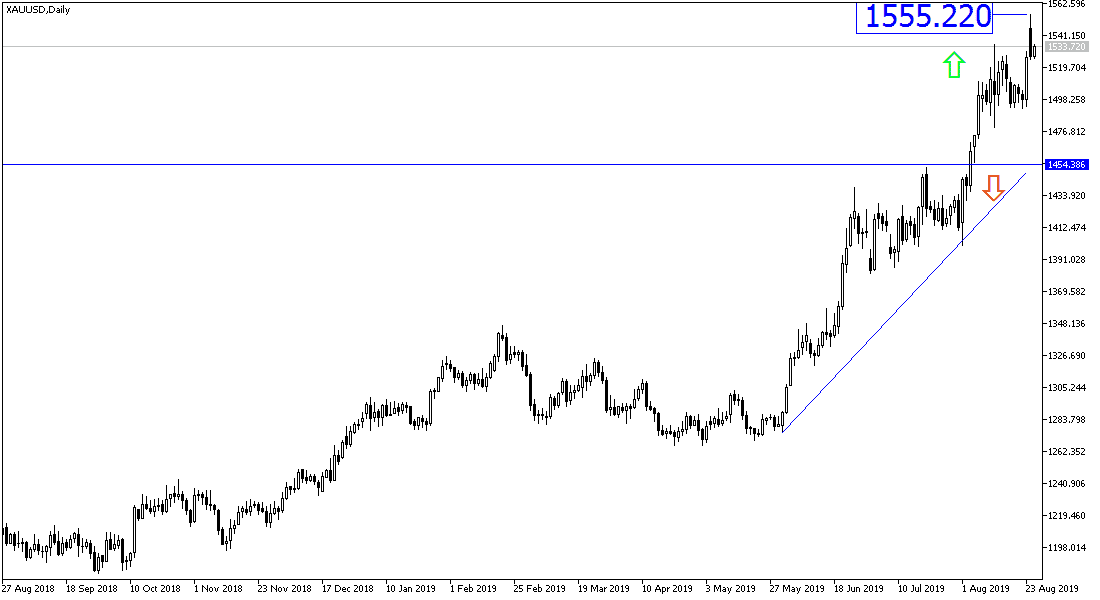

Gold price holding at the $1500 psychological peak, will continue to be a strong supporter of the yellow metal to move towards stronger record highs. These were the first attempts at the beginning of this week's trading, as the price started with a bullish gap based on resistance to $ 1555 per ounce, the highest price in more than six years. That was due to the growing global trade tensions after China imposed more tariffs, and the Trump administration reacted immediately, in addition to the pressure on the US dollar after the recent update of the Fed's monetary policy after the release of the minutes of its last meeting, and the remarks of Governor Jerome Powell at the Jackson Hole. Concerns eased temporarily after Trump signaled the possibility of negotiating and halting tariffs, pushing the price of gold to move quickly down to $1,525 support, from which prices set off early Tuesday to stabilize around $1,533 at the time of writing.

Investors were confused after Federal Reserve Governor Jerome Powell's remarks on Friday, and before that the minutes of the bank's last meeting did not make clear to the markets the next target of the Fed's downgrade policy. The bank stressed that it would continue to monitor economic developments and rising global risks to determine the appropriate monetary policy and was not greatly affected by recent criticism from US President Trump. The minutes showed a clear split among members of the Federal Reserve about the amount and timing of the US rate cut, some of whom felt that the rate cut should not be made until there are negative and continuous developments on the good performance of the US economy.

Technical analysis of gold: Gold prices holding on around and above $1500 psychological resistance, will continue to support the strength of the upward trend, the technical indicators directions did not show any signs of a near downward correction and the break of the current trend. Therefore, resistance levels at 1545, 1560 and 1575 will be closest to the current gold performance. A downside correction could meet support levels at 1520, 1507 and 1490 as first stops. Overall, continued global trade and geopolitical tensions will continue to be supportive of gold purchases. If fears subsided and the two sides of the World Trade War return to negotiate, we may see a rapid breakdown of gold's gains.

Economic data front, the economic calendar today includes the German GDP, followed by the US Consumer Confidence and the Richmond Manufacturing Index.