The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 4th August 2019

In my previous piece two weeks ago, I forecasted that the best trades would be short of GBP/USD, long Gold in USD terms following a daily close above $1450, and long Silver in USD terms following a daily close above $16.50.

Gold never closed above $1450 so this trade was not triggered. Silver closed above $16.50 one day that week but closed at the end of the week down from there by 2.55%. GBP/USD fell by 0.96% over the week. These trades add up to an averaged loss for the week of 0.40%.

Last week’s Forex market saw the strongest rise in the relative value of the Japanese Yen, and the strongest fall in the relative value of the Australian Dollar.

Last week’s market was dominated by the first rate cut from the U.S. Federal Reserve in 10 years, and the imposition by President Trump of a new tariff on Chinese goods. This has produced a strong movement into safe havens, especially the Japanese Yen, and out of riskier currencies and stocks. The new British Government also seems prepared to leave the E.U. at the end of October even without a deal, and this has sent the Pound to new 28-year lows and the Euro to significant new lows also.

The Forex market exploded into life last week, with much heavier volumes and volatility an obvious feature.

This week has a thinner news agenda scheduled than last week, but there are some important items due concerning the British Pound, and the Australian, New Zealand, and Canadian Dollars.

Fundamental Analysis & Market Sentiment

Fundamental analysis now sees the Federal Reserve as taking a balanced approach following last week’s rate cut – however, another cut of 0.25% is widely expected later this year, with Goldman Sachs giving an 80% probability to this scenario. The U.S. economy is still growing quite strongly, but the new tariffs on Chinese goods have caused stock markets to fall and the Dollar to give up most of its earlier gains, with a general flight to safety taking place.

Market sentiment is more strongly risk-off and this is playing out mostly as a flow into the Japanese Yen and Gold to a lesser extent. The British Pound remains very weak as a new, more strongly pro-Brexit British government has hit the ground running. The Australian Dollar is also notably weak.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index rose substantially, printing a near-pin candlestick. This almost suggests that a move down next week is likely. However, the price is up over both 3 months and over 6 months, indicating a bullish trend. Additionally, the price made its highest weekly close in almost 2.5 years, which is another bullish sign. This suggests that we are more likely to see a further rise next week, but the new U.S. tariffs sent the Dollar falling at the end of the week, and this may well continue, so I have no confidence that a rise next week is probable.

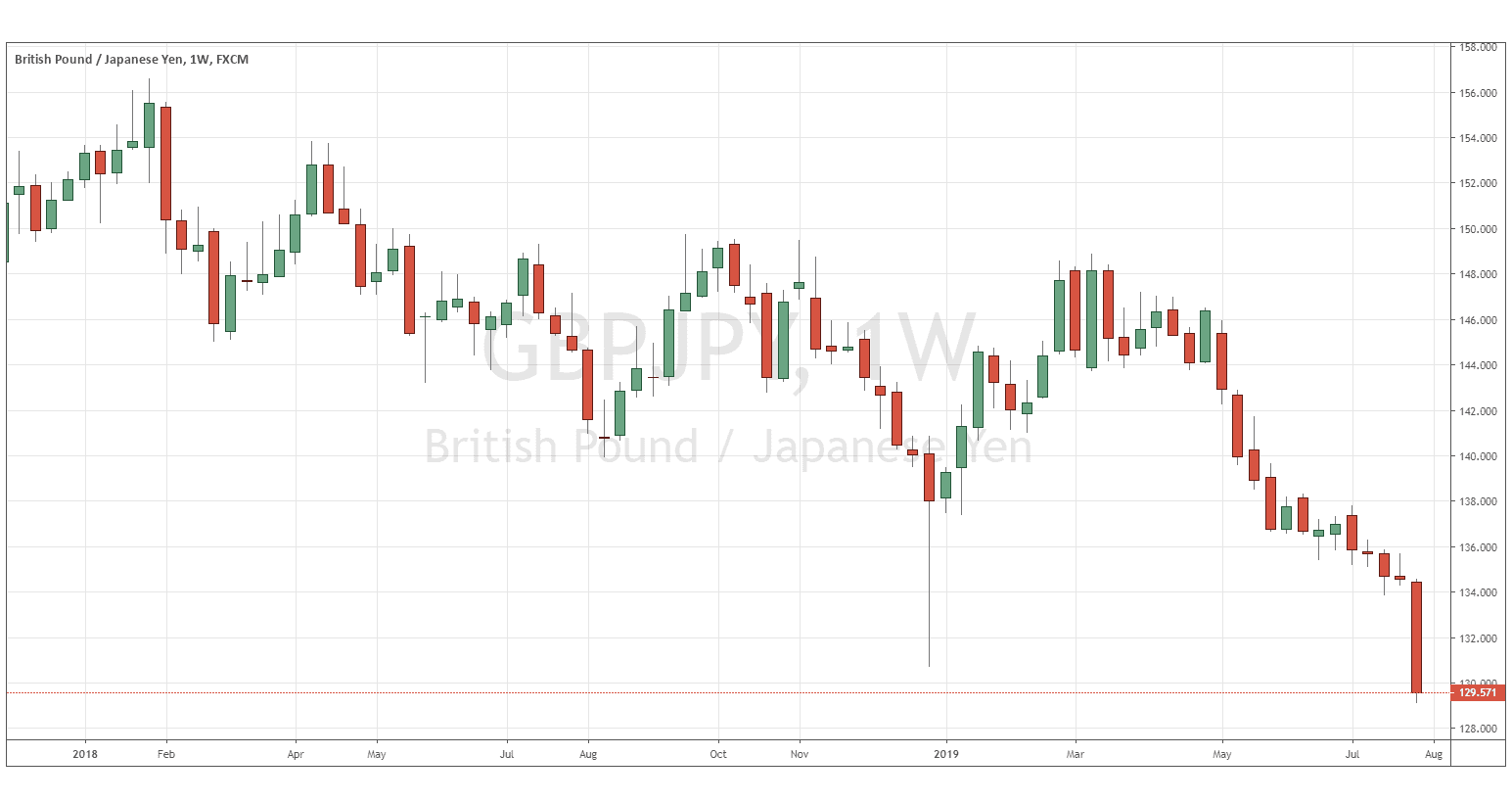

GBP/JPY

This currency cross printed a very large, strongly bearish candlestick last week, which closed very near its low, at a 2.5-year low price. These are all bearish signs. The Pound is generally very weak, driven by an increasing probability of a no-deal Brexit at the end of October. The Yen is very strong and is currently benefiting from a flight into safety. This puts this currency cross at the heart of the Forex market, with a probability of still lower prices over the coming week.

AUD/JPY

This currency cross printed a relatively big, strongly bearish candlestick last week, which closed very near its low, at a 7-month low price. These are all bearish signs. The Australian Dollar is generally weak and has been steadily trending downwards over the long-term as the RBA continues to take a dovish approach to a weakening Australian economy. The Aussie also tends to be hit hard during risk-off market environments such as we have today. The Yen is very strong and is currently benefiting from a flight into safety. This puts this currency cross near the heart of the Forex market, with a probability of still lower prices over the coming week.

XAU/USD

Gold in USD terms just made its highest weekly close in over 6 years, printing a relatively large and bullish candlestick which closed in the upper part of its range. Gold Is benefiting from the current flight to safety. These are all bullish signs, but the resistance at $1450 continues to hold and will need to be broken before the price can advance much more.

Conclusion

This week I forecast the best trades will be short of GBP/JPY and AUD/JPY. XAU/USD (Gold in USD terms) long could also be good following a daily close above $1450.