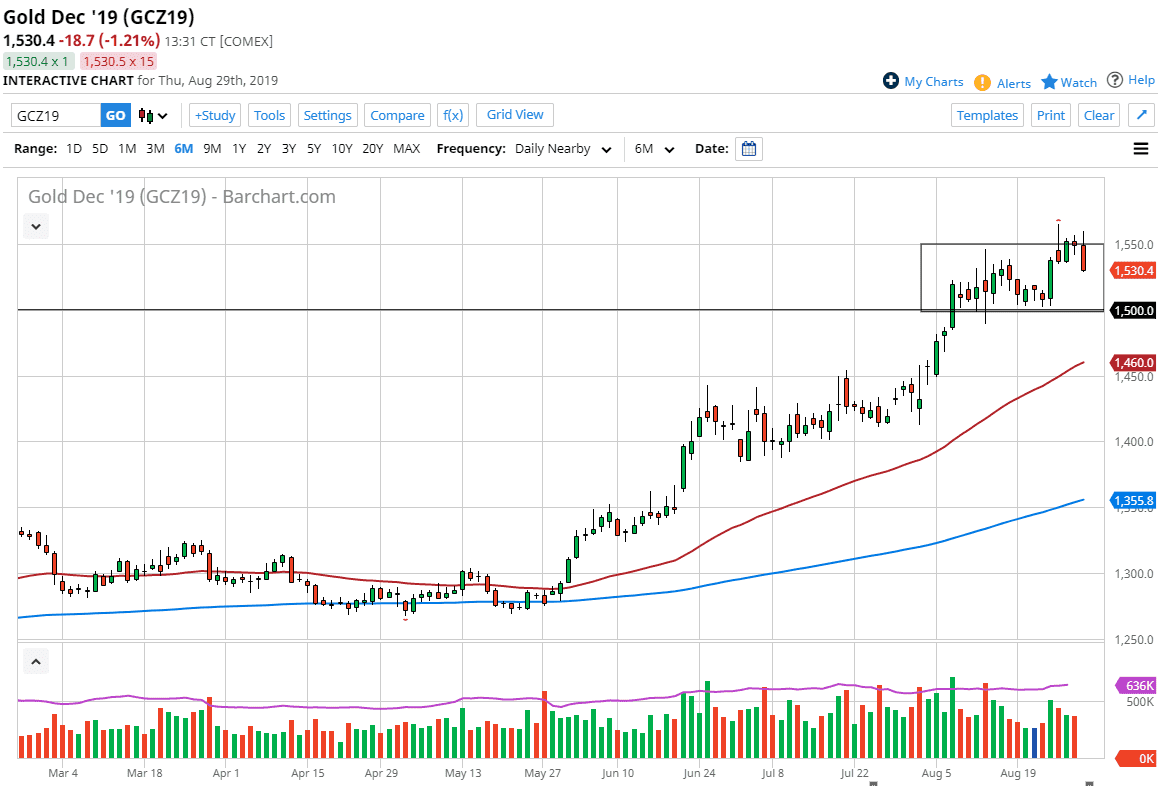

Gold markets fell rather hard during the trading session on Thursday, breaking down from the $1550 level. I have been suggesting recently that perhaps we would pull back to consolidate in this area, and it’s very likely that the market will go looking towards the bottom of the range for support. I believe that the $1500 level is essentially the “floor” in the market so I think it’s only a matter time before buyers come back in and pick up this market if we get down there. After all, nothing has truly changed in the world and we still have a lot of concerns geopolitically, as well as trade related.

Gold markets fell rather hard during the trading session on Thursday, breaking down from the $1550 level. I have been suggesting recently that perhaps we would pull back to consolidate in this area, and it’s very likely that the market will go looking towards the bottom of the range for support. I believe that the $1500 level is essentially the “floor” in the market so I think it’s only a matter time before buyers come back in and pick up this market if we get down there. After all, nothing has truly changed in the world and we still have a lot of concerns geopolitically, as well as trade related.

Beyond that, we also have the central banks around the world continue to loose monetary policy, and it’s very likely that we will see the Gold markets rally for the longer-term. At this point, the fact that we pull back is simply a bit of profit taking from what I see, because nothing has changed substantially. Even if we were to break down below the $1500 level, it’s likely that the 50 day EMA will cause quite a bit of support which is currently hanging about the $1460 level.

Looking for value is the best way to play a market that has been this bullish, and of course Gold won’t be any different. There has been a little bit of an overextension as of late, so it makes sense that we will continue to see a little bit of profit taking. I think this is healthy, it should help sustain the longer-term trend in this market. Overall, it’s not until we break down below the $1450 level that I would be a longer-term seller of this market.

To the upside, if we were to turn around and break to a fresh, new high then I think it opens up the door to the $1600 level, possibly even higher than that. Longer-term I believe that Gold continues to rally towards the $1800 level and then the $2000 level as central banks will continue to loose monetary policy into the foreseeable future. Beyond that, there are plenty of reasons to think that volatility will continue, because the markets don’t really know what to do with all of the issues around the world. Look for value, take advantage of it when it appears, as it most certainly will at lower levels.