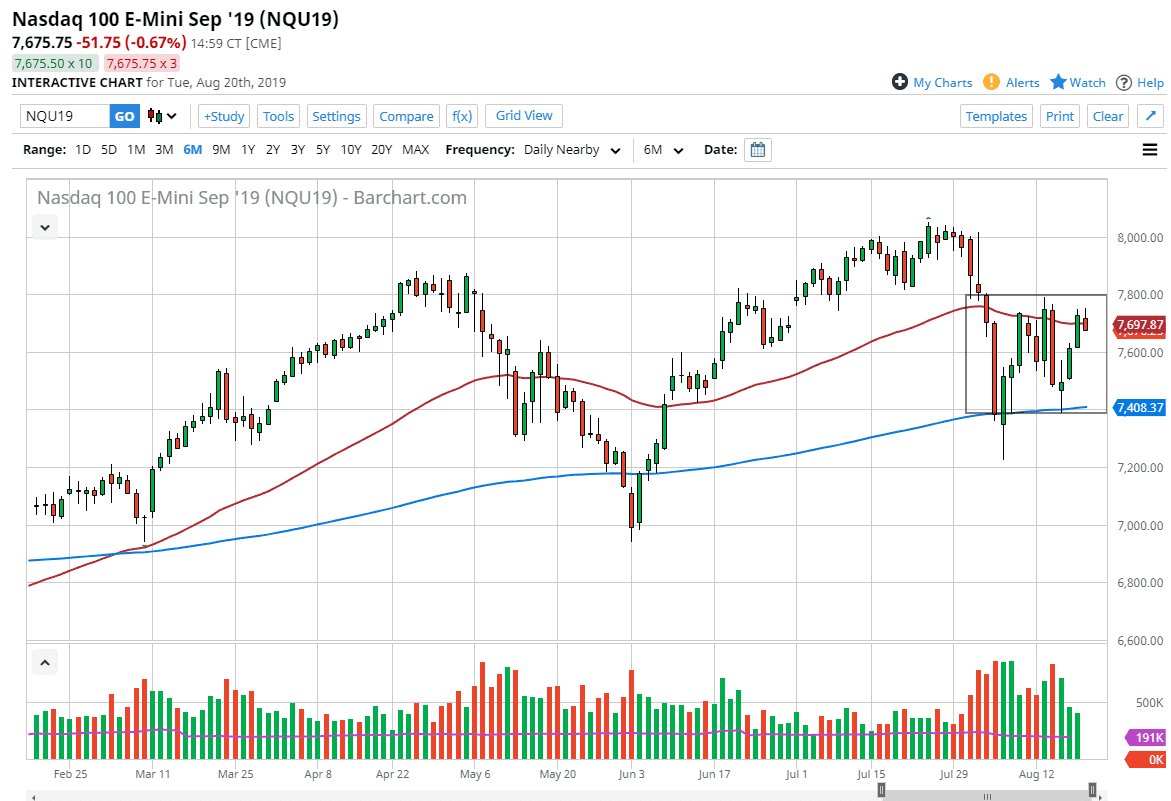

The NASDAQ 100 initially tried to rally during the New York trading session on Tuesday but as you can see we have rolled right back over. Looking at this market, the consolidation is very obvious. The 7800 level is resistance, just as the 7400 level underneath is massive support. At this point, I think that the market participants continue to tread water in this area, as we have to wait the Jackson Hole announcement on Friday to try to get a sense of what will happen in the U.S. economy going forward.

It should be noted is that some of the other indices are showing signs of weakness, well beyond what we see in the NASDAQ 100 and the S&P 500. The Russell 2000 is just one such example. With that, it’s very likely that we are going to continue to see a lot of back-and-forth noise. The 50 day EMA which is painted in red is quite resistive, but at the same time, the blue 200 day EMA underneath has offered support. Ultimately, I think this is a market that isn’t quite sure where to go next.

With all of that being said, I think it’s easier to simply use some type of range bound system in the short term, and therefore I think the next couple of days will probably be negative. I’m not necessarily looking for some type of meltdown, but what I do think is that we are trying to find some type of equilibrium before the next major move. There are a lot of reasons to think that stock markets could continue to struggle overall, and although we have had a couple of nice moves to the upside after the initial meltdown, I think at this point we still haven’t done enough to convince people to hold on to their stock shares.

If we can break above the 7800 level, the market should then go looking towards the 8000 handle next. On the other hand, if we were to break down below the 7400 level, it’s likely that we go down to the 7200 level, and then possibly the 7000 handle. At this point, the NASDAQ 100 is probably more susceptible to the negative headlines coming out of the US-China trade talks, but realistically speaking, I think that the headlines are more likely to be negative than positive, so I do think the next couple of days should be watched carefully before taking big positions.