On Tuesday, the EUR / USD pair continues bullish correction with gains to reaching 1.1250, the highest level in two weeks, despite the announcement of a sharp decline in the German manufacturing sector, which negatively affects the Eurozone economy, which is close to the decline in the entire activity. With a monthly overview of the manufacturing and services sectors, the results of the Eurozone composite Purchasing Managers' Index showed that the sectors fell to 51.5 points in July from 52.2 in the previous month, and the drop near the 50-point threshold threatens the sector into recession. The results of the index showed differences between the sectors, with the services sector continuing to grow strongly, while industrial production fell rapidly. The global trade war continues to increase pressure on the Eurozone economy.

From the United States, the results of US jobs were mixed, and before that, the US Federal Reserve cut US interest rates by a quarter point and the US dollar was not strongly affected after the announcement, with the bank confirming that the cut would not be a permanent policy and that what happened was only an update of the policy cycle. The EUR/USD pair will continue to be under pressure of contrasting economic performance and monetary policy for both the Eurozone and the US. Expectations are that the ECB is ready to adopt negative interest rates along with other stimulus plans at its next meeting.

The US-China trade war has intensified, as Trump imposed more tariffs on Chinese products and the Chinese responded by devaluing the Chinese Yuan to hit US exports on world markets.

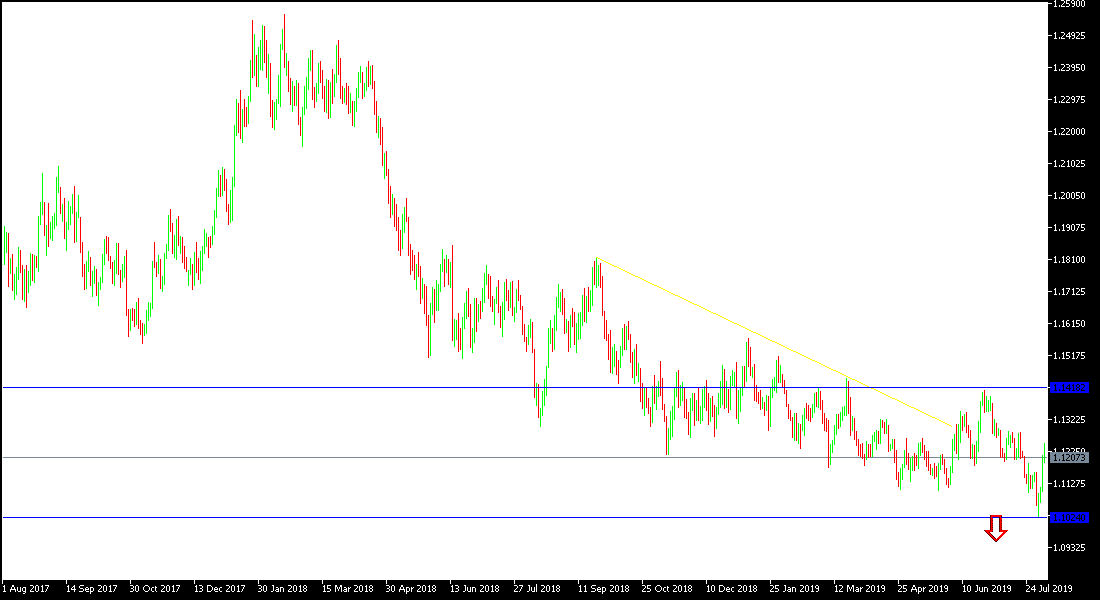

Technically: Despite the recent gains, the EUR / USD pair on the daily chart is still moving within a bearish channel and the bullish correction will not strengthen further without the pair moving towards 1.1285, 1.1330 and 1.1400 resistance zones respectively. On the downside, the nearest support levels for the pair today are 1.1155, 1.1080 and 1.1000 and the last level confirms the strength of the current bearish trend.

On the economic data front: The economic calendar today is free of any important data from either the US or the Eurozone.