Gold markets pulled back a bit during the trading session on Thursday, testing the $1500 region before bouncing later in the day. This is a very bullish sign, because it shows that the markets are very comfortable with the $1500 level, an area that should cause quite a bit of psychological pressure in both directions in this market. The fact that the buyers have continued to jump in is a good sign, although I would not be completely surprised to see this market break down below there and go looking for support underneath there.

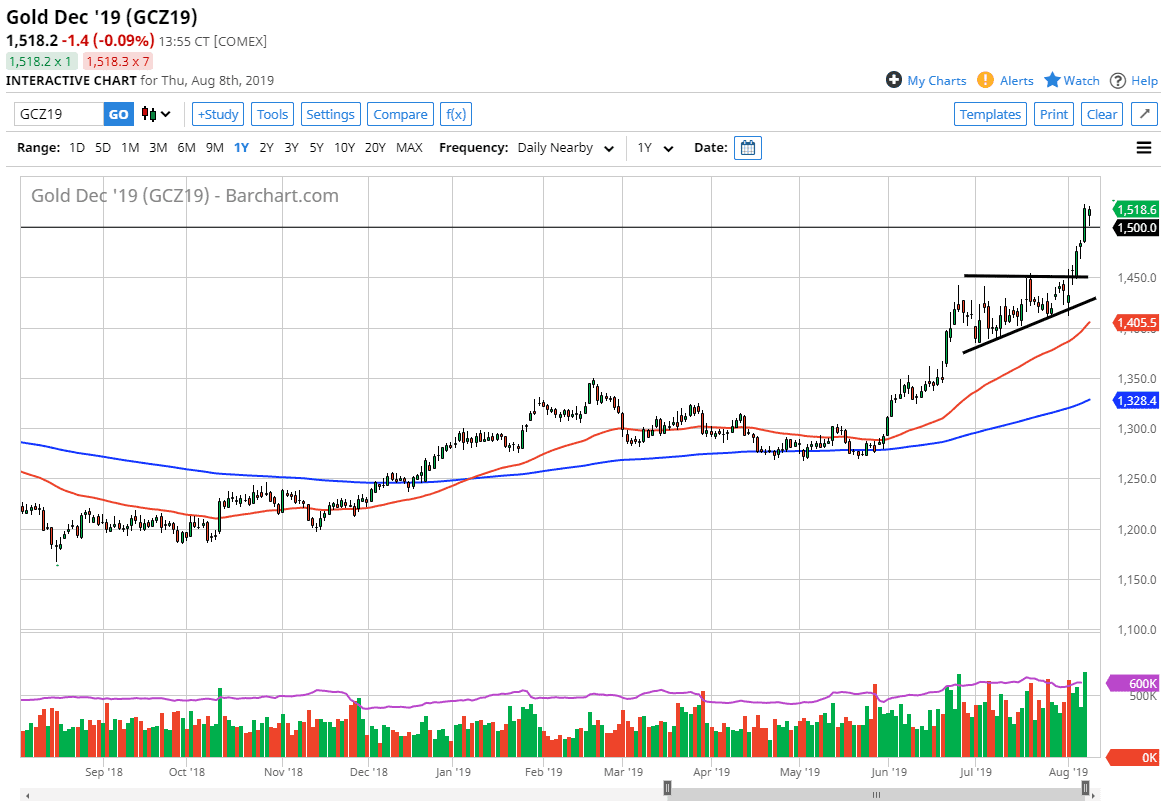

Ultimately, the $1450 level underneath will be massive support, as it was major resistance previously. Looking at this ascending triangle that I have marked on the chart, we have filled that measured move, so at this point I think a pullback is likely, and quite frankly even more desirable than any other outcome. After all, we don’t want to get ahead of ourselves in this market, which is something that we are very cautious about at this point. Yes, I do believe that gold goes higher over the longer-term due to a whole host of reasons, but at this point I would like to see a little bit of consolidation or perhaps even value present itself.

Looking at the fundamental underlying reasons, I believe that the central banks around the world continue to cut rates will help gold. After all, the central banks are all starting to move in a coordinated effort to cut rates, therefore fiat currencies are losing a significant amount of value. This drives more assets into so-called “hard money”, which of course commodities are. With that, I believe that buying the dips will probably work out the best, and I do hope that we break down below the $1500 level and go looking towards the $1450 level underneath where I think there’s even more demand. One thing is for sure though, I can’t sell this market, because there’s nothing on this chart that even remotely suggests that I should be doing so. Even if we break below the $1500 level, I think that simply stepping back and looking for something like a hammer on an hourly chart is probably going to be the trigger for me next trade. If we break above both the Thursday and Wednesday session, then I recognize we are going higher, but I really am nervous about getting involved in a parabolic market.