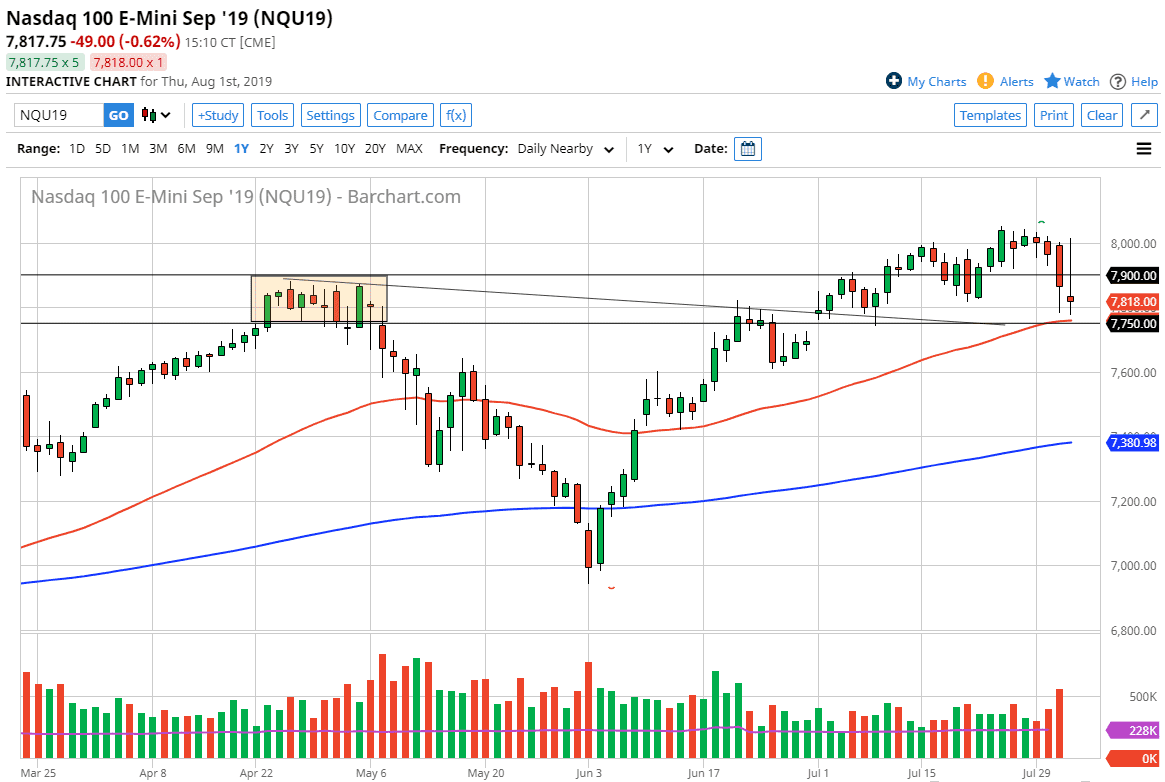

The NASDAQ 100 has had a rough session during Thursday, initially shooting higher and actually breaking above the 8000 handle. However, by the time we closed out the day the candlestick with quite a bit different. As the resistance was too much to overcome, Donald Trump of course didn’t help the situation.

The NASDAQ 100 is very sensitive to the US/China trade situation, and an additional 10% in tariffs being announced on Chinese goods starting September 1 did nothing to help the risk appetite of this market. Add to that the fact that the jobs numbers coming out on Friday, and we have what could be an explosive set up.

Nonfarm Payroll Numbers

We get the Nonfarm Payroll Numbers during the trading session on Friday, and that of course is going to cause a lot of noise in the market as per usual. I think at this point most traders on Wall Street are hoping we get soft jobs numbers in order to force the Fed to cut interest rates yet again. The question now is whether or not they will get that. If the jobs number is strong that may actually work against the stock market, as we seem to be an another “bad news is good news” type of scenario.

Technical analysis

The technical analysis in this pair is a bit of a mess right now, because the candle stick for the trading session on Thursday is so negative. However, we are sitting right on top of major support in the form of several different levels. We have the 7750 level which of course is very supportive due to the gap that’s underneath there, and we also have the downtrend line that is slicing through that area. Beyond that, we also have the 50 day EMA which is testing this area, so between all of those reasons, I think there is a certain amount of support to be found here.

That being said, if we were to break down below the candle stick, and more importantly the 7700 level, we could drop down towards the 200 day EMA. All things being equal though, the best we can probably hope for is a return towards the highs. I do not believe we go much higher, but if we were to break out to a fresh, new high, that would be extraordinarily bullish for the longer-term.