Gold markets have exploded to the upside during trading on Wednesday, as central banks continue to cut interest rates. During the early hours of Wednesday, New Zealand, India, and Thailand all cut interest rates, continuing to flood the markets with cheap money. If central banks around the world continue to cut rates, then it drives up demand for “hard money”, which of course Gold falls into that purview. Precious metals in general all seem to be getting a bit of a boost, with perhaps the exception of copper which is more sensitive to the economic growth story.

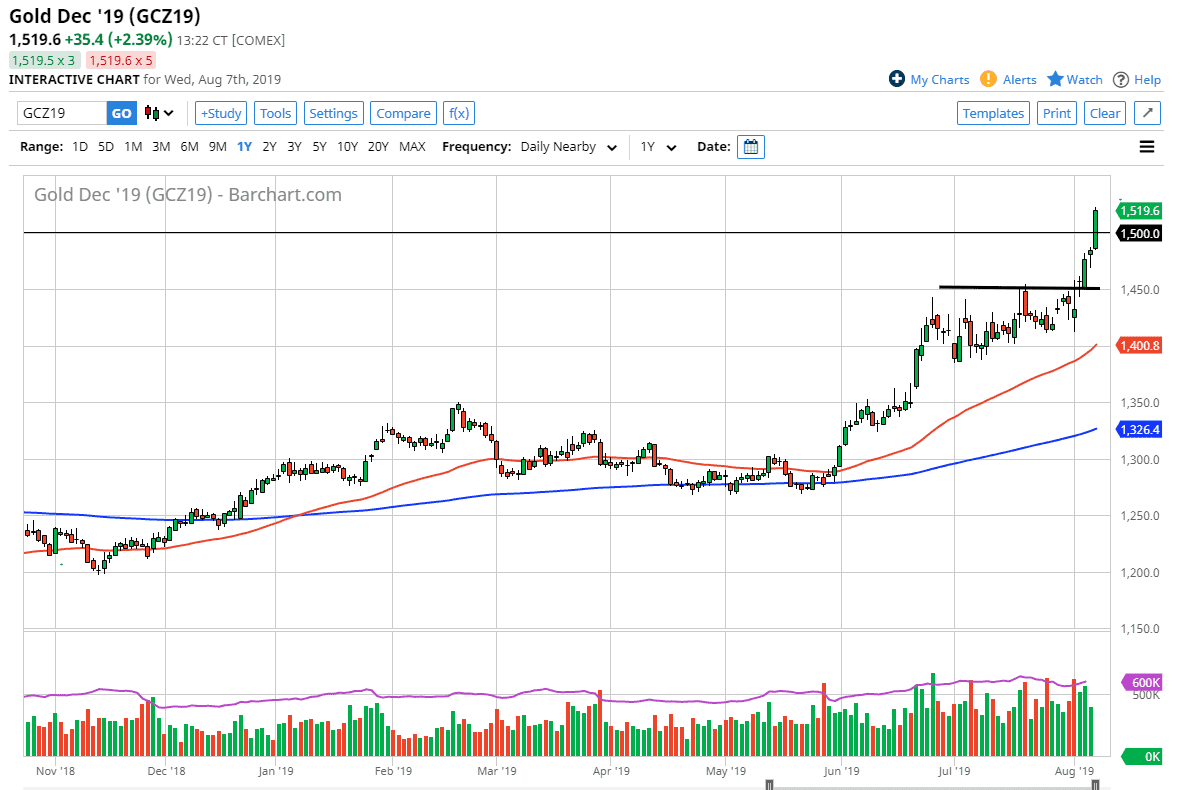

As we break above the $1500 level, this is a major event. With that being the case, it’s very likely that we need to pullback in order to take advantage of what is an obvious uptrend. While breaking above the highs of the session on Wednesday is in theory a very bullish sign, the reality is that we are getting a bit overstretched. I think at this point we need to see some type of value reenter the market so that we can take advantage of it. We are obviously in and uptrend, so there’s no need to fight that but that doesn’t necessarily mean that we need to just jump in with both feet.

To the downside, I believe that the $1450 level is massive as far as support is concerned and is essentially the “floor” in the market. As long as we can stay above that level I think that any type of bounce should be bought. I would be a buyer here though, because you are chasing the trade and we are roughly $67 above that floor. In other words, we could have a couple of days of weakness and still be very bullish overall. I think at this point Gold obviously wants to go a lot higher but it needs to pick up buyers in order to make that move.

Ultimately, I have no scenario in which I am willing to sell gold in the present environment. With central banks around the world cutting rates gold is not only a significant opportunity in the futures market, but it will be in various other spot markets as well, denominated in a multitude of other currencies around the world. Gold will be favored as there is no such thing as a hawkish central bank at this point in time.