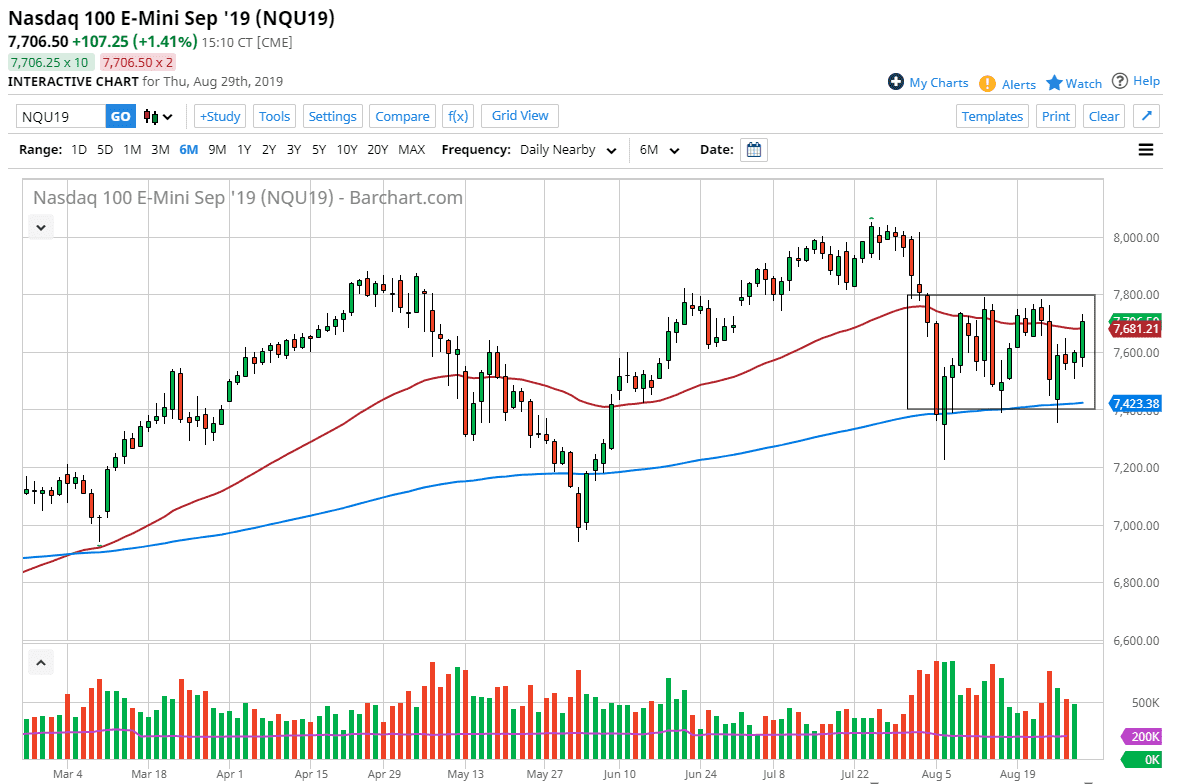

The NASDAQ 100 has rallied quite significantly during the trading session on Thursday, reaching above the 50 day EMA late during the session. That being said, there is a lot of resistance just above that should cause a bit of selling pressure. It would make sense to have a bit of profit taking heading into the weekend, because not only are we heading into a weekend but we are also heading into a three day weekend in the United States. With that being the case, it’s very likely that the traders that have been whipsawed for so long it makes sense that they would be a bit cautious.

The 7800 level above I think offers a bit of a “ceiling” in the market. If we were to break above there, that would change a lot of things and perhaps reach towards the 8000 level, which is a massive target. Ultimately, if we see some signs of exhaustion, it’s likely that we would go down to the 76 level, perhaps down to the 7400 level. All things being equal, another thing that you should pay attention to is the 50 day EMA and the 200 day EMA as they have been offering both support and resistance as of late. The market is simply tightening at this point, so it makes sense that we will continue to see a lot of choppiness.

Keep in mind that this market is highly sensitive to the US/China trade wars, and this of course is going to move on every word coming out of that. It’s very unlikely that the markets will go very long before seen yet another headline or negative situation that throws this market back down. All things being equal, I think that the market is going to offer a nice opportunity to start shorting sooner or later but I’m also willing to reverse my position and attitude completely if we break above the 7800 level on a daily close.

This is a market that will remain noisy, so therefore as we are getting to the extent of the top of the consolidated box, it makes quite a bit of sense that we should see more likely selling than buying. Having said that, I think we are more likely to see sellers than buyers but you have to keep your mind open as the stock market is a bit then at this point.