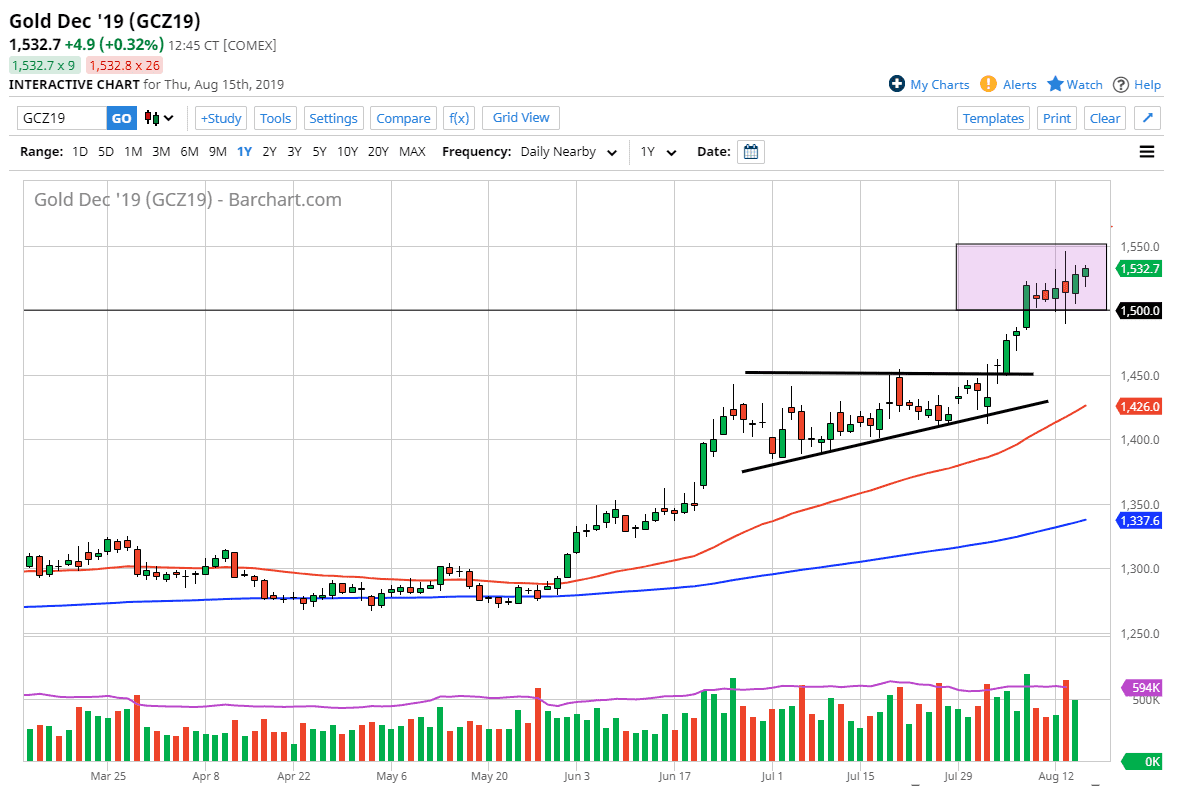

The Gold markets rallied slightly during the trading session on Thursday, as we continue to reach towards the highs again. At this point I think the market is likely to pull back from here to look for buying opportunities, as it could give you a bit of value in a market that is very strong. Because of this, I don’t like the idea of this selling gold, as it has been very bullish in every time you have tried to short this market because it became “too expensive”, you have gotten your head handed to you.

I believe that the $1500 level underneath is going to be support, as it was previous resistance. It’s a large, round, psychologically significant figure, so that of course will attract a certain amount of attention and therefore support. If we were to break down below there, then I think there is much more structural support below at the $1450 level, which was where we had seen resistance in the ascending triangle. Beyond that, we also have the 50 day EMA reaching towards that level and getting ready to slice through it. That should keep the sellers at bay, as technical trading will take over near the 50 day EMA as an indicator.

If we do break out to the upside, we could then reach above the $1550 level, and then start looking towards the $1600 level. I do think that happens given enough time because the central banks around the world continue to cut monetary policy back, meaning that the loosened monetary policy should continue to have the wealthy looking to protect their wealth in places like gold in Bitcoin. Silver, palladium, and platinum have all done well in this environment also, and I think should continue to do so.

Keep in mind that this is about getting away from fiat currencies. If we were to break down through here I think there will be a lot of value hunters down near the trend line or at the very least the $1450 level. I believe that the value hunters will continue to flock toward this market as we have quite a bit of room to go to the upside. Longer-term I believe that we are probably looking at the $1800 level, possibly even $2000. I have no interest in shorting this market, the fundamentals simply line up against that idea.