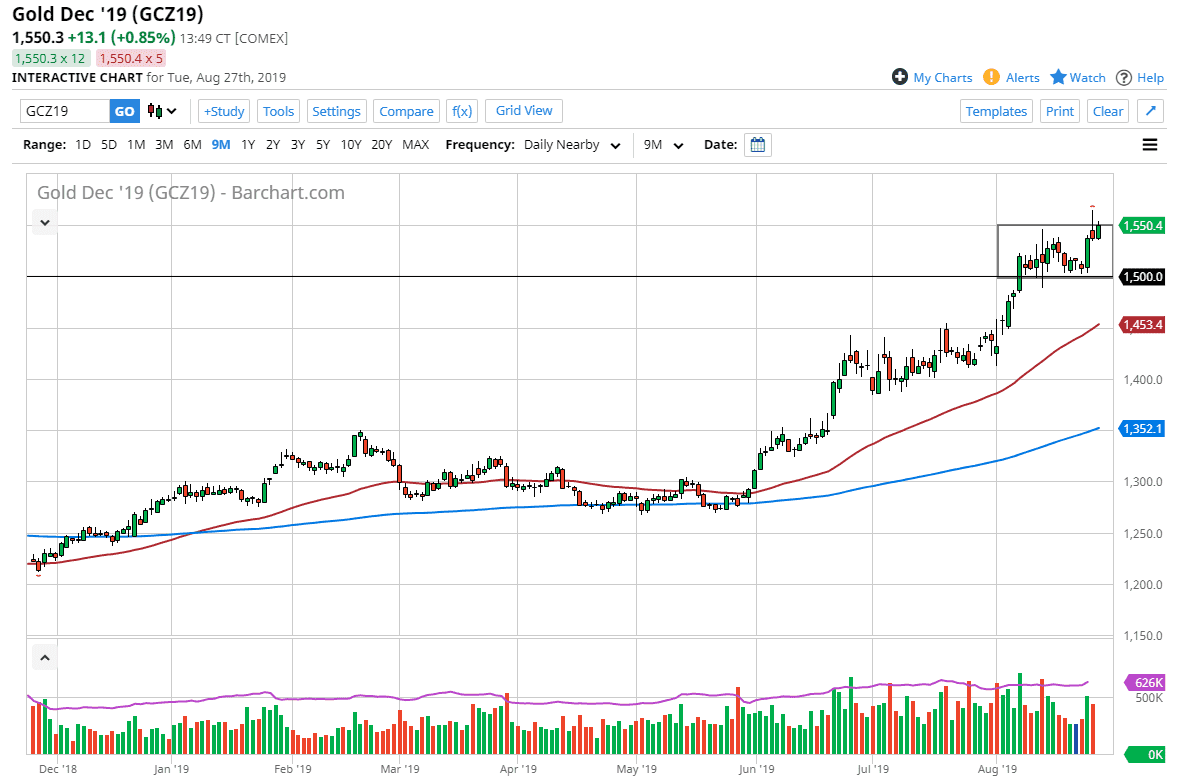

Gold markets are very likely to continue going higher given enough time, because although we ended up forming a massive shooting star during the Monday session, we have seen the market continue to try to grind to the upside. At this point, the $1550 level has continue to offer a bit of resistance, which is the basis of the shooting star from the Monday trading session. At this point, it’s likely that any short-term pullback will probably be a buying opportunity. The $1500 level underneath is a large, round, psychologically significant figure, and that of course is an area that will cause a lot of attention to be paid to this market.

The market pulling back is rather healthy considering how bullish we have been, and the market probably needs to digest the idea of being above the psychologically and structurally important $1500 level. All things being equal, it’s very likely that the market will continue to find value underneath so I like the idea of buying pullbacks as gold is obviously very bullish, but you need to find value as we are a bit overextended.

The alternate scenario is that we break above the top of the shooting star from the previous session, and therefore bust through a ton of resistance. While that could happen, I think that it’s likely we would need some type of catalyst to actually do so. While this market looks very bullish, again I cannot stress enough that you should be looking for value in an uptrend. This market will be very noisy as it is a market that people run to when they are concerned. There are a lot of things to worry about in this market overall, and gold of course is a strong uptrend that you can take advantage of.

I think to the downside, the $1500 level offers massive support, just as the $1450 level underneath should be supportive as well, as it was the top of the previous ascending triangle. Beyond that, we also have the 50 day EMA traveling around that area, and that of course could offer a lot of support as well. All things being equal, I believe that there are a couple of areas underneath that should continue to offer buying opportunities on supportive candles, and although I would by a break out to the upside, it’s my least favorite way to purchase gold.