozone or the United States.