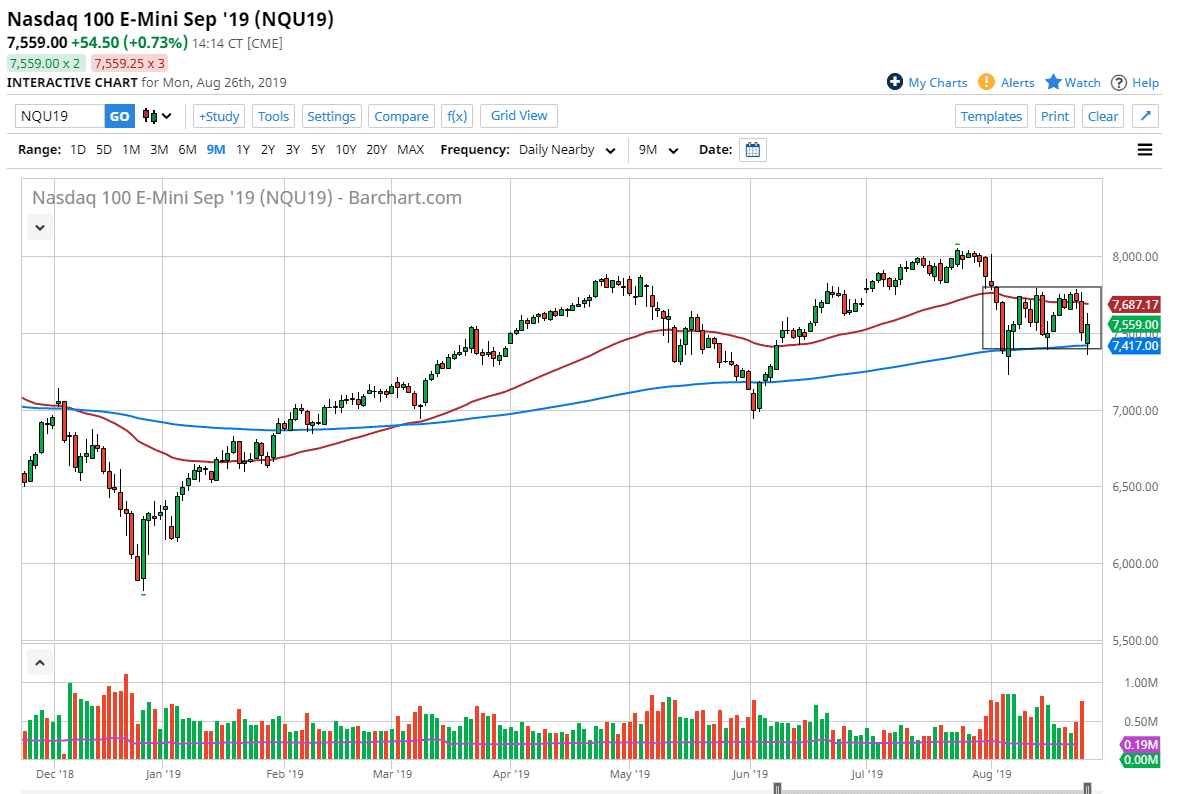

The NASDAQ 100 initially gapped lower to kick off the week as we had a bit of a “risk off” type of situation. We broke down below the 200 day EMA, and even managed to break down below the 7400 level initially. However, after traders reacted to the expansion of tariffs, we have been seeing the possibility of the Americans and Chinese talking going forward, so therefore I think it’s likely that this is a bit of a relief rally. With that in mind, I don’t necessarily think that we are going to have a major bounce, but I don’t necessarily think we are going to collapse either.

Another thing to keep in mind is that this is the last week of summer and it is typically very light as far as volume is concerned. With that being the case, it’s very likely that we don’t have enough conviction to move the market in one direction or the other without some type of headline or sudden shift.

I believe in the short term it’s possible that we go back towards the 50 day EMA, which is closer to the 7690 handle. At this point, I think any exhaustive candle on a short-term chart near that level should be a selling opportunity. Beyond that, I also believe that if we break down below the lows of the trading session on Monday, then we could unwind a couple of hundred points in this market. This is a very volatile market and one that is very sensitive to the US/China trade talks as so much of the technologically-based companies do a lot of business in both the United States and China and of course global supply chains can become a bit of an issue. All things being equal, I believe that the back-and-forth continues in the short term.