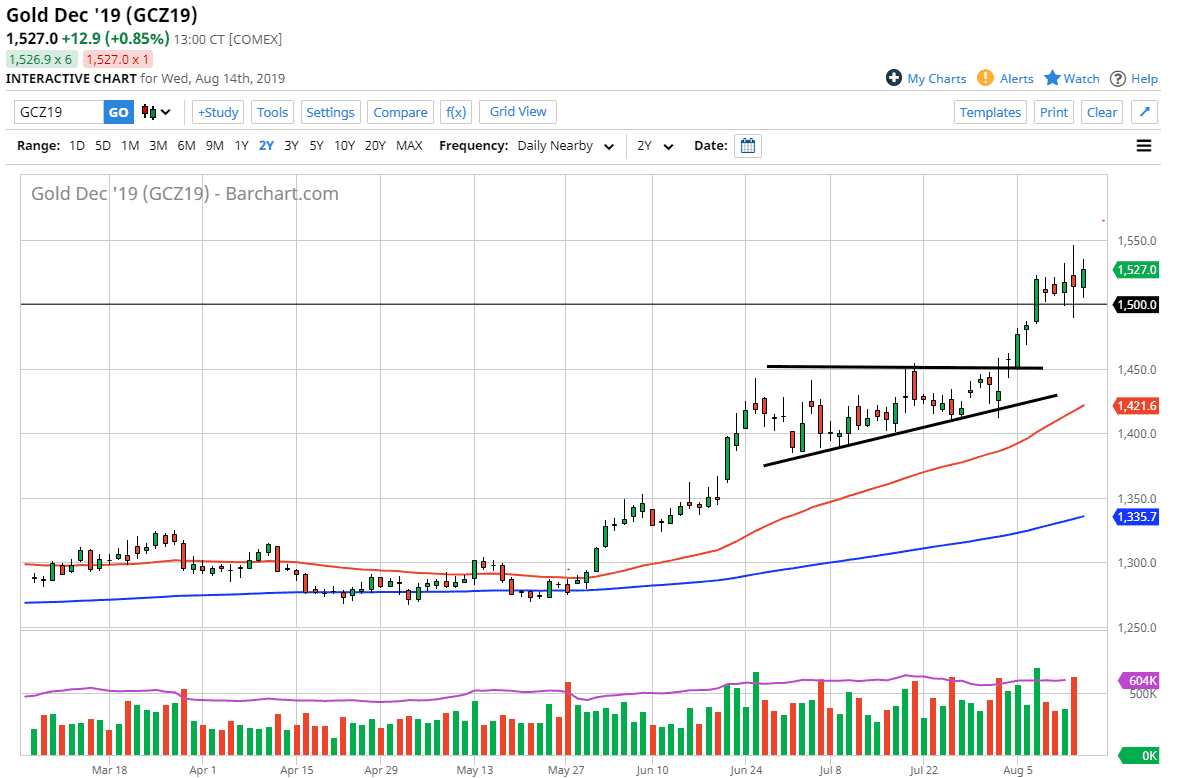

Gold markets initially pulled back during the trading session on Wednesday, reaching down towards the $1500 level. This is an area that of course attracts a lot of attention due to the fact that the level is such a large, round, psychologically significant figure. With that in mind, you will see a lot of support and resistance at levels like this. Lately, it has been supported as we sliced through this level and then bounced around several days in a row to use the $1500 level as support.

Now that we broke in this level, I think the market is trying to become comfortable above the $1500 level, as it is an area that they have not traded above for quite some time. With this, I think we will eventually go towards the $1550 level, which was the most recent high. If we can break above there, then I think we continue to go higher. Longer-term, I believe the Gold goes to $1800 an ounce. I understand that’s a pretty big move, basically about 17% from here but I do believe that happens given enough time. With that being the case I have been buying dips on short-term charts and take profits as we show signs of exhaustion. Gold continues to perform quite well, and with central banks around the world looking to cut interest rates I think that continues to be the case.

If we were to break down below the candle stick from the Tuesday session, then we could drop down towards the $1450 level which is the top of the previous ascending triangle. That should now be a lot of support, as it was such an important resistance previously. Beyond that, we also have the 50 day EMA which is painted in red on the chart starting to turn toward that level. If we can break down below the 50 day EMA, then we can start to have a completely different argument about which direction the markets going to go. Right now though I believe that the market is one that should be bought and not sold, and any time you see a significant selloff you should look at it as a potential value play as Gold will essentially be “on sale” at that point in time. I don’t see a bearish case for gold anytime soon coming into play.