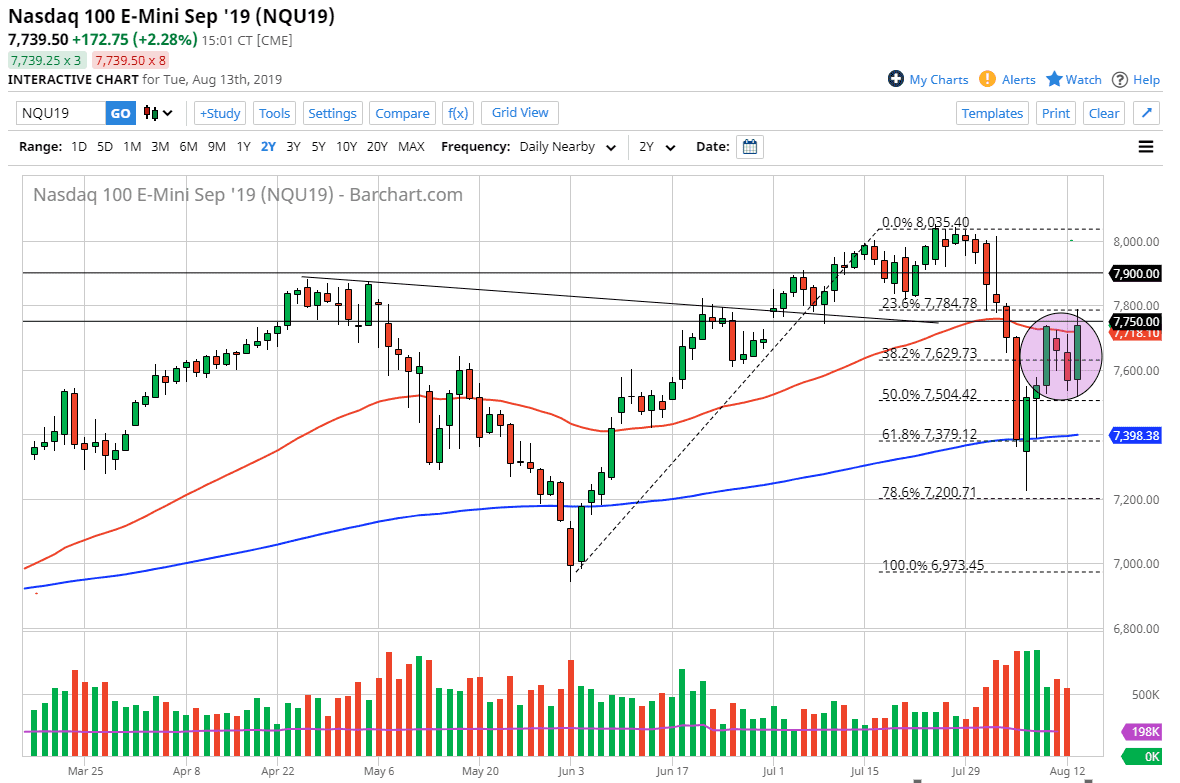

The NASDAQ 100 had a wild ride during the trading session on Tuesday, as word got out that the Americans were willing to delay the tariffs against the Chinese, pushing back against the idea of a September 1 showdown. With that being the case, we rallied towards the 50 day EMA and the 7750 handle. It’s very interesting that we stopped at that area, because it is the 50 day EMA as well. With that being the case, it’s very likely that the marketplace will continue to respect this area as we have over the last couple of days. That being said though, it does set up for a nice trade in an obvious area to play the market from.

If we can break above the 7800 level, then it’s likely that we will go looking towards the 7900 level. Above there, the 8000 level could be another target. At this point, the bullish candle stick should continue to attract attention but if we were to pull back, it’s likely that we will try to reach down towards the lows of the last couple of days, which is extensively the 7500 level.

The question now is whether or not stocks will continue to rally based upon this news, or will they pull back into the overall consolidation? At this point I suspect that we will probably have a bit of headwind above is, but if we do break out it could be rather explosive. The reality is that this isn’t anything new as far as developments are concerned, because the Americans and Chinese have come to terms as far as selling things down more than once. We all have seen how that goes, so this point I think that a rally is probably somewhat limited, but I do recognize that the 7800 level giving way would be a rather significant move.

To the downside, I see the 200 day EMA which is currently trading near the 7400 level to offer quite a bit of support. With that in mind, if we were to break down below the 200 day EMA it would be a very negative sign of things to come. I do like more or less the idea of going back and forth in a range bound market with the idea of picking up dips on short-term charts for little bit of value here and there.