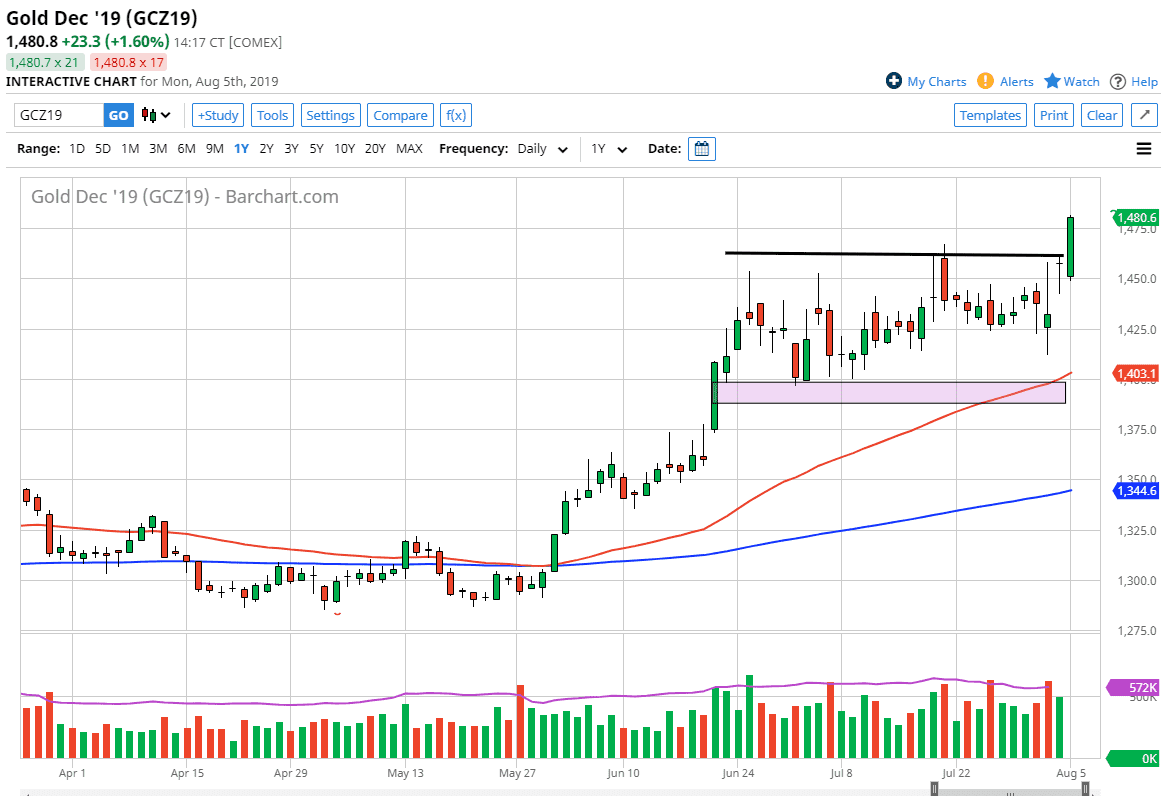

Gold markets rallied significantly on Monday to send the market higher, reaching towards the $1480 level before pulling back a bit. That being said, we did break the top of a hammer shaped candle stick from the Friday session, and perhaps more importantly a minor resistance barrier that has been the top of the recent consolidation. With that being the case, it’s obvious that the buyers are in control although there is an absolute ton of uncertainty out there in both directions.

The candlestick is of course very bullish but the fact that we broke through that horizontal line tells me that we are ready to go higher. Pullbacks at this point should be a nice buying opportunity, because I think that the hammer from Monday is crucial, and then below there we have the gap that opened up the Friday session as well that should offer plenty of support. I think that the short-term “floor” in the market is probably closer to the $1425 level, so at this point I think that the “floor” has moved up about $25.

For what it’s worth, the 50 day EMA is now above the $1400 level, which had been the previous support. I think that the 50 day EMA is going to go looking towards $1425 level, so I believe that there will be plenty of buyers underneath. That being said, the alternate scenario of course is that we simply break above the top of the candle stick for the trading session on Monday, showing a bit of continuation in the bullish move that we have seen. Ultimately, I do think that will happen, but I also anticipate that a short-term pullback is probably more likely than not.

Above on a breakout to the upside the next thing that we need to pay attention to is the $1500 level as it is a large, round, psychologically significant figure. That of course will attract a significant amount of order flow, and I think it will be difficult to break above the $1500 level right away. I would anticipate that it would take several pullbacks to eventually find enough momentum to break out to the upside. If and when we do, then I think we are looking at a “buy-and-hold” type of market that we are ready to go into. Until then though, short-term dips should continue to be buying opportunities.