Gold rushed back up as, and as expected in the previous technical analysis that gold continues move around and the above $1500 psychological resistance will remain supportive of the upward trend and may motivate investors to return to buy it as long as global trade and geopolitical tensions exist, as gold is one of the most important safe havens for investors, with increased uncertainty in global financial markets. During Tuesday's session, prices moved to the $1545 resistance from the $1526 support at the beginning of the session, in a correction from the $1555 resistance, the highest in more than six years, which was recorded in the first minutes of trading this week. The gold price was stable at $1543 at the beginning of Wednesday.

The US president is talking about a truce that the two sides of the global trade war are ready to negotiate. On the ground, we see the announcement of increased tariffs on their products, which prompted investors to buy gold again and ignore Trump's recent tweets, which support optimism, as Trump often called for a truce and then suddenly declare decisions that reignite the conflict.

Gold was supported by the return of pressure on the US dollar after the announcement of the clarification of the future of the Federal Reserve policy, according to the contents of the last minutes, and Jerome Powell's statements in Jackson Hole, no timetable was set for the US rate cut, but in general there was a clear division between The Board of Directors of the Bank on the amount and timing of the US rate cut and some of them refused to cut interest rates until the emergence of negative and continuous developments on the good performance of the US economy.

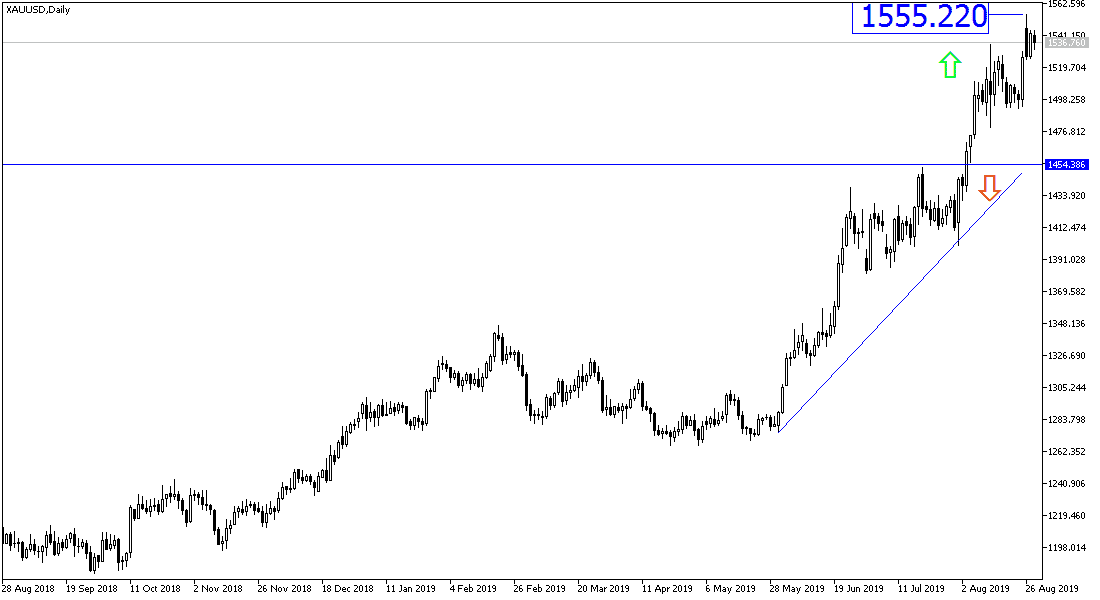

According to the technical analysis of gold: There is no change in our technical view of gold, moving around and the above $1500 psychological resistance will continue to support the strength of the uptrend and supports the making of new purchases to go to test the highest peaks as long as global trade and geopolitical tensions persist. Currently, the nearest resistance levels are 1545, 1560 and 1575 respectively. Profit-taking operations, if happened, will be at the closest support levels for gold at 1530, 1515 and 1500 respectively.

On the economic data front: The economic calendar today does not contain important economic and influential data to the price of gold. From the Eurozone, there will be announcement of the German GFK consumer climate index and the Eurozone money supply and private loans. From the United States, there will be the weekly crude oil inventories.