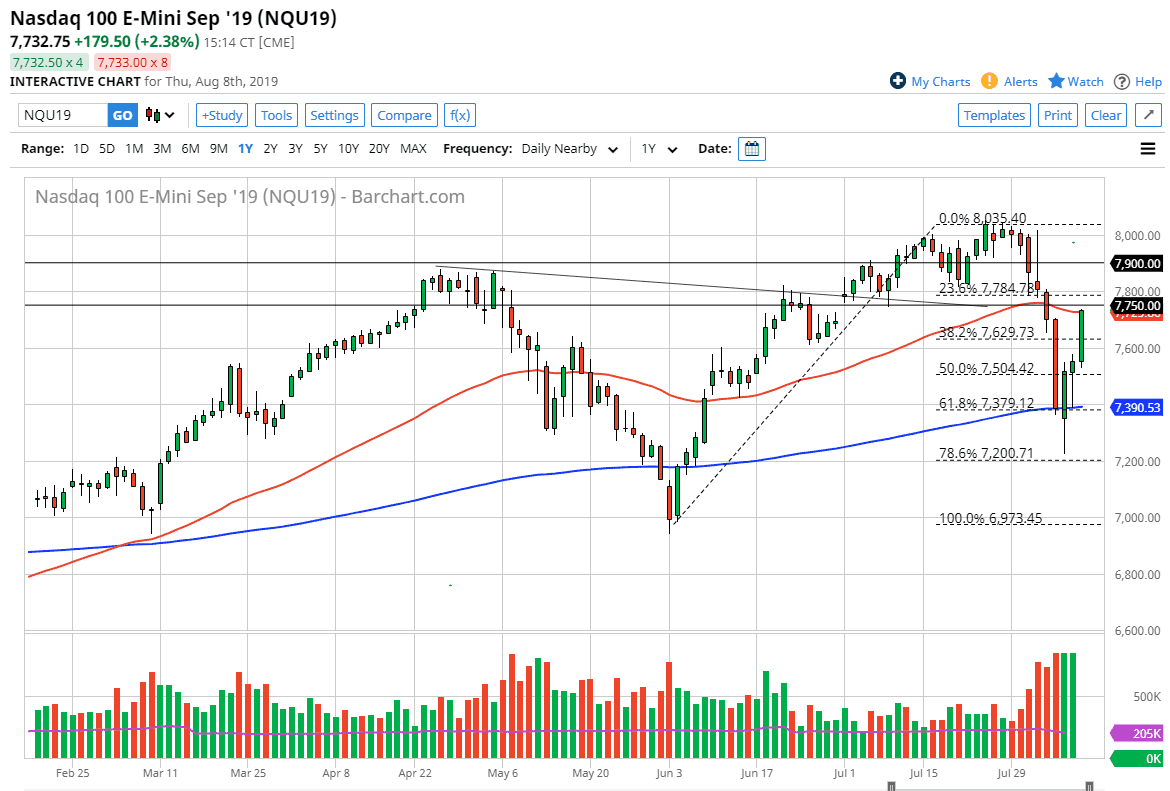

The NASDAQ 100 has rallied significantly during the trading session on Thursday, gaining over 2% during the trading session. We closed the session at the 50 day EMA, and of course the previous gap at the 7750 handle. We are showing signs of real strength now but having said that there is a lot of noise above that could come back into play. Ultimately, this market has seen quite a bit of volatility over the last couple of days. Ultimately, I believe this market will continue to attract a lot of attention because we have seen so much in the way of choppiness. That being said, there have been a lot of things that have been moving this market.

Without a doubt, the biggest thing that moves this market is the US/China trade talks. Ultimately, this is a market that has been rather difficult to get your hands on because we had seen what look like an apocalypse over the previous week, and now we have wiped out quite a bit of that move. However, above the 7800 level there is going to be a lot of noise in the market and could show quite a bit of danger. As we head into the weekend though, there will be a handful of things to pay attention to.

Unfortunately, one of the biggest movers of this market in the next 24 hours will be Twitter. This is because President Donald Trump likes to tweet on Fridays about the markets. With that, we could get a bit of a boost type of tweet or get one that will be very negative toward China. Keep in mind that there are a lot of algorithmic machine based trading systems out there that read headlines and trying to place a trade. It’s only going to take one misspoke word to knock this market right back over. Because of this, I still believe this is probably a market that’s best left alone. I do not like the idea of trying to chase the trade to the upside, which I freely admit I missed. There have been plenty of other opportunities out there that have a lot less volatility. With that, let’s pay attention to the weekly chart more than anything else before we risk our money. It would not surprise me though that people may take profits heading into the weekend to get rid of risk.