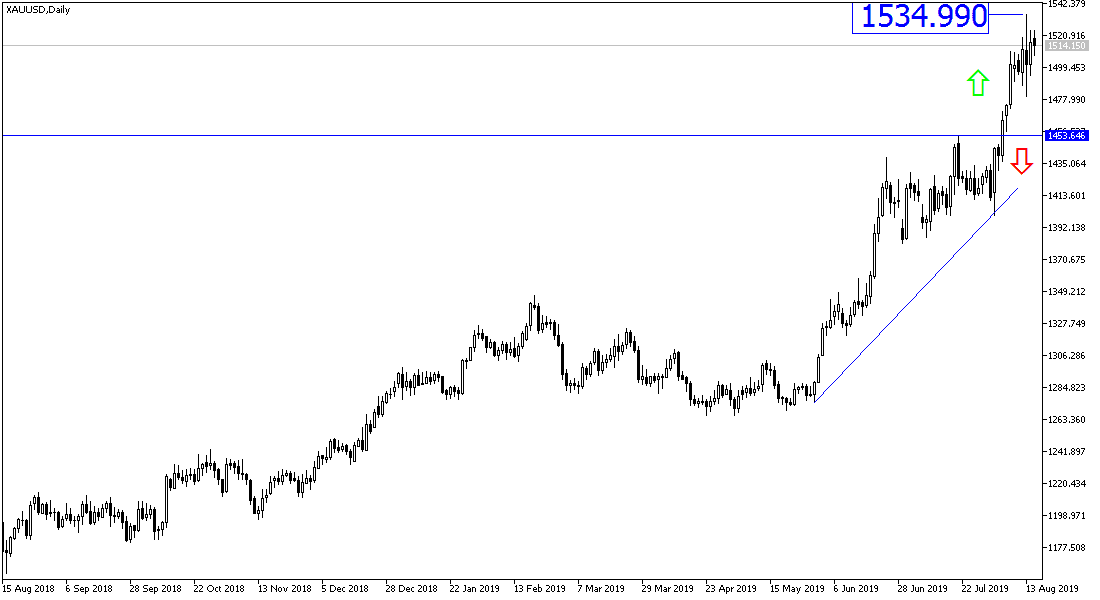

Gold prices recovered the losses of Tuesday's session, and rose to the $ 1524 level at the time of writing, with financial markets and investors absorbing the content and the consequences of the recent US decision to postpone the imposition of tariffs on some Chinese goods, as many don’t trust Trump’s decisions, as they might be maneuvers after China's recent devaluation of the Yuan against the dollar to an 11-year low. To hedge, investors have returned to buy gold as their preferred safe haven asset in times of uncertainty. Tuesday's sell-off pushed gold to collapse from the $ 1535 resistance level, the six-years high, to the $ 1480 support level. We expected that a return to the psychological peak of $ 1,500 would support the return of gains, which is what happened now.

The price of gold will continue to be supported by further gains as long as the reasons for its previous rise continued, led by expectations of a slowdown in the world economy, which is clearly visible on the world two largest economies, as well as the Eurozone and the Brexit, which showed no signs except for a no-deal Brexit. Tensions in the Middle East are also important. Central banks are moving towards easing monetary policy to revive economies.

As it is known, the relationship between gold and the US dollar is inverse, the interest rate cut will weaken the dollar and give gold the opportunity to launch for stronger gains again.

According to the technical analysis, the general trend of the price of gold will remain strongly supported for further gains as long as it is stable around and above the psychological resistance of $ 1500. All technical indicators are still indicating the possibility of a continuation of the rally, and did not change the direction of gold so far. In case of a downward correction, support levels of 1500, 1485 and 1460 will be closer to the price of gold. As the above mentioned factors continue, we would prefer to buy gold from every bearish level.

On the economic data front, the price of gold will be affected by the release of the US data package today, namely the release of retail sales figures, the Philadelphia Industrial Index, the non-farm productivity, jobless claims and the industrial production.