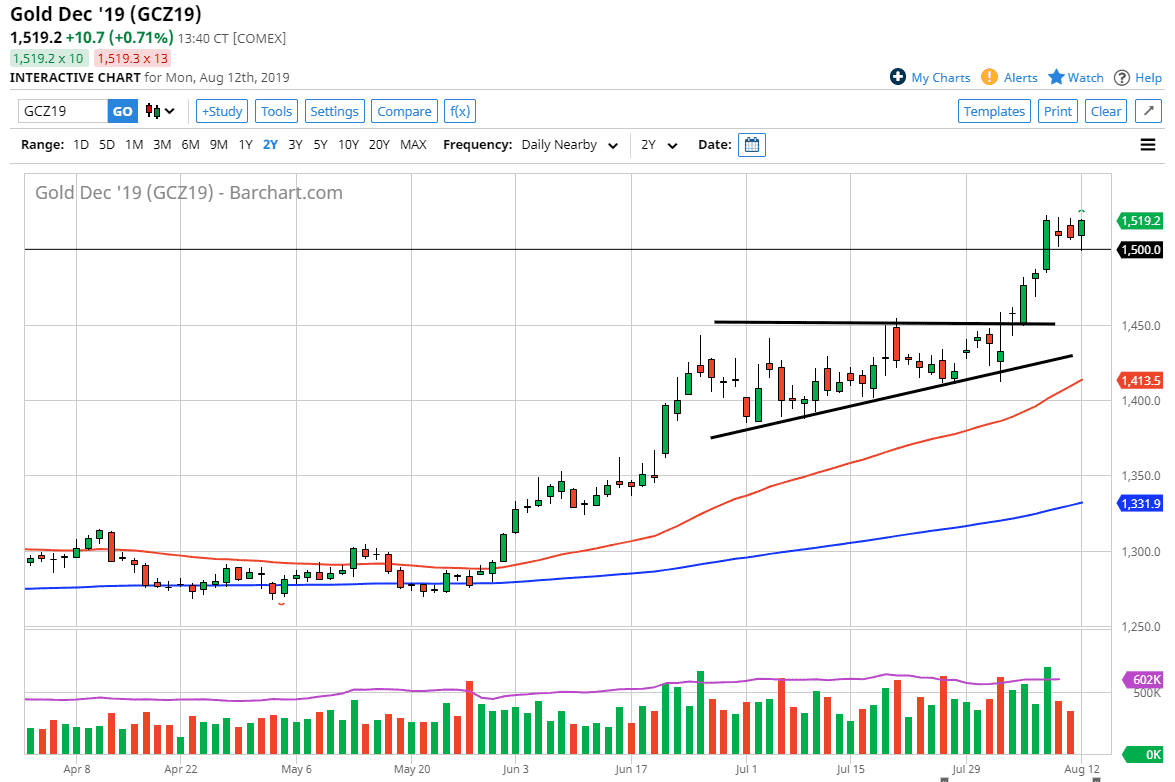

Gold markets have initially pulled back during the trading session on Monday to kick off the week, testing the $1500 level for support. We have in fact found buyers in that region, and now it looks as if we are starting to go higher yet again. I believe that the $1525 level is under assault, and we will break through it. The next major target of course will be the $1550 level, and it now looks as if the $1500 level is trying to offer a bit of a “floor” in the market.

All that being said, even if we break down below the $1500 level I have no interest in shorting Gold. Central banks around the world continue to ease monetary policy and that of course will be good for precious metals overall. The dwindling and destruction of fiat currency will continue to drive money into precious metals, so Gold of course is one of the first places that people flock to. That being said, I also like silver, platinum, and to a much lesser degree, palladium. At this point, I believe that precious metals in general all go much higher, so short-term pullbacks do offer buying opportunities.

Breaking above the $1500 level in simply hanging about it is a psychologically important victory sign for gold. I believe that even if we break down from here, the $1450 level should be very supportive as it was the top of an ascending triangle, and therefore should offer support as it was such a significant resistance. The 50 day EMA is starting to move toward that level, reaching towards the $1450 region. All things being equal, I don’t necessarily have a scenario in which I am willing to sell gold, it just comes down to whether or not the gold is more of a value. I mean by that is when it pulls back I’m willing to buy more. I believe that although we have fulfilled the ascending triangle measured move, we still have much further to go as central banks around the world are afraid to tighten monetary policy so that should continue to help gold, not only in US dollar terms but against almost any currency. In fact, you typically see some of the more “risky currencies” out there collapse against the gold market. Regardless though, it doesn’t matter what currency it’s denominated in, gold looks like it’s going to go quite a bit higher.