Going back to my recent technical analysis, I pointed out that gold's gains will persist and last longer. The recent, brutal and rapid developments of the US-China-led global trade war have prompted investors to aggressively buy gold to hedge against the risks of that war to the global economic growth as a whole. Growing tensions between the world's two largest economies have brought record losses to billions in global stock markets, adding to gold's recent gains.

The question for investors now is: what will happen after the $1500 ounce peak? The answer depends on the course of the global trade war. Truce means strong sales of gold for profit taking. Growing tensions and any sudden moves by both sides that negatively affect investor psychology will add to gold's record gains.

The US-China trade dispute has developed into a currency war between the two sides, especially after China devalued the Yuan against the dollar to the level of $ 7, a very political level, which is meant to hit the competitiveness of US exports in world markets. Trump is currently in a dilemma. He has no power to weaken the dollar and the US central bank is determined to continue its policy and monitor economic developments before making any policy change.

The foundations of gold's continued gains are: fears of a no-deal Brexit, growing global trade tensions, slowing global economic growth, and tensions in the Middle East, without these factors, gold could lose all of its recent record gains.

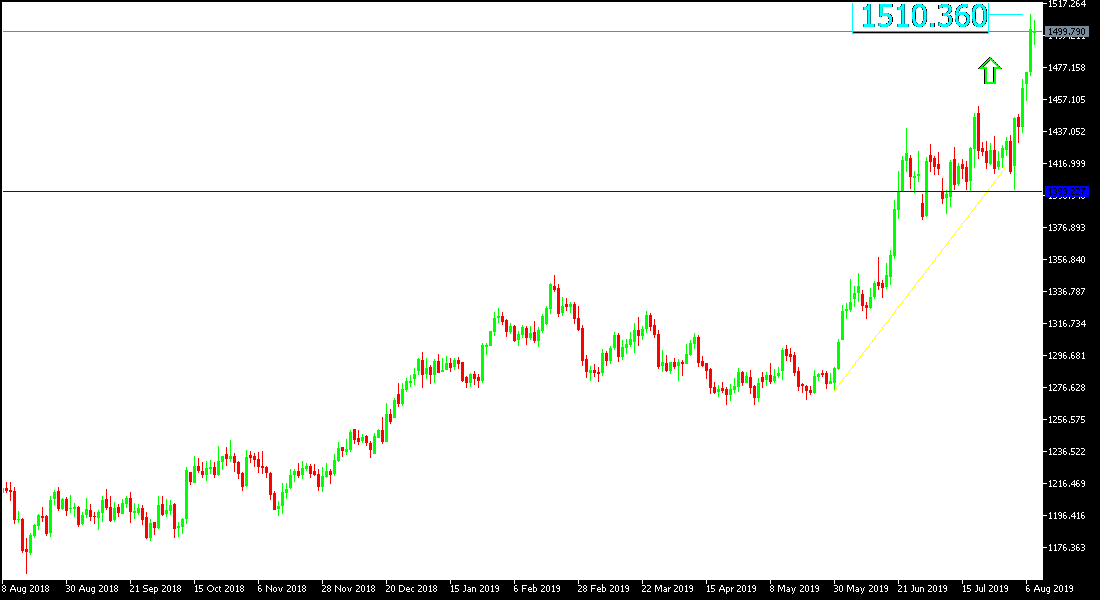

Technically: Gold prices today get stronger bullish momentum by testing the $1500 psychological resistance, and the stability around and above that will support testing stronger resistance areas that may reach 1515, 1525 and 1540 levels respectively. Should there be correction for profit-taking sell-off after recent strong gains, support levels will be 1490, 1479 and 1460, respectively, which may be the closest when this happens. I still prefer to buy gold from every bearish level.

On the economic data front: Today's economic calendar highlights the announcement of the trade balance in China and from the US, there is only the weekly jobless claims.