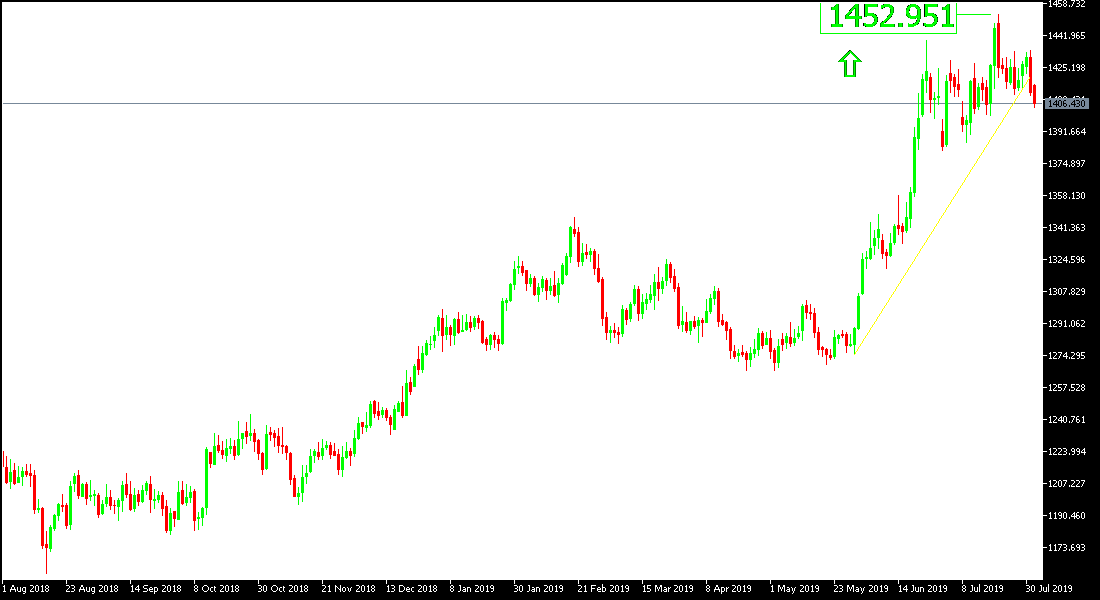

Stronger gains for the US dollar after the Federal Reserve announced its monetary policy supported stronger losses of gold, pushing it to $1404 support level an ounce, and as shown on the daily chart, price entered a breaking point of the uptrend, and will strengthen this trend if settled below $1400. The US central bank reduced interest rates, citing the effects of global developments on economic outlook as well as the slight inflationary pressures, as reasons for cutting interest rates. Adding to the gains of the US dollar, the bank's decision was not unanimous among members of the bank's monetary policy, and they still believes in the performance of the US economy, and hinted that the reduction will not be the policy of the bank continuously. At his press conference, Federal Reserve Chairman Jerome Powell described the interest rate cut as "essentially as a mid-session adjustment to monetary policy." Powell said the rate cuts should not be seen as "the beginning of a long-term reduction cycle. That's not what we're seeing now, that's not our view now."

Although the price of gold has fallen, strength factors are on the rise, and most notably the current speculation that Britain is on its way out of the EU without an agreement. Furthermore, on the level of global trade tensions, the US-China negotiations failed to meet the wishes of financial markets to achieve a breakthrough. Trump threatened to impose tariffs on all imports from China. Tensions in the Middle East have not calmed down so far. This will continue to encourage investors to buy gold for hedging, as the yellow metal remains one of the most important safe haven assets for investors in times of uncertainty.

Technically: Gold prices today are in a downward correction phase, which will strengthen if stabilized below the 1400 psychological resistance, where the targets of 1392, 1385 and 1360 will be the following support areas, which confirm the strength of the downward correction and that gold starts a new downward phase. On the upside, the nearest resistance levels for gold are currently 1415, 1425 and 14337 respectively. In general, we still recommend buying gold from every bearish level.

On the economic data front, the economic calendar today will focus on the Bank of England's monetary policy announcement and the US data on unemployment claims and the ISM Manufacturing PMI data.