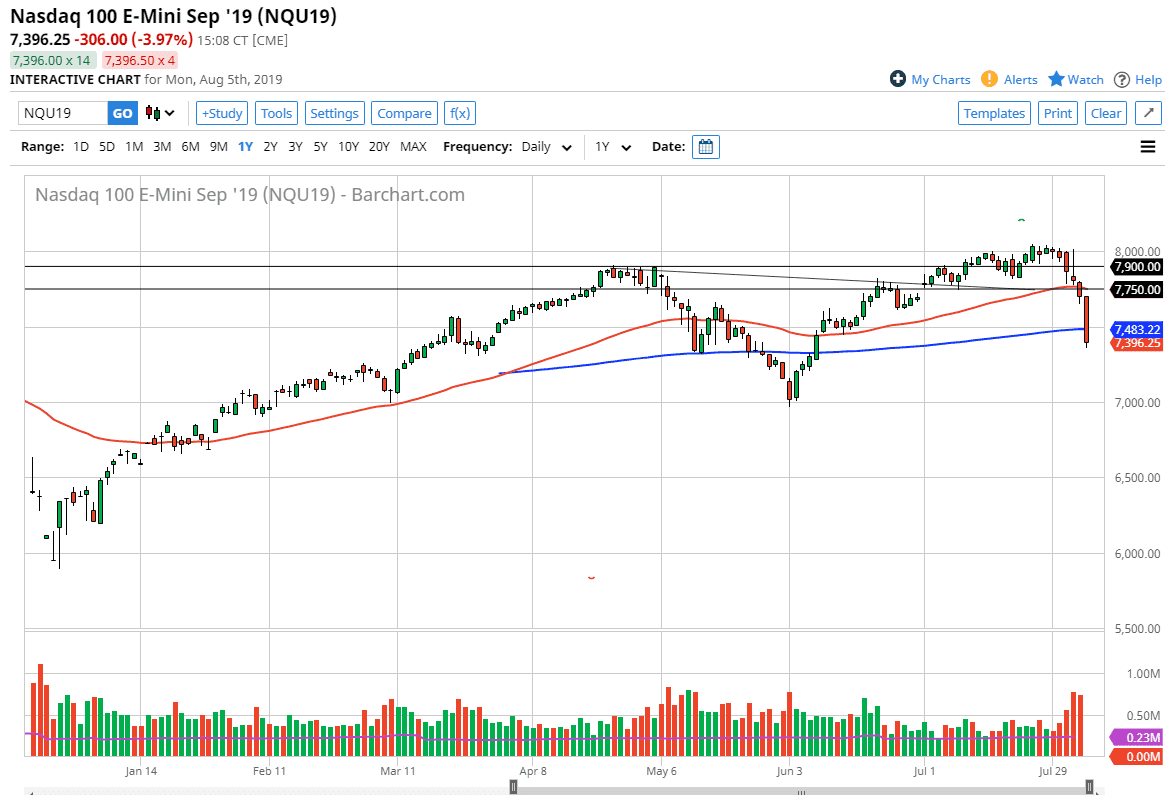

The NASDAQ 100 broke down rather significantly during the day on Monday, slicing through the vital 200 day EMA. This was quite violent as stock markets around the world got hammered. After all, the Chinese have retaliated against extra tariffs put on by the Americans, by allowing the Chinese yuan to depreciate below the 7 level against the US dollar. This is a rather significant development, and then beyond that we have seen the Chinese government announced that US agricultural products will not be bought going forward.

This is an extreme escalation of the US/China trade tensions, and now it looks like we will probably continue to struggle. That being said, this is still the one country where people are throwing money at it as far as equities are concerned. While this has been a very bearish candle, it of course we have seen a couple of bad days, I believe that the US stock market should be “less bad” than many others around the world.

However, the NASDAQ 100 is extraordinarily sensitive when it comes to Chinese rhetoric and the trade talks. This is because it is so heavily weighted to just a handful of technology stocks. Making even more noise is the fact that South Korea and Japan are both now in a trade war with each other, and of course there is a lot of technological backlash there as well.

All things being equal, we are getting two very extreme levels, so I wouldn’t be surprised to see some type of bounce from here. That being said, I believe that the 7750 level is going to function as a bit of a “ceiling” in the short term. The alternate scenario of course is that we break down below the lows of the trading session on Monday, which opens up the door for a move down to the 7000 handle, which would of course be a very negative move.

I don’t necessarily think that we are going to see some type of massive meltdown, but a pullback has been needed for some time. Stock markets have not been following what’s going on in the world, and I think we are just now starting to see them react to the fact that perhaps the trade tensions are going to get worse before they get better. In fact, there is now a school of thought that the Chinese are going to wait until after the 2020 elections to see who they have to deal with.