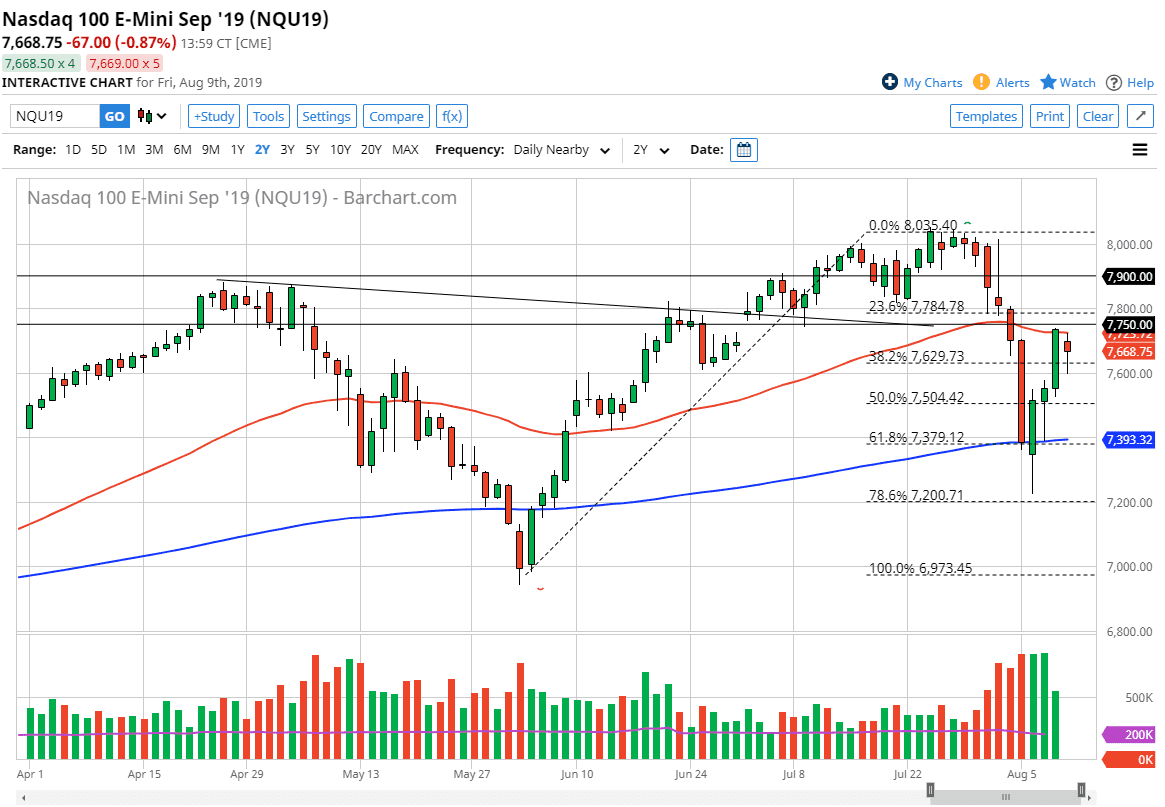

The NASDAQ 100 has gone back and forth during the trading session on Friday and it looks like the Monday session is going to be rather difficult. We have several things going on at the same time, so it’ll be interesting to see how this plays out but at this point in time there are a couple of levels that we should be paying attention to. At this point, I believe that the 7800 level is crucial, because it would clear the 7750 handle which has been important in the past, the 50 day EMA, and of course a large, round, psychologically significant figure. If we can get a daily close above there, then we could go higher.

However, any sign of exhaustion just above that area tells me that that previous consolidation area is now going to break it down. At this point, if we were to break down below the 7600 level, then we could go a bit lower, perhaps reaching down towards the 200 day EMA. The 7400 level coincides nicely with the 61.8% Fibonacci retracement level and the 200 day EMA, so at this point I would anticipate that there would be some buyers in that general vicinity.

It’s quite common for the market to bounce around between the 50 and the 200 day EMA indicators, so at this point it’s likely that the market does exactly that. It should offer plenty of short-term back and forth volatility, and I think that’s probably going to be the norm in general. Overall, I believe that there has been an excellent recovery during the week, but we also have a certain amount of trouble above, and we are only one tweet away from disaster I suspect.

The NASDAQ 100 is very sensitive to the US/China trade relations, and that of course is something that seems to be struggling. If we break down below the bottom of the hammer for the trading session on Friday, I think that’s a sell signal down to the 200 day EMA. We break above the 7800 level then we will probably go looking towards the 7900 level, and then the 8000 handle, assuming that we can get a daily close above that barrier. Expect a lot of noise, but right now the one thing you should do is keep your position size relatively small in this environment.