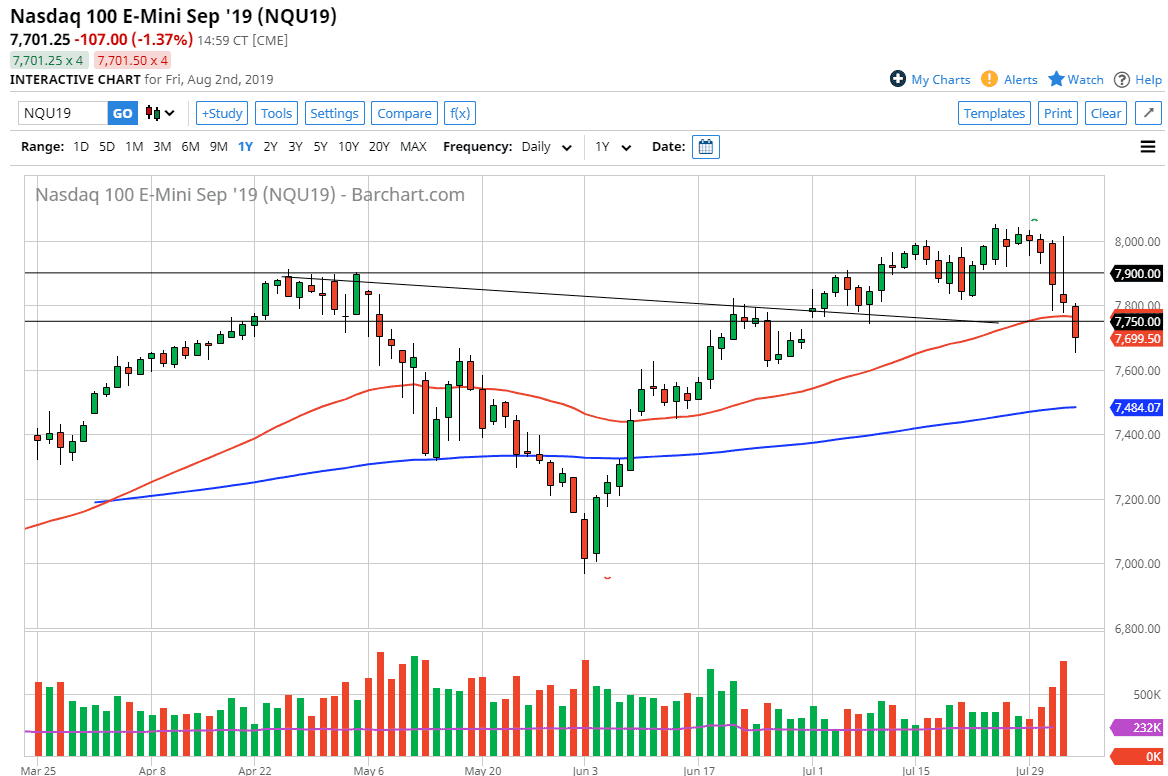

The NASDAQ 100 looks very soft all of the sudden, as we have broken through the gap that had been holding this market up. That being said though, we are closing out heading into the weekend above the 7700 level. I think we are currently one tweet away from a serious break down as the NASDAQ 100 is so sensitive to US/China trade relations. Ultimately, this is a market that is going to continue to have trouble as the largest companies do a lot of business across the Pacific Ocean.

The candlestick of course look very weak, and quite frankly I think we would not have had anything close to being a recovery if it wasn’t Friday. The 7600 level underneath is probably a target, perhaps even the 200 day EMA which is approaching the psychologically important 7500 level. At this point, it should be noted that we broke down below the bottom of an inverted hammer from the Thursday session, so that’s another reason to think that we will continue to see a lot of selling.

Rallies are to be sold, unless of course something changed over the weekend. That’s possible but the reality is that the market looks very spooked, and unless the Federal Reserve comes out and promises more interest rate cuts, it’s very difficult to imagine a scenario where the stock market suddenly feel happy. We have broken through quite a bit of support during the last couple of trading sessions, and that kind of damage typically has follow-through. I’m not necessarily saying that the uptrend is over, but a pullback certainly looks to be eminent. Pullbacks are good though, as it clears out a lot of the weak money in the market.

The 7500 level will of course present a significant challenge, so if we were to break down below there it’s likely that we could go much lower, possibly even the 7400 level, maybe even 7000 after that. All things being equal though, we are still in an uptrend so it comes down to what timeframe you like to trade on. If you are more of a swing trader or a longer-term trader, then you’re going to be looking for some type of supportive hammer or other such candlestick underneath. For those trading shorter time frames, it’s very likely that we are going to break down further.