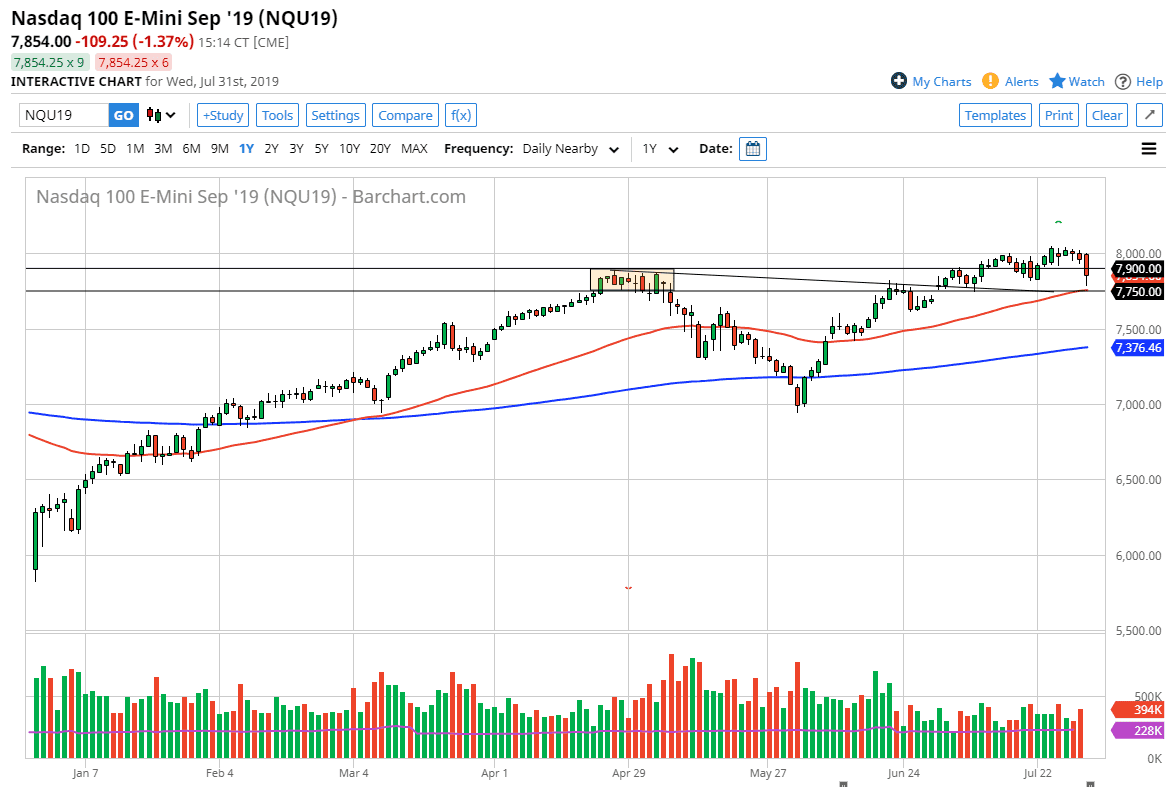

The NASDAQ 100 fell rather hard during the trading session on Wednesday, slicing through the 7900 level. This is a market that has been very bullish, but at this point I still was a bit concerned about whether or not we would test the previous gap. We did in fact do so during the trading session on Wednesday after the Federal Reserve interest rate statement, so now I think we can get back to business. While it is a negative candle stick, the reality is that I am more interested in the NASDAQ 100 now that I had been previously.

The 7750 level of course is supportive because of the 50 day EMA and the gap, but at this point I think what we are looking at is the opportunity to go long. The NASDAQ 100 has been very bullish and I think that should continue to be the case. The 8000 level above is a major resistance barrier, and I think we will try to work our way back towards that region. Granted, the Federal Reserve wasn’t nearly dovish enough to get Wall Street excited, but it wasn’t exactly hawkish either. They didn’t necessarily guarantee further rate cuts, but they did suggest they were possible. The stock market of course wanted some type of guarantee of extraordinarily cheap money, and I do think that it will get it but it didn’t get the guarantee that it wanted.

That being said, we may see a little bit of weakness in the short term, but I do believe that we bounce from the 7750 level yet again. At that point, then we should go to the 8000 handle, perhaps even try to break above there. If we can break above that level, then the NASDAQ 100 is free to go much higher. I have no interest in shorting this market, at least not until we get a close well below the 50 day EMA, and even then I would be a bit cautious. To me it looks like the stock markets are ready to go higher, as the Federal Reserve had to essentially “thread the needle” to keep things somewhat under control, and it should be noted that a lot of the selling was probably due to algorithmic trading and black box systems rather than the sentiment of the market. The next couple of days will of course be crucial, but I still believe that there are plenty of buyers out there willing to take this market out and up to higher levels.