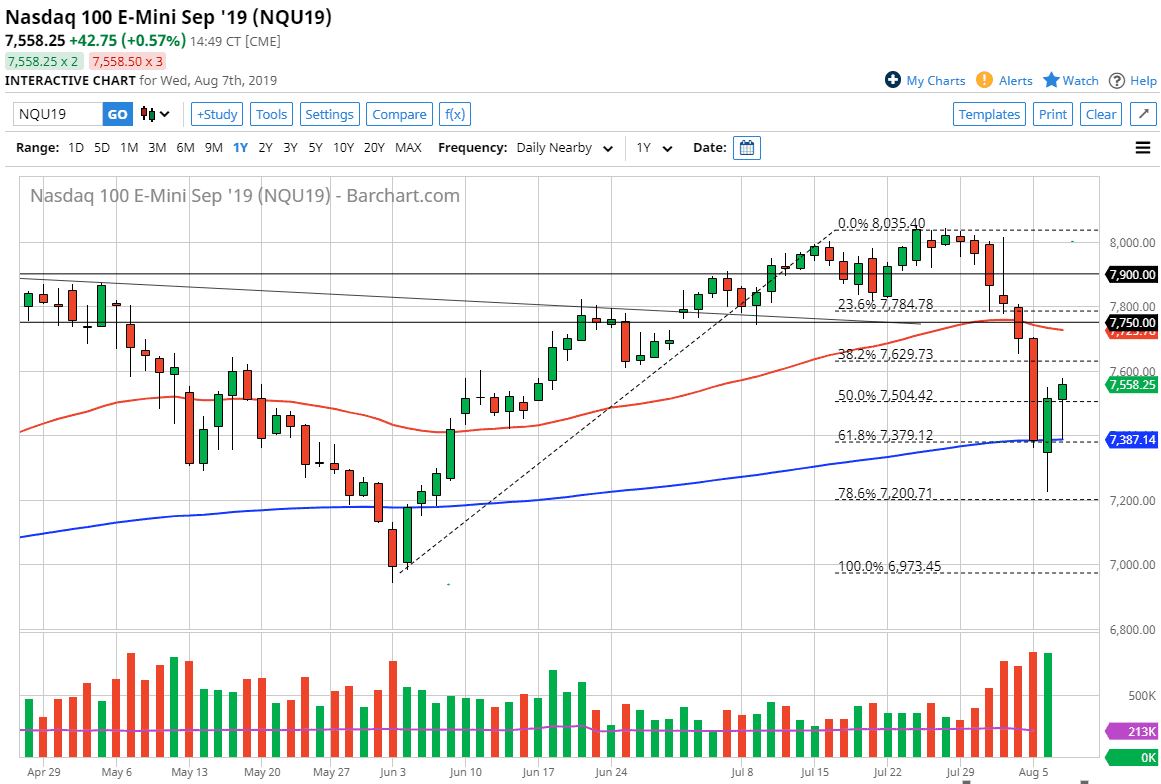

The NASDAQ 100 initially fell during the trading session on Wednesday, reaching down towards the 200 day EMA before turning around and bouncing significantly later in the day. Keep in mind that Asian and European traders have only a limited amount of influence on the futures markets, so the fact that we turned around during the New York session is very crucial. At this point, it’s very likely that the 7600 level above will be resistance so if we can break above that level then I think we could make a serious move to the upside

At this point, I believe that the market will continue to respect the 200 day EMA, as it is an area where a lot of algorithms will fire off due to the longer-term trend following systems out there. As we are starting to see the situation between the Americans and the Chinese come down again, it looks as if the trading session during the day on Wednesday has confirmed the bullish candle stick on Tuesday. The fact that we have formed a couple of these in a row shows that we have an opportunity to rally from here. That being said though, I don’t know that we can break above the 50 day EMA. If we do, then we could go much higher.

I think we have a lot of exhaustion out there as far as sellers are concerned, and therefore I think we are perhaps seeing a bit of short covering. I don’t know whether or not we are suddenly going to be bullish, but it does appear that we are at least make an attempt to go higher. If we can break down from here, we still need to go down below the 7200 level, which would be very supportive now based upon what we have seen. I think we are essentially going to continue to chop around in this area, and therefore longer-term traders will have to be very patient when it comes to this market. All of that being said, it should be pointed out that the candle stick for the Wednesday session is quite bullish and supportive looking. Pay attention to things going on in China, it will quite often influence what the NASDAQ 100 does as so many technologically driven companies are part of this index. Although we have had a rough couple of sessions, the 200 day EMA has held.