Gold markets exploded to the upside after initially pulling back on Thursday due to Donald Trump tweeting yet again. Now the latest thing is that he’s looking to add tariffs to the Chinese imports coming into the United States as of September 1. Another 10% as the market reeling, and there was a huge run towards safety.

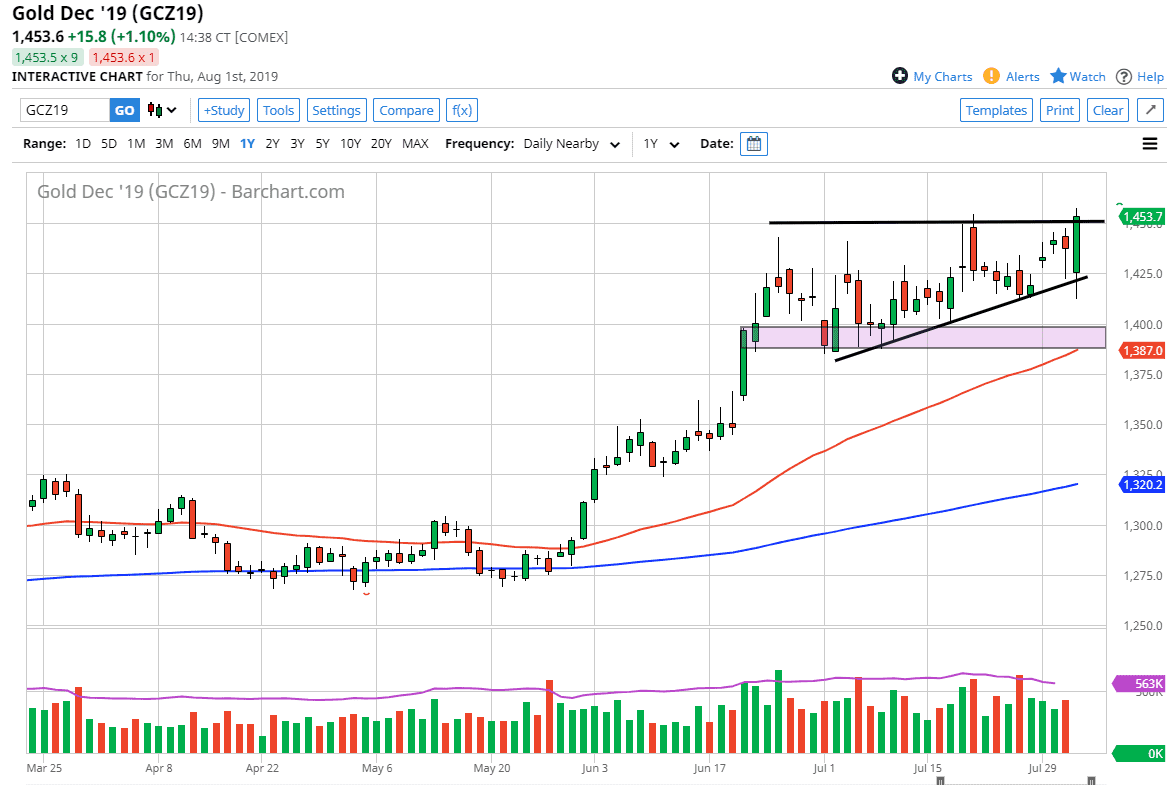

We initially pulled back during the day but found enough support underneath to show signs of life at the uptrend line that I had been mentioning. Now that we have bounced from that uptrend line, we have touched the top of the ascending triangle, which is a very bullish sign and I think that it’s only a matter time before we break out to higher levels. That being said, there are a multitude of factors coming into play at one time.

Jobs number

The jobs number of course will be a major factor as to how the market behaves during the trading session today. That being said, I think it’s obvious that Gold is already made its intentions known as we continue to find buyers. The $1450 level has been massive resistance in the fact that we are closing right at that level at the end of the day tells me that it’s only a matter of time before we break out for a bigger move.

That being said, keep in mind that at 8:30 AM New York time, we will have the jobs number coming out of America and that could very easily throw this market around. After all, it will have a significant effect on what happens with the US dollar, which by extension has a lot to do with what happens here in the gold market. Interestingly enough, I believe that the market hopes to see a very negative jobs number as it could have people thinking that the Federal Reserve is likely to cut rates again.

The technical set up

As you can see, we did break down through the uptrend line and at that point I thought perhaps we were going to continue to go lower. However, we have reversed due to Donald Trump, and it now looks likely that we will continue to see a lot of volatility. Judging by the shape and length of the candle, I think a lot of structural damage has been done to the sellers and the resistance, so I do believe that any pullback at this point should be thought of as a potential opportunity to start buying the market yet again.