The gold ounce lost a total of $ 55 during Tuesday's session, with strong gains in global stocks immediately after the United States announced the postponement of new tariff on Chinese imports, which was scheduled for September 1. The breakthrough in the global trade war has supported investors' appetite for risk and the abandonment of gold as a safe haven of choice for investors in times of uncertainty. The price of gold fell from a $1535 high, a six-year high, to a $1,480 support level, before prices stabilized around the $1,500 psychological peak again in early trading on Wednesday, ahead of the announcement of a package of important economic data.

Despite the recent correction, gold has enough momentum to rebound and test stronger record highs. The catalysts for gold's strength include expectations of a global economic slowdown and recent speculation that the US economy may be stagnant in the coming months, adding to pressure on the Federal Reserve to cut US interest rates. The earliest dates for this can be during the bank's meetings in September and October.

As it is known, the relationship between gold and the US dollar is inverse, the rate cut will weaken the dollar and give gold the opportunity to launch for stronger gains again.

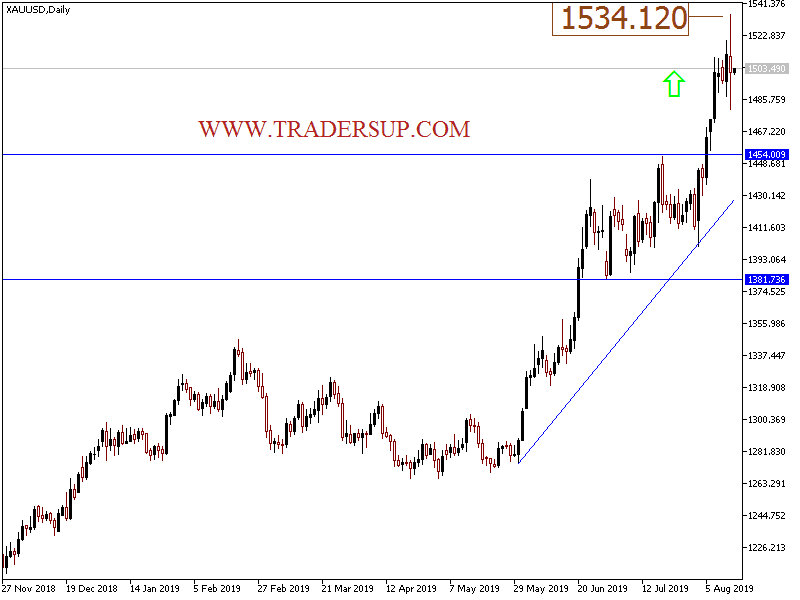

According to technical analysis: Despite the recent correction of the price of gold to 1480 support, the general trend of the yellow metal is still upward, and the return to stability around and above the psychological resistance of $1500 will increase the bullish momentum again, and the resistance levels can be at 1515, 1527 and 1540, respectively, which are short-term gold targets. The technical indicators are still indicating the possibility of a continuation of the uptrend and the pair has not changed its direction so far. On the downside, the price of gold has almost reached the full support levels mentioned in yesterday's analysis. Currently, the nearest support levels are 1480, 1472 and 1460 respectively. I still prefer to buy gold from every bearish level especially as global trade and geopolitical tensions persist.

On the economic data front: The price of gold will react with the release of Chinese data on industrial production, investment rate, retail sales, then the GDP figures. Then, the cost of employment and industrial production from the Eurozone.