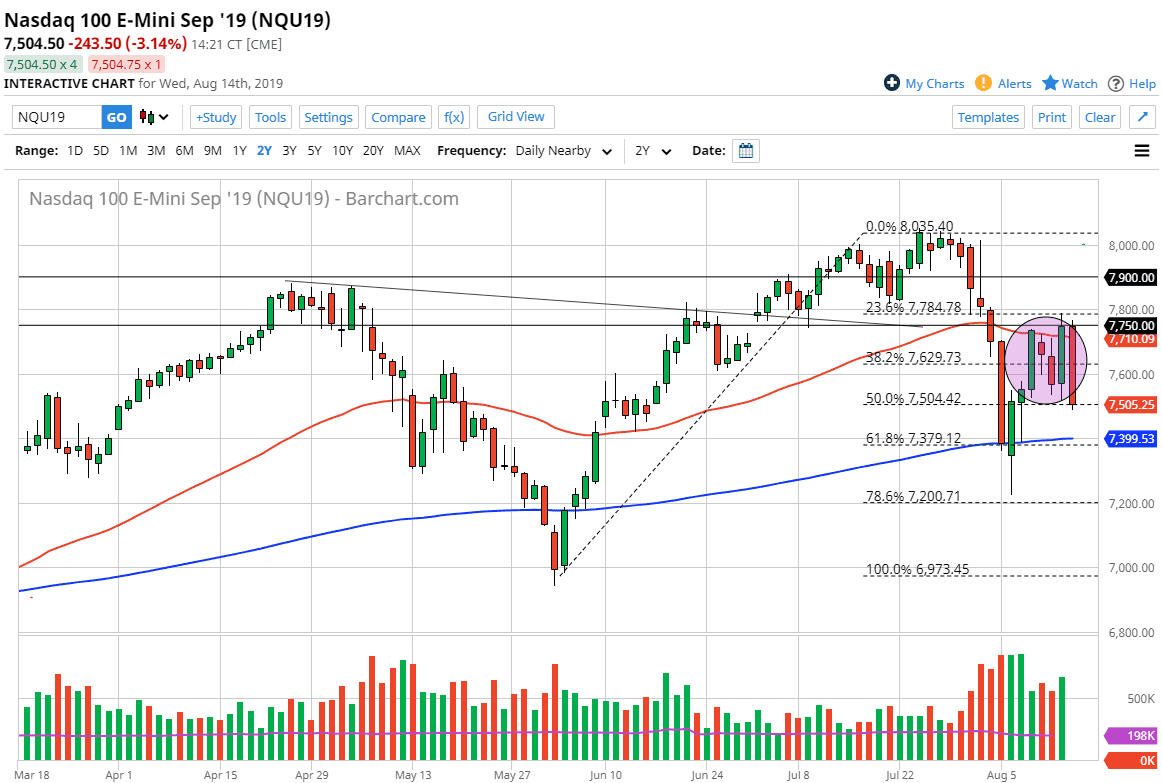

The NASDAQ 100 has broken down significantly during the trading session on Wednesday as we approached the 7500 level. At this point, I don’t think there’s a whole lot to keep this market from dropping from here, perhaps reaching towards the 200 day EMA. I believe at this point we are likely to continue to see a lot of negativity because not only have we formed a very negative candle stick, but we have closed very poorly as well. Selling started to accelerate at 3 PM New York time.

With this being the case, I anticipate that we should continue to see a lot of trouble, as the yield curve started to invert during the trading session several times. This is a market that is starting to worry about recession, so I think at this point the market is very fragile and it’s likely that we will continue to see it react very drastically to the headlines out there, as people are starting to become very concerned. If that’s going to be the case going forward, then it’s very likely that rallies are to be looked at with suspicion, and that we should be looking to fade the first signs of trouble.

I believe the 200 day EMA will be targeted which is closer to the 7400 level, and it wouldn’t surprise me at all to see the futures contract to that level sometime during either the Asian session or the European session. The real question is going to be what happens next. I think more than likely we are going to continue to see a lot of negativity overall, and it’s probably going to lead to a significant break down. I suspect we could see a move to the 7000 handle given enough time as it would be a return and complete breakdown of the recent rally. You will notice at the very least that the candlesticks lately have become much longer, which is very rarely a good sign after initially dropping. This shows that we have a lot of volatility picking up, and that volatility typically has people walking away from the markets. Whether or not we can break down below the 7000 is a completely different question, but at this point I certainly think that rallies are to be sold in that’s probably the best way to trade this market, as well as pretty much any other stock market right now.