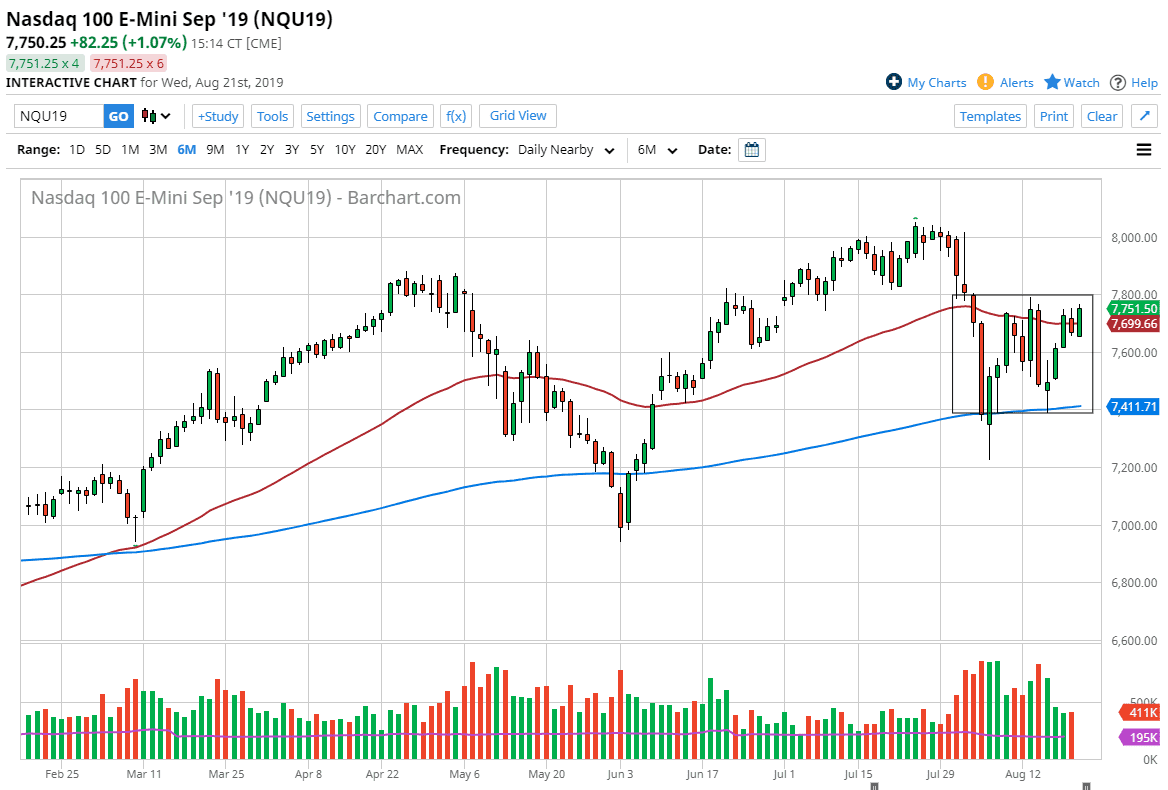

The NASDAQ 100 rallied significantly during the New York trading session on Wednesday, as we continued to see a lot of buying pressure but we also see a lot of resistance above at the 7800 level. I think it’s likely that we see a bit of a pullback from this area, as we continue to see the market struggle. That being said though, we have to keep the idea of both possible scenarios panning out, so we will take a look at that in this article.

A move above the 7800 level offers a move towards the 8000 level, possibly even the 8200 level based upon the size of the consolidation. It would probably need some type of reconciliation between the Americans and the Chinese or at the very least some type of switch in the attitude of central bankers to more dovish in us. However, what concerns me is that if we do get a break higher it could be more of a temporary one.

The alternative is that Thursday’s trading day is spent simply digesting gains from the previous session, meaning that we will drop from here. The 50 day EMA is slicing through the last several candles, and therefore it makes sense that we will continue to see a lot of traders to be attracted in both directions here. Ultimately, if we do break down below the bottom of the candle stick for the trading session on Thursday, then we could have the market reaching down towards the 200 day EMA below which is just above the 7400 level. Grinding back and forth makes quite a bit of sense as we are trying to figure out what’s going to come out of Jackson Hole, and of course what’s going to come next in the form of stimulus and/or global numbers. Recent Canadian data surprised the bit to the upside with CPI figures during the trading session on Wednesday, so we will have to wait and see how some of the other economies around the world are doing. Right now though, the global growth story does not look good so I think this is more of a “sugar high” than anything else. Because of this, I do remain skeptical and think that even a breakout is going to be painful. Expect a lot of choppiness and perhaps a slightly negative tilt on Thursday but recognize that a move above the 7800 level gives short term buying opportunity.