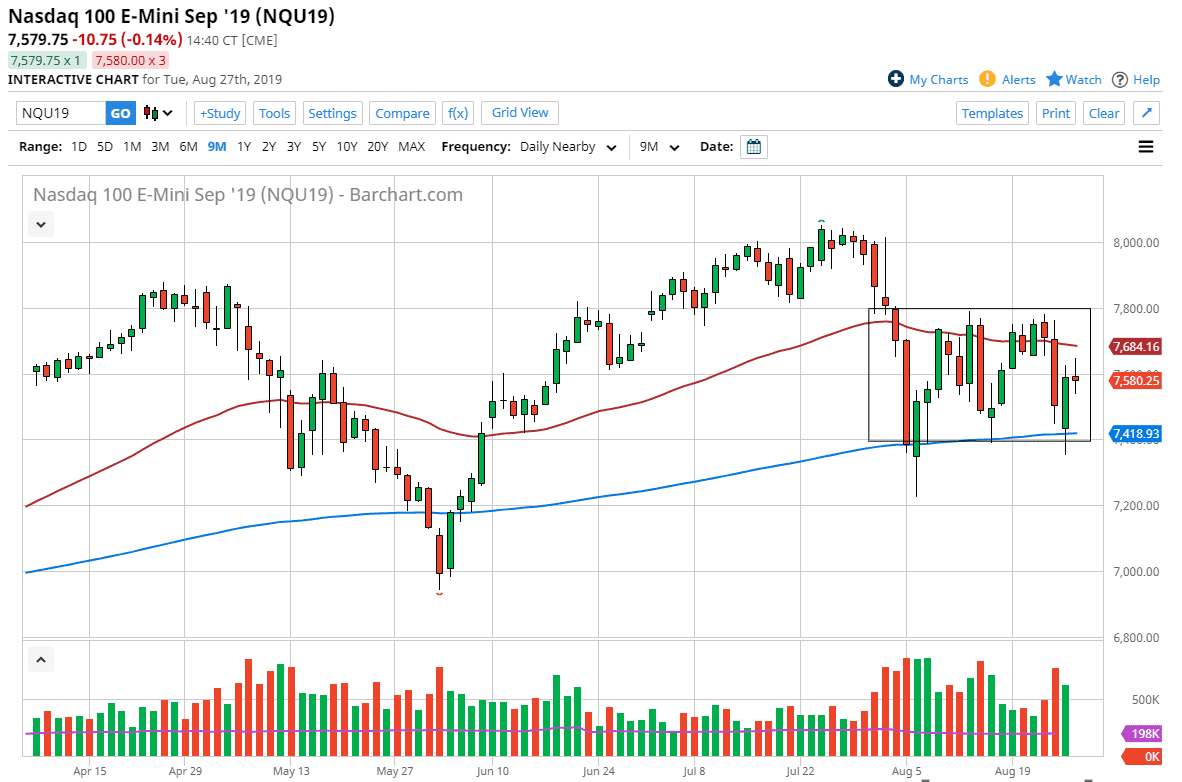

The NASDAQ 100 tried to rally during the trading session on Tuesday but found a lot of resistance above the 7600 level. Beyond that, the 50 day EMA is above at the 7680 region, and that should continue to cause issues as well. We also have the 200 day EMA underneath at roughly 7400, which frames the trading area quite nicely. When you look at the chart you can see that there is a clear consolidation area between the 7400 level on the bottom and the 7800 level to the upside.

The candle stick from the session wasn’t exactly impressive, and the fact that we have a neutral candle stick after a bounce shows that it’s going to take quite a bit to get this market rallying for a longer-term move. I think that we continue to go back and forth but I also suspect that there’s so much fear out there that it’s easier for this market to fall than it is to rally significantly. We are in a very thin time of year right now, as traders have been focusing more on the beach than stock markets. Beyond that, we have the jobs number coming late next week and with the Federal Reserve being “as clear as mud” recently, it suggests that the market still is going to have a lot of trouble. At this point, if we break down below the candle stick from the Monday session it will show a resumption of the flush lower, and it probably opens up the door to the 7200 level after that.

The alternate scenario is that we break above the 7800 level, which could open up the door to the 8000 handle. That being said, we are going to have a need filled, which is to simply see some type of catalyst for stock markets do believe in the upward momentum. It’s probably going to come in the form of a tweet from Donald Trump or a statement out of Beijing if it does happen. The NASDAQ 100 is very sensitive to US/China trade relations as almost everything is right now. Technology companies continue to be influenced by the global supply chain, which of course will be influenced by the tariffs and of course the continuing hostilities between the Americans and the Chinese. I suspect that it’s going to be easier to break down that it is up but we have the parameters laid out.