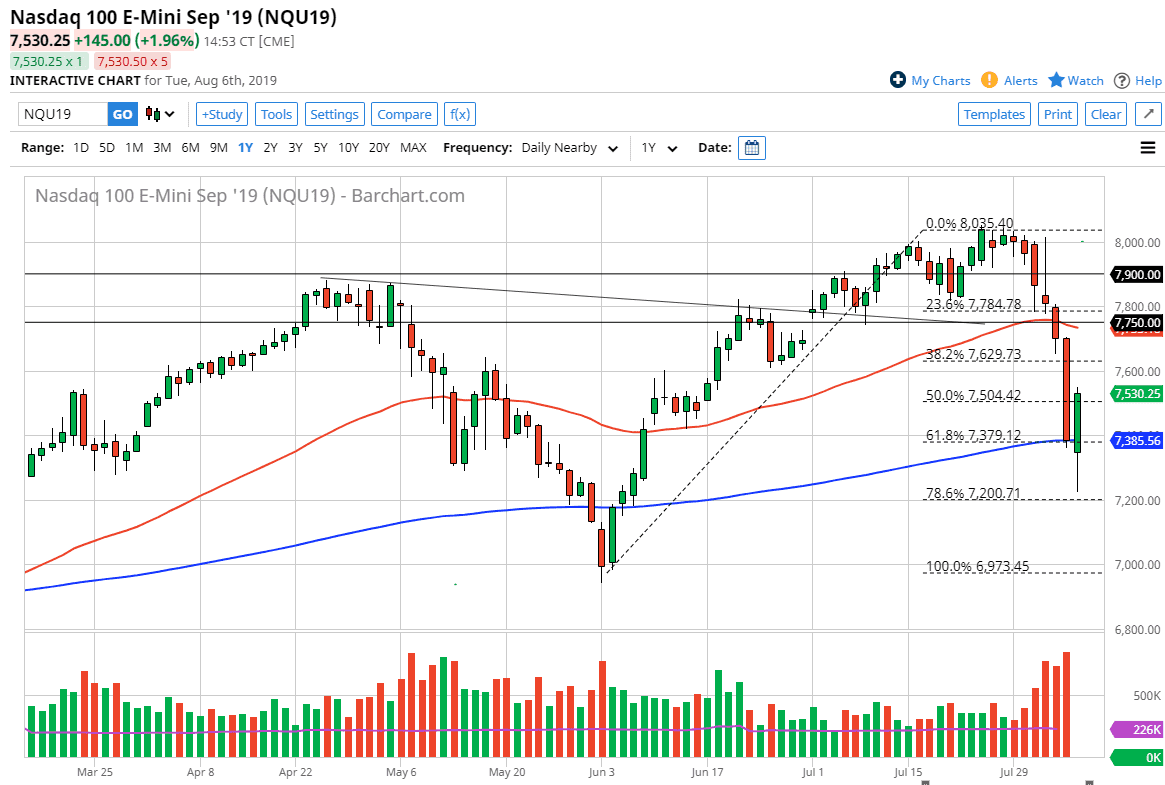

The NASDAQ 100 has broken down significantly during the trading session on Tuesday as it was announced that the Americans were labeling the Chinese as “currency manipulators”, which of course is an increase in the trade tensions. That of course had the futures markets breaking down and reaching towards the 7200 level, but I’m the first to admit that the recovery has been relatively impressive.

Perhaps there are a couple of things that are worth paying attention to here. As we close out the session, we are above the 7500 level, and have also found the 200 day EMA to be supportive. This is a nice looking candle stick, so therefore I think it’s very likely that we see some type of follow-through. However, there are some things to worry about above and therefore I suspect we are going to see a lot of noise.

One thing that this chart reflects is perhaps a bit of short covering because we had gotten ahead of ourselves. However, I’d be the first person to point out that the markets were selling off before the Chinese currency manipulation designation had happened. The Chinese yuan dropping below the 7.0 level against the US dollar was one of the catalyst, but if you look back a couple of days before that we had an inverted hammer that got broken down. In other words, people had started to worry about something ahead of time. Because of this I am a bit concerned about this rally, but quite frankly one of the most difficult things to do is to buy into this market, after seeing that kind of massive selloff. Because of this, the market is likely to “climbing a wall of worry.” In other words, I think it’s only going to take one tweet, comment out of Beijing, or anything like that to send this market tumbling again. In the short term though, it looks like we may try to reach towards the 50 day EMA which is just below the 7750 handle. If we can clear that, then we will make a serious attempt to reach the highs. All things being equal though, I would be very cautious about going long this market but we certainly don’t have a signal to start selling anytime soon. Stock markets are going to continue to be a mess, and should probably be avoided.